Now trading at a price of $48.34, Dominion Energy has moved -0.4% so far today.

Dominion Energy returned losses of -39.0% last year, with its stock price reaching a high of $81.61 and a low of $45.77. Over the same period, the stock underperformed the S&P 500 index by -55.0%. As of April 2023, the company's 50-day average price was $50.12. Dominion Energy, Inc. produces and distributes energy in the United States. Based in Richmond, VA, the large-cap Utilities company has 17,200 full time employees. Dominion Energy has offered a 5.5% dividend yield over the last 12 months.

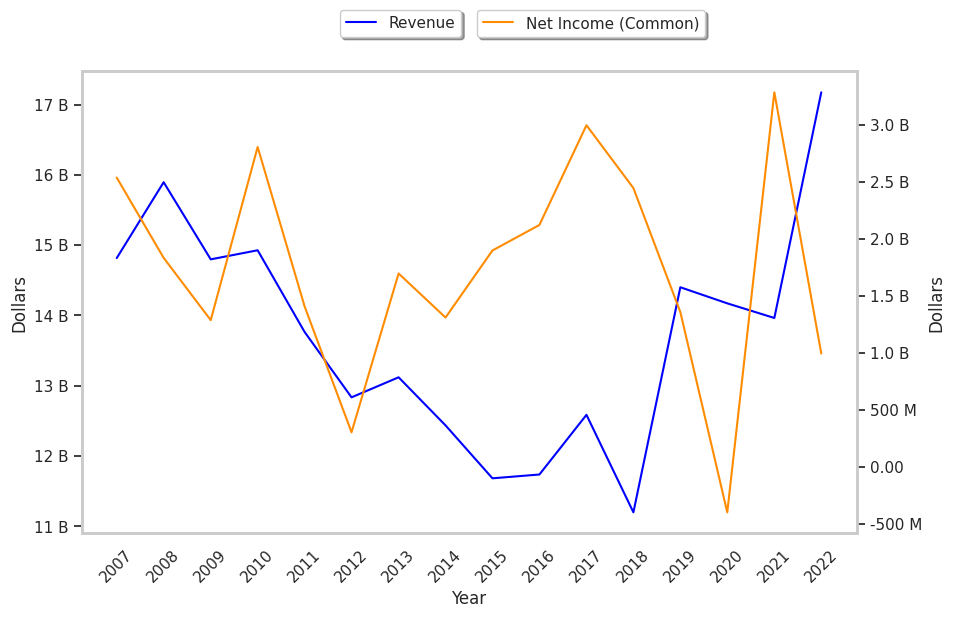

Exceptional Profitability Overshadowed by Excessive Leverage:

| 2018-02-27 | 2019-02-28 | 2020-02-28 | 2021-02-25 | 2022-02-24 | 2023-02-21 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $12,586 | $11,199 | $14,401 | $14,172 | $13,964 | $17,174 |

| Gross Margins | 76.0% | 70.0% | 69.0% | 78.0% | 75.0% | 69.0% |

| Operating Margins | 30% | 25% | 20% | 28% | 24% | 24% |

| Net Margins | 24.0% | 22.0% | 9.0% | -3.0% | 24.0% | 6.0% |

| Net Income (MM) | $2,999 | $2,447 | $1,358 | -$401 | $3,288 | $994 |

| Net Interest Expense (MM) | -$1,205 | -$1,279 | -$1,486 | -$1,377 | -$1,354 | -$966 |

| Depreciation & Amort. (MM) | -$2,202 | -$2,280 | -$2,977 | -$2,836 | -$2,768 | -$3,113 |

| Earnings Per Share | $4.72 | $3.74 | $1.68 | -$0.48 | $4.06 | $1.23 |

| EPS Growth | n/a | -20.76% | -55.08% | -128.57% | 945.83% | -69.7% |

| Diluted Shares (MM) | 636 | 655 | 809 | 831 | 810 | 810 |

| Free Cash Flow (MM) | $10,411 | $6,636 | $10,078 | $11,558 | $10,098 | $10,731 |

| Capital Expenditures (MM) | -$5,909 | -$1,863 | -$4,874 | -$6,331 | -$6,061 | -$7,031 |

| Net Current Assets (MM) | -$52,881 | -$50,705 | -$63,694 | -$62,558 | -$63,403 | -$66,512 |

| Long Term Debt (MM) | $30,948 | $31,144 | $28,998 | $33,957 | $37,426 | $38,914 |

| Net Debt / EBITDA | 6.19 | 6.91 | 5.46 | 5.28 | 6.62 | 6.32 |

A Lower P/E Ratio Than Its Sector Average but Trades Above Its Graham Number:

Dominion Energy has a trailing twelve month P/E ratio of 18.6, compared to an average of 22.89 for the Utilities sector. Based on its EPS guidance of $3.53, the company has a forward P/E ratio of 14.2. The company doesn't issue forward earnings guidance, and the compound average growth rate of its last 6 years of reported EPS is -8.9%. On this basis, the company's PEG ratio is -2.09, which indicates that its shares are overpriced. Furthermore, Dominion Energy is likely overvalued compared to the book value of its equity, since its P/B ratio of 1.52 is higher than the sector average of 1.03. The company's shares are currently trading 56.6% above their Graham number.

There's an Analyst Consensus of Some Upside Potential for Dominion Energy:

The 12 analysts following Dominion Energy have set target prices ranging from $44.0 to $61.0 per share, for an average of $52.08 with a hold rating. As of April 2023, the company is trading -3.8% away from its average target price, indicating that there is an analyst consensus of some upside potential.

Dominion Energy has a very low short interest because 0.7% of the company's shares are sold short. Institutions own 72.1% of the company's shares, and the insider ownership rate stands at 0.14%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 9% stake in the company is worth $3,668,985,798.