It's been a great afternoon session for SBA Communications investors, who saw their shares rise 2.2% to a price of $238.51 per share. At these higher prices, is the company still fairly valued? If you are thinking about investing, make sure to check the company's fundamentals before making a decision.

SBA Communications's Valuation Is in Line With Its Sector Averages:

SBA Communications Corporation is a leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells. The company belongs to the Real Estate sector, which has an average price to earnings (P/E) ratio of 30.37. In contrast, SBA Communications has a trailing 12 month P/E ratio of 50.2 based on its earnings per share of $4.75.

There is an important limit on the usefulness of P/E ratios. Since the P/E ratio is the share price divided by earnings per share, the ratio is determined partially by market sentiment on the stock. Sometimes a negative sentiment translates to a lower market price and therefore a lower P/E ratio -- and there might be good reasons for this negative sentiment.

One of the main reasons not to blindly invest in a company with a low P/E ratio is that it might have low growth expectations. Low growth correlates with low stock performance, so it's useful to factor growth into the valuation process. One of the easiest ways to do this is to divide the company's P/E ratio by its expected growth rate, which results in the price to earnings growth, or PEG ratio.

SBA Communications's PEG ratio is 1.24, which shows that the stock is overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

The Company May Be Profitable, but Its Balance Sheet Is Highly Leveraged:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $1,866 | $2,015 | $2,083 | $2,309 | $2,633 | $2,712 |

| Operating Margins | 28% | 28% | 30% | 34% | 35% | 34% |

| Net Margins | 3% | 7% | 1% | 10% | 18% | 19% |

| Net Income (M) | $47 | $147 | $24 | $238 | $461 | $502 |

| Net Interest Expense (M) | $377 | $387 | $352 | $361 | $348 | $397 |

| Depreciation & Amort. (M) | $269 | $282 | $287 | $272 | $274 | $272 |

| Diluted Shares (M) | 117 | 115 | 113 | 111 | 109 | 109 |

| Earnings Per Share | $0.41 | $1.28 | $0.21 | $2.14 | $4.22 | $4.61 |

| EPS Growth | n/a | 212.2% | -83.59% | 919.05% | 97.2% | 9.24% |

| Avg. Price | $156.98 | $212.67 | $281.97 | $309.97 | $325.88 | $238.51 |

| P/E Ratio | 382.88 | 163.59 | 1281.68 | 142.84 | 76.32 | 51.4 |

| Free Cash Flow (M) | $701 | $816 | $997 | $1,056 | $1,071 | $1,308 |

| CAPEX (M) | $150 | $154 | $129 | $134 | $214 | $237 |

| EV / EBITDA | 35.69 | 40.1 | 46.02 | 43.49 | 39.95 | 32.21 |

| Total Debt (M) | $10,880 | $10,857 | $11,120 | $12,327 | $12,892 | $12,967 |

| Net Debt / EBITDA | 13.2 | 12.42 | 11.74 | 11.34 | 10.63 | 10.67 |

| Current Ratio | 0.31 | 0.32 | 0.77 | 1.0 | 0.69 | 0.36 |

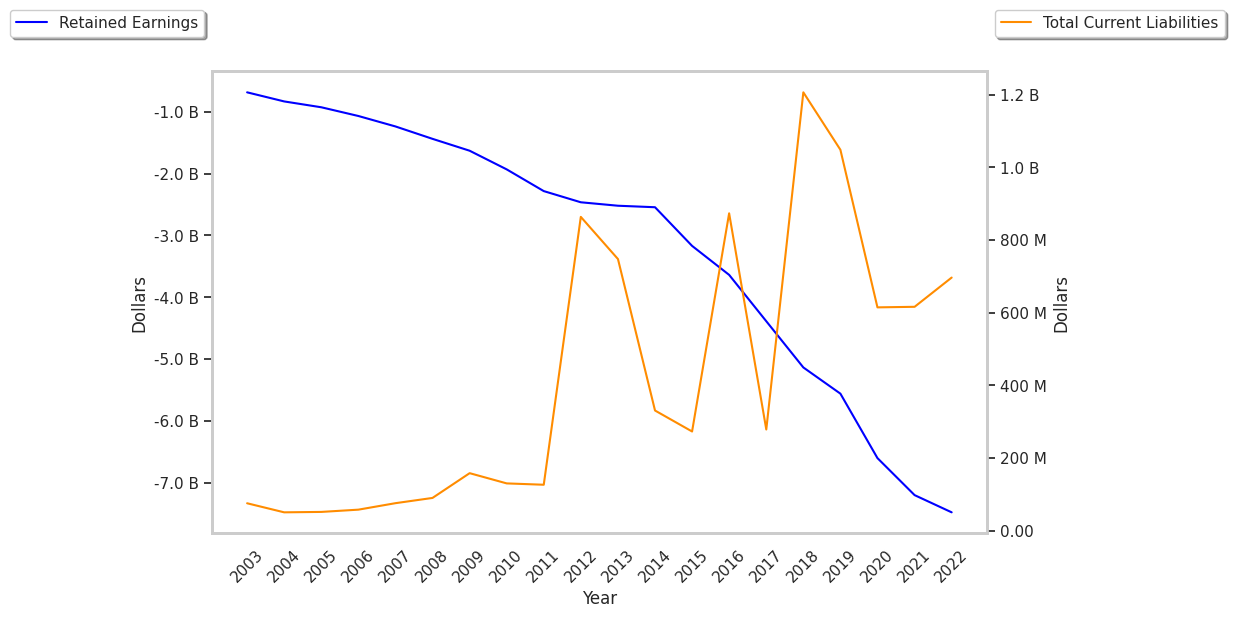

SBA Communications has growing revenues and increasing reinvestment in the business and exceptional EPS growth. Additionally, the company's financial statements display generally positive cash flows and decent operating margins with a stable trend. However, the firm suffers from not enough current assets to cover current liabilities because its current ratio is 0.36 and a highly leveraged balance sheet.