Crown Castle marked a 0.1% change today, compared to -2.0% for the S&P 500. Is it a good value at today's price of $134.7? Only an in-depth analysis can answer that question, but here are some facts that can give you an idea:

-

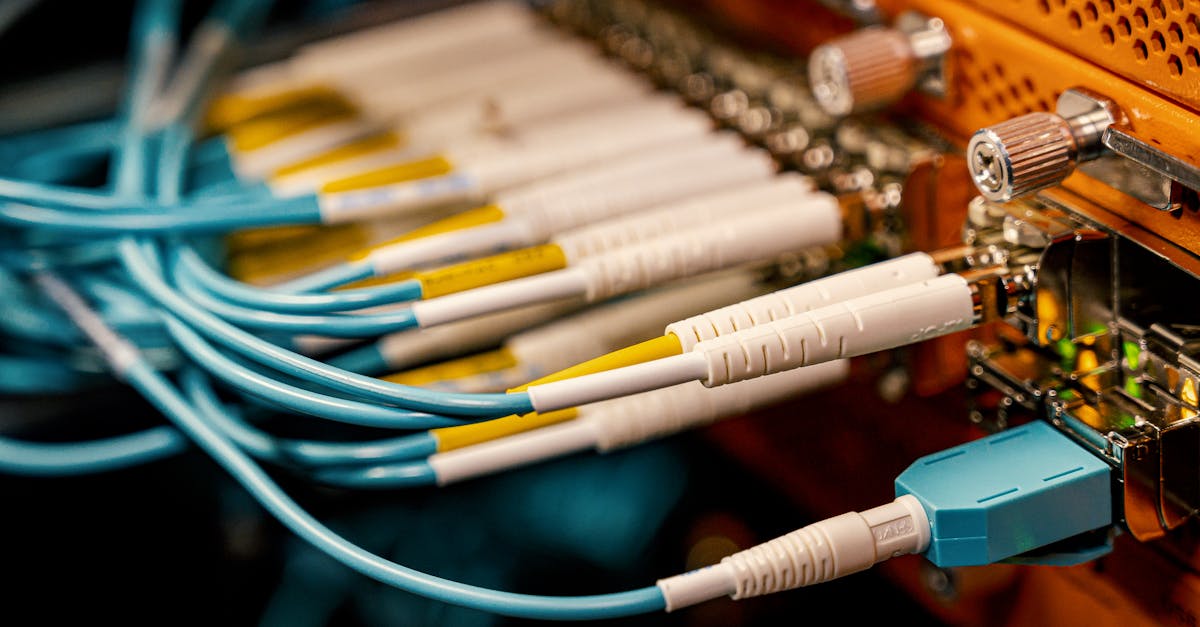

Crown Castle owns, operates and leases more than 40,000 cell towers and approximately 80,000 route miles of fiber supporting small cells and fiber solutions across every major U.S.

-

Crown Castle belongs to the Real Estate sector, which has an average price to earnings (P/E) ratio of 27.16 and an average price to book (P/B) of 2.39

-

The company's P/B ratio is 7.6

-

Crown Castle has a trailing 12 month Price to Earnings (P/E) ratio of 36.1 based on its trailing 12 month price to earnings (Eps) of $3.73 per share

-

Its forward P/E ratio is 35.6, based on its forward earnings per share (Eps) of $3.78

-

CCI has a Price to Earnings Growth (PEG) ratio of 3.14, which shows the company is overvalued when we factor growth into the price to earnings calculus.

-

Over the last four years, Crown Castle has averaged free cash flows of $1,082,750,000.00, which on average grew 37.4%

-

Crown Castle has moved -32.5% over the last year compared to -17.9% for the S&P 500 -- a difference of -14.6%

-

CCI has an average analyst rating of buy and is -14.9% away from its mean target price of $158.29 per share