It's been a great morning session for CVS Health investors, who saw their shares rise 1.4% to a price of $79.33 per share. At these higher prices, is the company still fairly valued? If you are thinking about investing, make sure to check the company's fundamentals before making a decision.

CVS Health Has Attractive P/B and P/E Ratios:

CVS Health Corporation provides health solutions in the United States. The company belongs to the Consumer Staples sector, which has an average price to earnings (P/E) ratio of 21.21 and an average price to book (P/B) ratio of 4.12. In contrast, CVS Health has a trailing 12 month P/E ratio of 12.3 and a P/B ratio of 1.34.

CVS Health's PEG ratio is 2.55, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

Strong Revenue Growth but Not Enough Current Assets to Cover Current Liabilities:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $194,579 | $256,776 | $268,706 | $292,111 | $322,467 | $347,809 |

| Operating Margins | 2% | 5% | 5% | 5% | 2% | 4% |

| Net Margins | 0% | 3% | 3% | 3% | 1% | 2% |

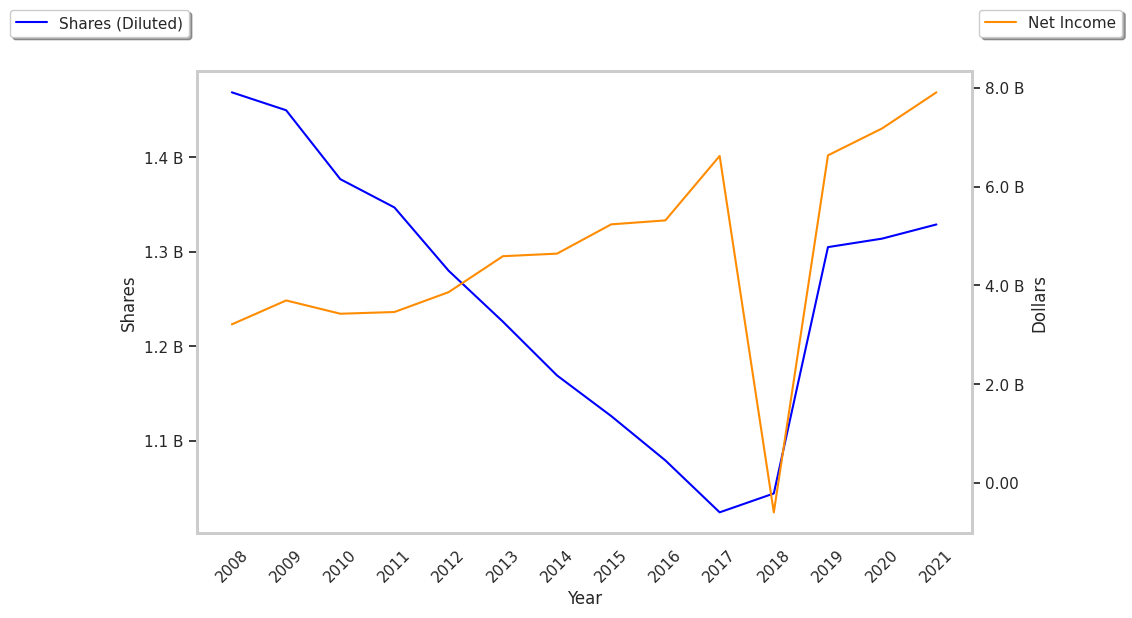

| Net Income (M) | -$594 | $6,634 | $7,179 | $8,001 | $4,311 | $8,632 |

| Net Interest Expense (M) | $2,619 | $3,035 | $2,907 | $2,503 | $2,287 | $2,520 |

| Depreciation & Amort. (M) | $2,718 | $4,371 | $4,441 | $4,486 | $4,224 | $4,275 |

| Diluted Shares (M) | 1,044 | 1,305 | 1,314 | 1,329 | 1,323 | 1,290 |

| Earnings Per Share | -$0.57 | $5.08 | $5.46 | $6.02 | $3.26 | $6.67 |

| EPS Growth | n/a | 991.23% | 7.48% | 10.26% | -45.85% | 104.6% |

| Avg. Price | $61.67 | $55.04 | $59.5 | $79.03 | $97.97 | $79.44 |

| P/E Ratio | -108.19 | 10.79 | 10.86 | 13.02 | 29.78 | 11.89 |

| CAPEX (M) | $2,037 | $2,457 | $2,437 | $2,520 | $2,727 | $2,808 |

| EV / EBITDA | 19.77 | 8.2 | 7.32 | 8.45 | 13.79 | 8.13 |

| Total Debt (M) | $74,694 | $68,480 | $64,647 | $56,176 | $52,254 | $59,782 |

| Net Debt / EBITDA | 10.48 | 3.84 | 3.09 | 2.63 | 3.23 | 2.55 |

| Current Ratio | 1.03 | 0.94 | 0.91 | 0.89 | 0.95 | 0.86 |

CVS Health has rapidly growing revenues and increasing reinvestment in the business, exceptional EPS growth, and decent operating margins with a stable trend. However, the firm has not enough current assets to cover current liabilities because its current ratio is 0.86. Finally, we note that CVS Health has significant leverage levels.