CVS Health logged a -0.0% change during today's afternoon session, and is now trading at a price of $69.05 per share.

CVS Health returned losses of -27.0% last year, with its stock price reaching a high of $104.83 and a low of $64.62. Over the same period, the stock underperformed the S&P 500 index by -39.0%. As of April 2023, the company's 50-day average price was $69.56. CVS Health Corporation provides health services in the United States. Based in Woonsocket, RI, the large-cap Consumer Staples company has 219,000 full time employees. CVS Health has offered a 3.3% dividend yield over the last 12 months.

The Business Runs With Healthy Debt Levels:

| 2017-02-09 | 2018-02-14 | 2019-02-28 | 2020-02-18 | 2021-02-16 | 2022-02-09 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $177,546 | $184,786 | $194,579 | $256,776 | $268,706 | $292,111 |

| Gross Margins | 16.0% | 15.0% | 16.0% | 18.0% | 18.0% | 18.0% |

| Operating Margins | 6% | 5% | 5% | 5% | 5% | 5% |

| Net Margins | 3.0% | 4.0% | 0.0% | 3.0% | 3.0% | 3.0% |

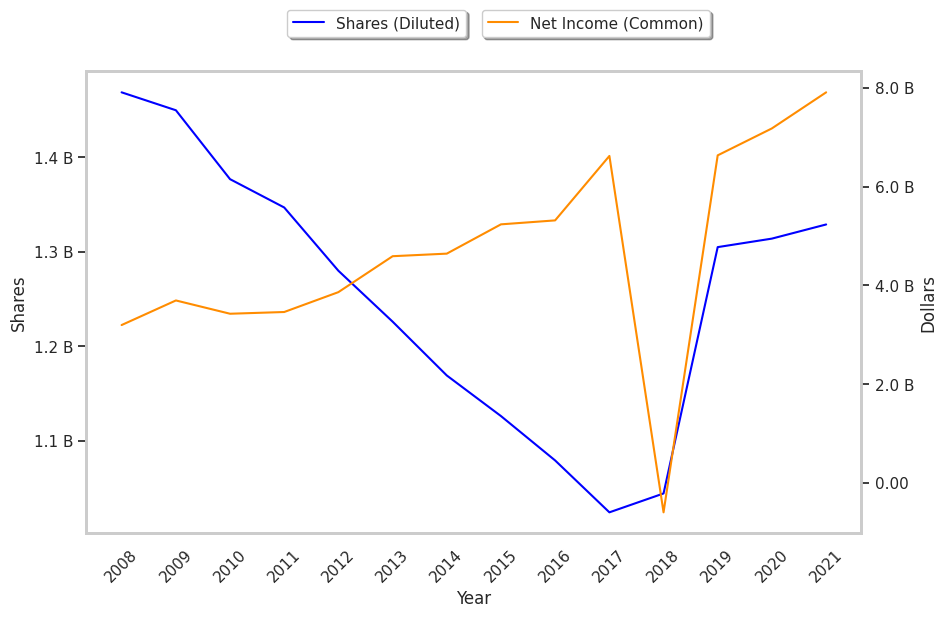

| Net Income (MM) | $5,317 | $6,622 | -$594 | $6,634 | $7,179 | $7,910 |

| Net Interest Expense (MM) | -$1,078 | -$1,062 | -$2,619 | -$3,035 | -$2,907 | -$2,503 |

| Earnings Per Share | $4.93 | $6.47 | -$0.57 | $5.08 | $5.46 | $5.95 |

| EPS Growth | n/a | 31.24% | -108.81% | 991.23% | 7.48% | 8.97% |

| Diluted Shares (MM) | 1,079 | 1,024 | 1,044 | 1,305 | 1,314 | 1,329 |

| Free Cash Flow (MM) | $12,365 | $9,925 | $10,070 | $15,305 | $18,302 | $20,785 |

| Capital Expenditures (MM) | -$2,224 | -$1,918 | -$1,205 | -$2,457 | -$2,437 | -$2,520 |

| Net Current Assets (MM) | -$26,586 | -$26,207 | -$92,670 | -$107,977 | -$104,645 | -$97,610 |

| Long Term Debt (MM) | $25,615 | $22,181 | $71,444 | $64,699 | $59,207 | $51,971 |

CVS Health has a pattern of improving cash flows and healthy debt levels. Additionally, the company's financial statements display average operating margins with a stable trend and positive EPS growth. However, the firm has slimmer gross margins than its peers. Finally, we note that CVS Health has weak revenue growth and a flat capital expenditure trend.

Trades Below Its Graham Number but Has an Elevated P/E Ratio:

CVS Health has a trailing twelve month P/E ratio of 31.8, compared to an average of 24.36 for the Consumer Staples sector. Based on its EPS guidance of $8.6, the company has a forward P/E ratio of 8.1. The company doesn't issue forward earnings guidance, and the compound average growth rate of its last 6 years of reported EPS is 3.2%. On this basis, the company's PEG ratio is 9.98, which suggests that it is overpriced. In contrast, the market is likely undervaluing CVS Health in terms of its equity because its P/B ratio is 1.22 while the sector average is 4.29. The company's shares are currently trading -20.8% below their Graham number. In conclusion, CVS Health's impressive cash flow trend, decent P/B ratio, and reasonable use of leverage demonstrate that the company may still be fairly valued — despite its elevated earnings multiple.

CVS Health Has an Analyst Consensus of Strong Upside Potential:

The 22 analysts following CVS Health have set target prices ranging from $76.0 to $110.0 per share, for an average of $90.16 with a buy rating. As of April 2023, the company is trading -22.8% away from its average target price, indicating that there is an analyst consensus of strong upside potential.

CVS Health has a very low short interest because 1.1% of the company's shares are sold short. Institutions own 79.9% of the company's shares, and the insider ownership rate stands at 0.18%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 9% stake in the company is worth $8,055,955,104.