Principal Financial shares fell by -3.4% during the day's morning session, and are now trading at a price of $81.53. Is it time to buy the dip? To better answer that question, it's essential to check if the market is valuing the company's shares fairly in terms of its earnings and equity levels.

an Increase in Expected Earnings Improves Its Value Outlook but Trading Above Its Fair Price:

Principal Financial Group, Inc. provides retirement, asset management, and insurance products and services to businesses, individuals, and institutional clients worldwide. The company belongs to the Finance sector, which has an average price to earnings (P/E) ratio of 19.48 and an average price to book (P/B) ratio of 1.85. In contrast, Principal Financial has a trailing 12 month P/E ratio of 15.2 and a P/B ratio of 1.72.

When we dividePrincipal Financial's P/E ratio by its expected five-year EPS growth rate, we obtain a PEG ratio of 0.93, which indicates that the market is undervaluing the company's projected growth (a PEG ratio of 1 indicates a fairly valued company). Your analysis of the stock shouldn't end here. Rather, a good PEG ratio should alert you that it may be worthwhile to take a closer look at the stock.

The Company's Revenues Are Declining:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $14,237 | $16,222 | $14,742 | $14,428 | $17,536 | $13,666 |

| Interest Income (M) | $150 | $158 | $163 | $166 | $176 | $171 |

| Net Margins | 11% | 9% | 9% | 11% | 27% | 5% |

| Net Income (M) | $1,546 | $1,394 | $1,396 | $1,580 | $4,757 | $623 |

| Depreciation & Amort. (M) | $151 | $227 | $252 | $275 | $296 | $273 |

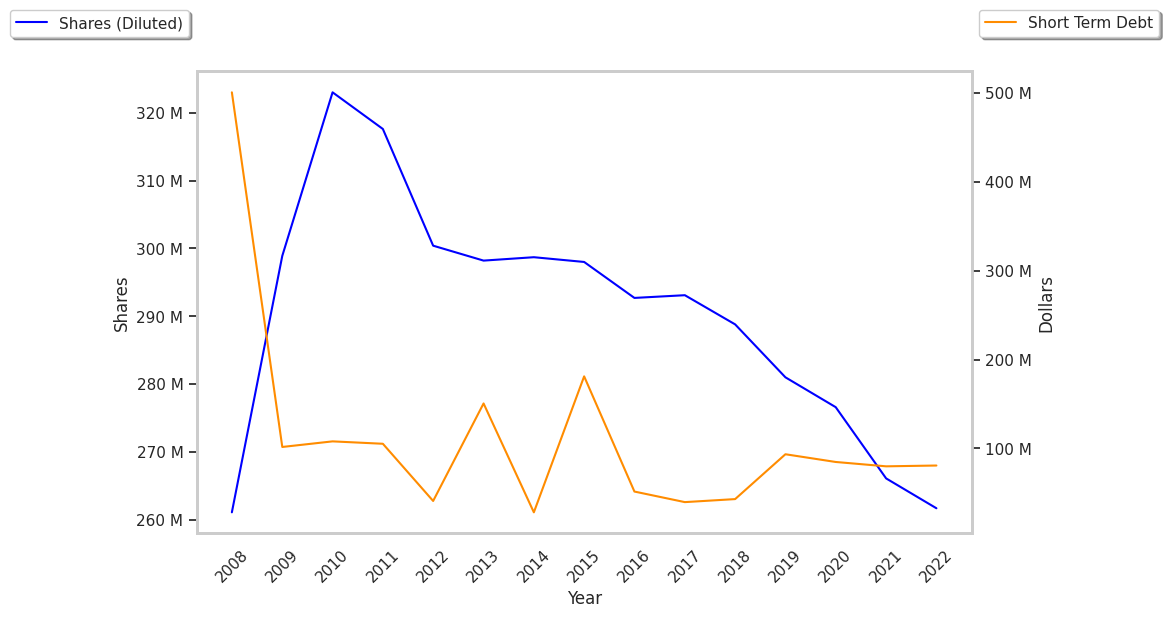

| Diluted Shares (M) | 289 | 281 | 277 | 273 | 255 | 245 |

| Earnings Per Share | $5.36 | $4.96 | $5.05 | $5.79 | $18.63 | $2.55 |

| EPS Growth | n/a | -7.46% | 1.81% | 14.65% | 221.76% | -86.31% |

| Avg. Price | $46.52 | $45.84 | $38.3 | $59.12 | $68.09 | $81.53 |

| P/E Ratio | 8.6 | 9.17 | 7.54 | 10.07 | 3.6 | 31.6 |

| Free Cash Flow (M) | $5,064 | $5,361 | $3,600 | $3,124 | $3,057 | $3,690 |

| CAPEX (M) | $92 | $132 | $109 | $130 | $116 | $102 |

| Total Debt (M) | $3,302 | $3,828 | $4,364 | $4,360 | $4,078 | $3,992 |

| Current Ratio | 69.41 | 26.94 | 33.65 | 29.22 | 60.07 | 77.05 |

Principal Financial has declining revenues and a flat capital expenditure trend, declining EPS growth, and positive cash flows. On the other hand, the company has an excellent current ratio of 77.05 working in its favor.