Based on the factors that Benjamin Graham considered in analyzing potential stock picks, NCR is not a quality investment. Only investors with a high risk tolerance and a solid investment thesis on the stock will be interested in this mid-cap Information Technology Services company.

NCR Is Probably Overvalued

Graham devised the below equation to give investors a quick way of determining whether a stock is trading at a fair multiple of its earnings and its assets:

√(22.5 * 6 year average earnings per share (0.57) * 6 year average book value per share (11.075) = $10.83

At today's price of $30.7 per share, NCR is now trading 183.5% above the maximum price that Graham would have wanted to pay for the stock.

Even though the stock does not trade at an attractive multiple, it might still meet some of the other criteria for quality stocks that Graham listed in Chapter 14 of The Intelligent Investor.

Positive Retained Earnings From 2009 To 2022, No Dividend Record, and Decreasing Earnings Per Share

Ben Graham wrote that an investment in a company with a record of positive retained earnings could contribute significantly to the margin of safety. NCR had positive retained earnings from 2009 to 2022 with an average of $1.29 Billion over this period.

Another one of Graham's requirements is for a 30% or more cumulative growth rate of the company's earnings per share over the last ten years.We are going to compare NCR's earnings per share averages from the two 'bookends' of the 15 year period for which we have data. The first bookend comprises the years 2008, 2009, and 2010, whose EPS values of $1.36, $-0.21, and $0.83 average out to $0.66. Next we look at the years 2020, 2021, and 2022, whose values of $-0.86, $0.58, and $0.31 average out to $0.01. The growth rate between the two averages does not meet Graham's standard since it is -98.48%.

We have no record of NCR offering a regular dividend.

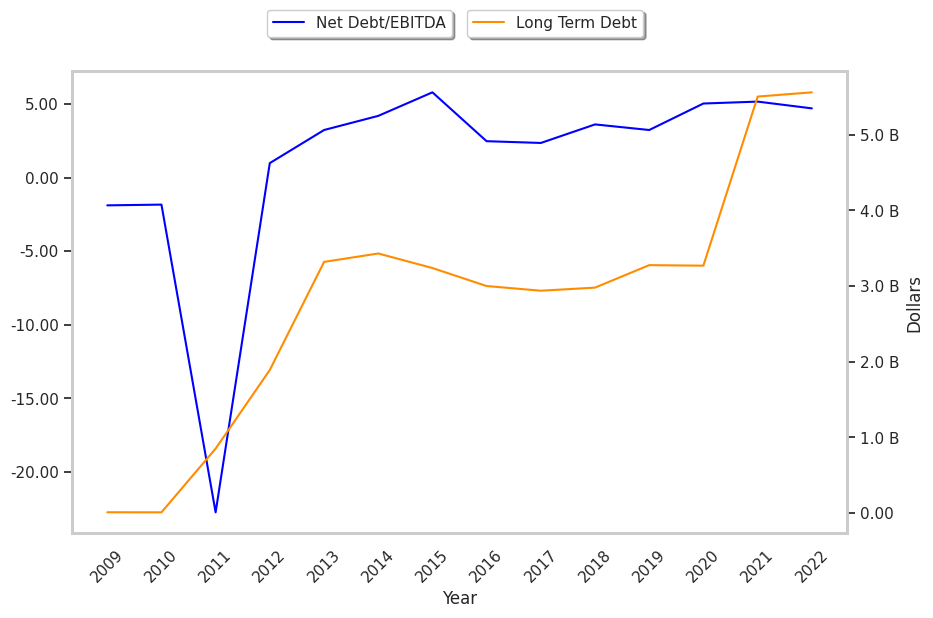

Negative Current Asset to Liabilities Balance and an Average Current Ratio

Graham sought companies with extremely low debt levels compared to their assets. For one, he expected their current ratio to be over 2 and their long term debt to net current asset ratio to be near, or ideally under, under 1. NCR fails on both counts with a current ratio of 1.1 and a debt to net current asset ratio of -0.8.

According to Graham's analysis, NCR is likely a company of low quality, which is trading far above its fair price.

| 2018-02-26 | 2019-02-28 | 2020-02-28 | 2021-02-26 | 2022-02-25 | 2023-02-27 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $6,516 | $6,405 | $6,915 | $6,207 | $7,156 | $7,844 |

| Gross Margins | 28.0% | 26.0% | 28.0% | 25.0% | 26.0% | 24.0% |

| Operating Margins | 11% | 7% | 9% | 4% | 7% | 6% |

| Net Margins | 4.0% | -1.0% | 8.0% | -1.0% | 1.0% | 1.0% |

| Net Income (MM) | $232 | -$88 | $564 | -$79 | $97 | $60 |

| Net Interest Expense (MM) | -$163 | -$168 | -$197 | -$218 | -$238 | -$285 |

| Depreciation & Amort. (MM) | -$354 | -$330 | -$333 | -$364 | -$517 | -$610 |

| Earnings Per Share | $0.97 | -$1.16 | $3.13 | -$0.62 | $0.7 | $0.42 |

| EPS Growth | n/a | -219.59% | 369.83% | -119.81% | 212.9% | -40.0% |

| Diluted Shares (MM) | 127 | 118 | 145 | 128 | 138 | 141 |

| Free Cash Flow (MM) | $874 | $712 | $714 | $665 | $1,182 | $529 |

| Capital Expenditures (MM) | -$122 | -$140 | -$80 | -$24 | -$105 | -$82 |

| Net Current Assets (MM) | -$3,277 | -$3,466 | -$4,341 | -$4,612 | -$7,232 | -$6,671 |

| Long Term Debt (MM) | $2,939 | $2,980 | $3,277 | $3,270 | $5,505 | $5,561 |

| Net Debt / EBITDA | 2.35 | 3.61 | 3.23 | 5.03 | 5.16 | 4.7 |