Now trading at a price of $2.99, RF Industries has moved 2.7% so far today.

RF Industries returned losses of -48.0% last year, with its stock price reaching a high of $6.0 and a low of $2.53. Over the same period, the stock underperformed the S&P 500 index by -70.0%. As of April 2023, the company's 50-day average price was $3.58. RF Industries, Ltd., together with its subsidiaries, designs, manufactures, and markets interconnect products and systems in the United States, Canada, Italy, Mexico, and internationally. Based in San Diego, CA, the small-cap Technology company has 344 full time employees. RF Industries has not offered a dividend during the last year.

An Exceptionally Strong Balance Sheet:

| 2017-01-27 | 2018-01-24 | 2018-12-20 | 2019-12-20 | 2020-12-29 | 2022-01-14 | |

|---|---|---|---|---|---|---|

| Revenue (k) | $30,241 | $22,983 | $50,196 | $55,325 | $43,044 | $57,424 |

| Gross Margins | 28.0% | 30.0% | 34.0% | 28.0% | 27.0% | 31.0% |

| Operating Margins | -6% | 1% | 15% | 8% | -1% | 8% |

| Net Margins | -14.0% | 2.0% | 12.0% | 6.0% | 0.0% | 11.0% |

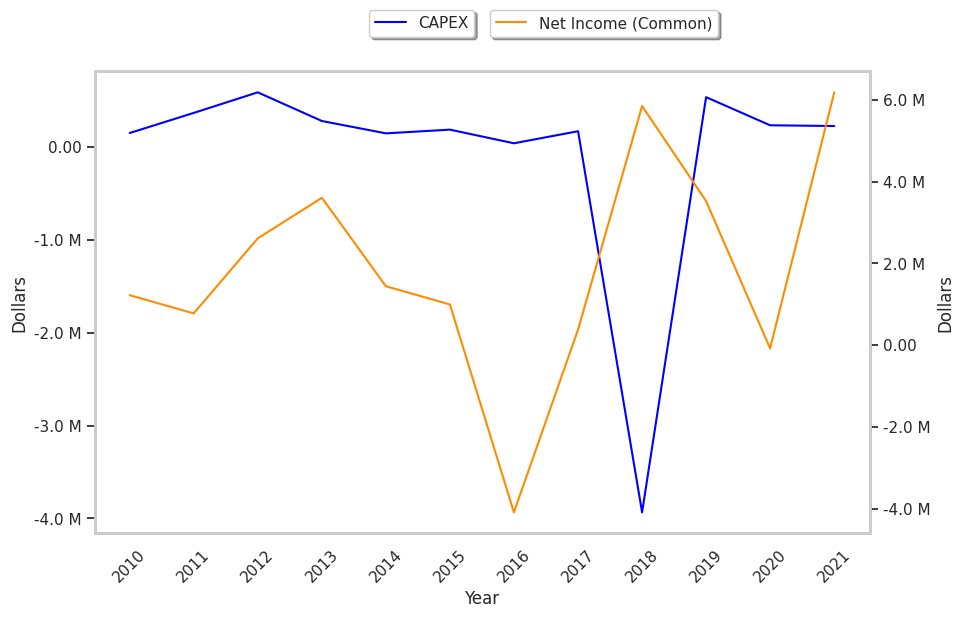

| Net Income (k) | -$4,089 | $382 | $5,846 | $3,521 | -$81 | $6,181 |

| Earnings Per Share | -$0.47 | $0.04 | $0.61 | $0.36 | -$0.01 | $0.61 |

| EPS Growth | n/a | 108.51% | 1425.0% | -40.98% | -102.78% | 6200.0% |

| Diluted Shares (k) | 8,787 | 8,916 | 9,593 | 9,855 | 9,679 | 10,131 |

| Free Cash Flow (k) | -$1,226 | $1,770 | $2,280 | -$2,172 | $4,782 | -$2,895 |

| Capital Expenditures | -$41 | -$171 | $3,935 | -$538 | -$235 | -$227 |

| Net Current Assets (k) | n/a | n/a | n/a | n/a | n/a | n/a |

RF Industries does not have a meaningful trailing P/E ratio since its earnings per share are currently in the red. Based on its EPS guidance of $0.34, the company has a forward P/E ratio of 10.5. In comparison, the average P/E ratio for the Technology sector is 27.16. On the other hand, the market is undervaluing RF Industries in terms of its equity because its P/B ratio is 0.76. In comparison, the sector average is 6.23. In conclusion, RF Industries's impressive cash flow trend, decent P/B ratio, and reasonable use of leverage demonstrate that the company may still be fairly valued — despite its elevated earnings multiple.

RF Industries Benefits From Positive Market Indicators:

The lone analyst who follows RF Industries has a rating of buy and a target price of $4.25, which is -15.8 away from its current price.

RF Industries has a very low short interest because 0.0% of the company's shares are sold short. Institutions own 26.6% of the company's shares, and the insider ownership rate stands at 19.5%, suggesting a large amount of insider shareholders. The largest shareholder is Punch & Associates Investment Management, Inc., whose 10% stake in the company is worth $3,042,773.