Super Micro Computer's price surge today seems to be confirming the bullish analyst outlook on the stock. Ending the day at $874.03, SMCI has posted 12.8% gains, pushing the valuation of the stock even higher. Might the stock be overvalued, despite its buy rating?

The first step in determining whether a stock is overvalued is to check its price to book (P/B) ratio. This is perhaps the most basic measure of a company's valuation, which is its market value divided by its book value. Book value refers to the sum of all of the company's assets minus its liabilities -- you can also think of it as the company's equity value.

Traditionally, value investors would look for companies with a ratio of less than 1 (meaning that the market value was smaller than the company's book value), but such opportunities are very rare these days. So we tend to look for company's whose valuations are less than their sector and market average. The P/B ratio for Super Micro Computer is 10.05, compared to its sector average of 4.25 and the S&P 500's average P/B of 4.59.

Modernly, the most common metric for valuing a company is its Price to Earnings (P/E) ratio. It's simply today's stock price of 874.03 divided by either its trailing or forward earnings, which for Super Micro Computer are $17.97 and $34.24 respectively. Based on these values, the company's trailing P/E ratio is 48.6 and its forward P/E ratio is 25.5. By way of comparison, the average P/E ratio of the Technology sector is 32.54 and the average P/E ratio of the S&P 500 is 27.65.

The problem with P/E ratios is that they don't take into account the growth of earnings. This means that a company with a higher than average P/E ratio may still be undervalued if it has extremely high projected earnings growth. Conversely, a company with a low P/E ratio may not present a good value proposition if its projected earnings are stagnant.

When we divide Super Micro Computer's P/E ratio by its projected 5 year earnings growth rate, we obtain its Price to Earnings Growth (PEG) ratio of 0.52. Since a PEG ratio between 0 and 1 may indicate that the company's valuation is proportionate to its growth potential, we see here that SMCI is actually fairly valued if we factor growth into the price to earnings calculus. One important caveat here is that PEG ratios are calculated on the basis of future earnings growth estimates, which may turn out to be wrong.

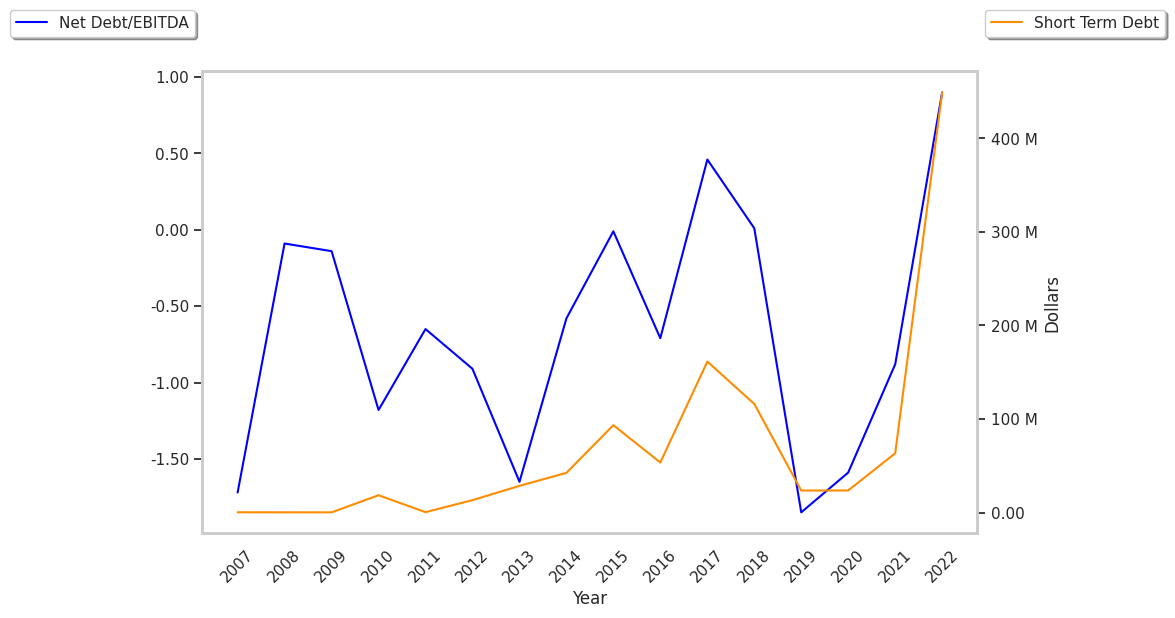

If a company is overvalued in terms of its earnings, we also need to check if it has the ability to meet its financial obligations. One way to check this is via the so called Quick Ratio or Acid Test, which is the sum of its current assets, inventory, and prepaid expenses divided by its current liabilities. Super Micro Computer's Quick ratio is 2.21, which indicates that that its total liquid assets are sufficient to meets its current liabilities.

When we had up all the inflows and outflows of cash, including payments to creditors, we obtain Super Micro Computer's levered free cash flow of $626.79 Million. This represents the money left over from the company's operations that is available for reinvestment in the business, or for paying out to equity investors in the form of a dividend. Despite its positive cash flows, Super Micro Computer does not currently pay a dividend.

Despite the quantitative evidence that Super Micro Computer is overvalued, analysts are mostly bullish on the stock. What do they know about the stock's that trumps its weak valuation and growth potential? We will look into this question in a future report focusing on qualitative factors that might be favoring SMCI.