Valero Energy logged a 2.7% change during today's morning session, and is now trading at a price of $163.7 per share.

Valero Energy returned gains of 27.0% last year, with its stock price reaching a high of $166.1 and a low of $104.18. Over the same period, the stock underperformed the S&P 500 index by -2.5%. The company's 50-day average price was $139.15. Valero Energy Corporation manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally. Based in San Antonio, TX, the Large-Cap Energy company has 9,886 full time employees. Valero Energy has offered a 2.6% dividend yield over the last 12 months.

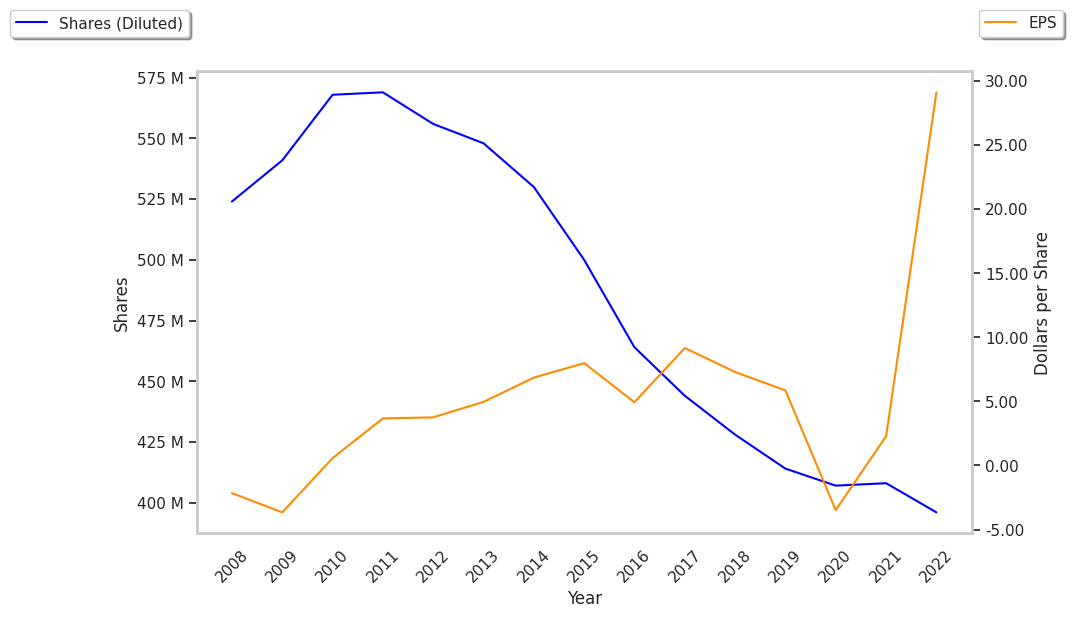

Exceptional EPS Growth and Healthy Leverage Levels:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $117,033 | $108,324 | $64,912 | $113,977 | $176,383 | $151,098 |

| Operating Margins | 4% | 4% | -2% | 2% | 9% | 10% |

| Net Margins | 3% | 2% | -2% | 1% | 7% | 7% |

| Net Income (M) | $3,122 | $2,422 | -$1,421 | $930 | $11,528 | $10,746 |

| Net Interest Expense (M) | $470 | $454 | $563 | $603 | $562 | $580 |

| Depreciation & Amort. (M) | $52 | $53 | $48 | $47 | $45 | $43 |

| Diluted Shares (M) | 428 | 414 | 407 | 407 | 396 | 349 |

| Earnings Per Share | $7.29 | $5.84 | -$3.5 | $2.27 | $29.04 | $29.25 |

| EPS Growth | n/a | -19.89% | -159.93% | 164.86% | 1179.3% | 0.72% |

| Avg. Price | $80.88 | $70.38 | $50.56 | $66.27 | $98.73 | $163.7 |

| P/E Ratio | 11.08 | 12.05 | -14.45 | 29.19 | 3.4 | 5.59 |

| EV / EBITDA | 8.9 | 9.38 | -20.94 | 16.91 | 3.0 | 4.53 |

| Total Debt (M) | $9,109 | $9,672 | $14,677 | $13,870 | $11,635 | $11,441 |

| Net Debt / EBITDA | 1.33 | 1.82 | -7.42 | 4.48 | 0.43 | 0.38 |

| Current Ratio | 1.65 | 1.44 | 1.71 | 1.26 | 1.38 | 1.51 |

Valero Energy has exceptional EPS growth, a decent current ratio of 1.51, and healthy leverage levels. Furthermore, Valero Energy has weak operating margins with a positive growth rate.

Valero Energy's Valuation Is in Line With Its Sector Averages:

Valero Energy has a trailing twelve month P/E ratio of 5.6, compared to an average of 8.53 for the Energy sector. Based on its EPS guidance of $13.38, the company has a forward P/E ratio of 10.4. The 9.1% compound average growth rate of Valero Energy's historical and projected earnings per share yields a PEG ratio of 0.62. This suggests that its shares are undervalued. In contrast, Valero Energy is likely overvalued compared to the book value of its equity, since its P/B ratio of 2.07 is higher than the sector average of 1.78. The company's shares are currently trading 35.2% above their Graham number.

Valero Energy Has an Average Rating of Buy:

The 16 analysts following Valero Energy have set target prices ranging from $135.0 to $178.0 per share, for an average of $154.69 with a buy rating. The company is trading 5.8% away from its average target price, indicating that there is an analyst consensus of little upside potential.

Valero Energy has an average amount of shares sold short because 3.6% of the company's shares are sold short. Institutions own 80.7% of the company's shares, and the insider ownership rate stands at 0.48%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 10% stake in the company is worth $5,253,654,941.