Tesla logged a 1.6% change during today's afternoon session, and is now trading at a price of $242.42 per share.

Tesla returned gains of 39.0% last year, with its stock price reaching a high of $299.29 and a low of $101.81. Over the same period, the stock outperformed the S&P 500 index by 22.0%. More recently, the company's 50-day average price was $234.48. Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. Based in Austin, TX, the large-cap Consumer Discretionary company has 127,855 full time employees. Tesla has not offered a dividend during the last year.

Growing Revenues With Increasing Reinvestment in the Business:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $21,461 | $24,578 | $31,536 | $53,823 | $81,462 | $95,924 |

| Revenue Growth | n/a | 14.52% | 28.31% | 70.67% | 51.35% | 17.75% |

| Gross Margins | 19% | 17% | 21% | 25% | 26% | 20% |

| Operating Margins | -2% | 0% | 6% | 12% | 17% | 12% |

| Net Margins | 0% | 0% | 3% | 10% | 15% | 11% |

| Net Income (MM) | -$87 | $87 | $862 | $5,644 | $12,587 | $10,795 |

| Net Interest Expense (MM) | $663 | $685 | $748 | $371 | $191 | $275 |

| Depreciation & Amort. (MM) | $1,110 | $1,370 | $1,570 | $1,910 | $2,420 | $3,106 |

| Earnings Per Share | -$0.1 | $0.1 | $0.27 | $1.67 | $3.62 | $3.08 |

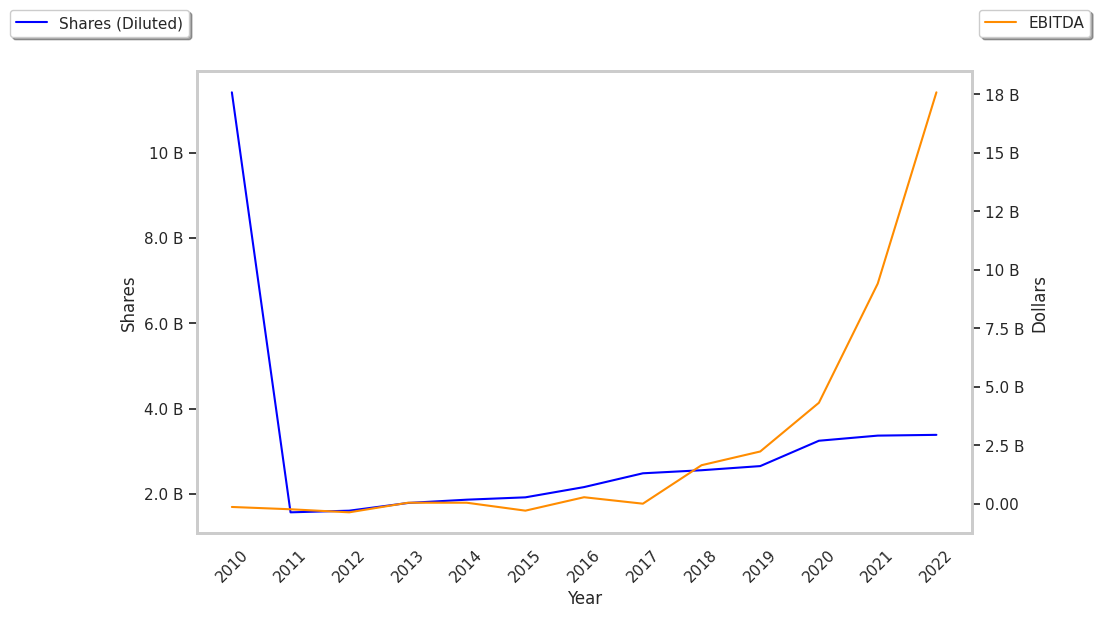

| Diluted Shares (MM) | 853 | 887 | 3,249 | 3,386 | 3,475 | 3,510 |

| Free Cash Flow (MM) | -$3 | $1,078 | $2,786 | $5,015 | $7,566 | $3,714 |

| Capital Expenditures (MM) | $2,101 | $1,327 | $3,157 | $6,482 | $7,158 | $8,450 |

Tesla has growing revenues and increasing reinvestment in the business, exceptional EPS growth, and wider gross margins than its peer group. Furthermore, Tesla has average net margins with a positive growth rate and irregular cash flows.

The Market May Be Overvaluing Tesla's Earnings and Assets:

Tesla has a trailing twelve month P/E ratio of 75.4, compared to an average of 22.96 for the Consumer Discretionary sector. Based on its EPS guidance of $3.84, the company has a forward P/E ratio of 61.1. Furthermore, Tesla is likely overvalued compared to the book value of its equity, since its P/B ratio of 14.41 is higher than the sector average of 4.24.

Tesla Has an Analyst Consensus of Little Upside Potential:

The 38 analysts following Tesla have set target prices ranging from $24.33 to $380.0 per share, for an average of $224.9 with a hold rating. As of April 2023, the company is trading 4.3% away from its average target price, indicating that there is an analyst consensus of little upside potential.

Tesla has an average amount of shares sold short because 3.4% of the company's shares are sold short. Institutions own 44.2% of the company's shares, and the insider ownership rate stands at 13.04%, suggesting a large amount of insider shareholders. The largest shareholder is Vanguard Group Inc, whose 7% stake in the company is worth $54,773,032,091.