Smart Global Holdings, Inc. (SGH) has announced a strategic investment of $200 million from SK Telecom (SKT), an affiliate of SK Group. This investment is in the form of 200,000 preferred shares convertible into ordinary shares of SGH at a conversion price of $32.81 per preferred share. The preferred shares also carry a 6% annual dividend, payable in-kind or in cash at SGH's option.

The investment is intended to enhance SGH’s capabilities and provide financial flexibility as the company expands its Penguin Solutions branded end-to-end AI factory offerings. SGH plans to leverage this capital to advance its AI infrastructure solutions and to collaborate with SKT to enhance customer offerings in global end-to-end AI factory and data center solutions, advanced memory market products and services, and AI edge servers.

SGH's CEO, Mark Adams, expressed enthusiasm about the strategic collaboration opportunities with SKT, emphasizing the potential value creation for both companies' stakeholders. SKT's CEO, Ryu Young-sang, highlighted SGH's proven methodology in deploying AI infrastructure solutions at large-scale enterprise customers and emphasized the potential for enhanced reach and capabilities through the collaboration.

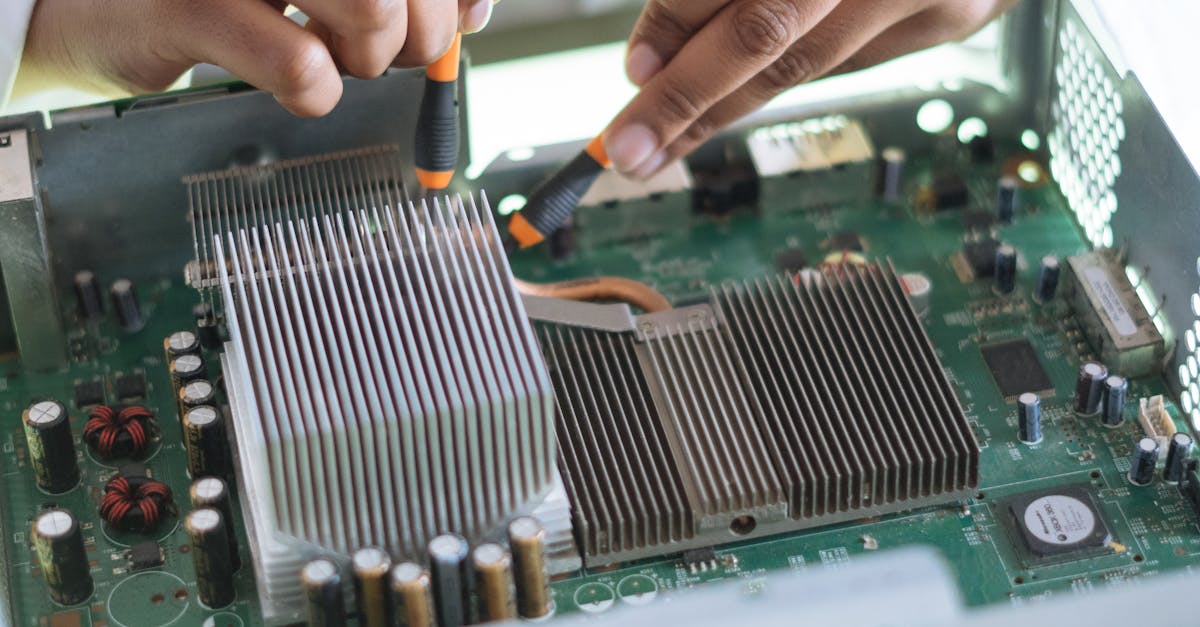

Penguin Solutions, a division of SGH, has demonstrated its technology leadership through the development and deployment of innovative AI-driven technologies, including high-performance and high-availability systems design, fluid-based immersion cooling, "zero fail" memory solutions, end-to-end managed services offerings, and AI cluster management software suite. Currently, Penguin Solutions manages over 75,000 GPUs, positioning it as a significant player in the AI infrastructure space.

SKT's investment in SGH aligns with its broader AI-related investments and partnerships, emphasizing its focus on the AI value chain, including AI semiconductor, AI infrastructure, and AI services.

The investment is subject to customary closing conditions, and SGH anticipates the transaction to close by the end of 2024.

SGH's exclusive financial advisor for this transaction is Centerview Partners, while Latham & Watkins is acting as its legal advisor. Baker McKenzie is serving as the legal advisor to SKT.

SKT, a prominent player in the mobile industry since 1984, is rapidly transforming into an AI company with a strong global presence, focusing on driving innovations in AI infrastructure, AI transformation (AIX), and AI services.

On the other hand, SGH specializes in designing, building, deploying, and managing high-performance, high-availability enterprise solutions across computing, memory, and LED lines of business, with a focus on providing deep technical knowledge, custom design engineering, and best-in-class quality to its customers. As a result of these announcements, the company's shares have moved 1.6% on the market, and are now trading at a price of $29.35. Check out the company's full 8-K submission here.