A strong performer from today's afternoon trading session is Axon Enterprise, whose shares rose 5.2% to $380.57 per share. For those of you thinking about investing in the stock, here is a brief value analysis of the stock using the company's basic fundamental ratios.

Axon Enterprise's Valuation Is in Line With Its Sector Averages:

Axon Enterprise, Inc. develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally. The company belongs to the Industrials sector, which has an average price to earnings (P/E) ratio of 25.19 and an average price to book (P/B) ratio of 3.17. In contrast, Axon Enterprise has a trailing 12 month P/E ratio of 100.2 and a P/B ratio of 14.91.

Axon Enterprise's PEG ratio is 3.71, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

Exceptional EPS Growth but Declining Revenues:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $420 | $531 | $681 | $863 | $1,190 | $343 |

| Operating Margins | 6% | -1% | -2% | -19% | 8% | 45% |

| Net Margins | 7% | 0% | 0% | -7% | 12% | 51% |

| Net Income (M) | $29 | $1 | -$2 | -$60 | $147 | $174 |

| Net Interest Expense (M) | $3 | $8 | $8 | $1 | $4 | $42 |

| Depreciation & Amort. (M) | $11 | $11 | $12 | $16 | $20 | $28 |

| Diluted Shares (M) | 58 | 60 | 62 | 66 | 73 | 75 |

| Earnings Per Share | $0.5 | $0.01 | -$0.03 | -$0.91 | $2.03 | $2.31 |

| EPS Growth | n/a | -98.0% | -400.0% | -2933.33% | 323.08% | 13.79% |

| Avg. Price | $51.33 | $60.8 | $89.5 | $163.31 | $120.44 | $382.21 |

| P/E Ratio | 98.71 | 6080.0 | -2983.33 | -179.46 | 58.18 | 162.64 |

| Free Cash Flow (M) | $53 | $50 | -$34 | $75 | $180 | $130 |

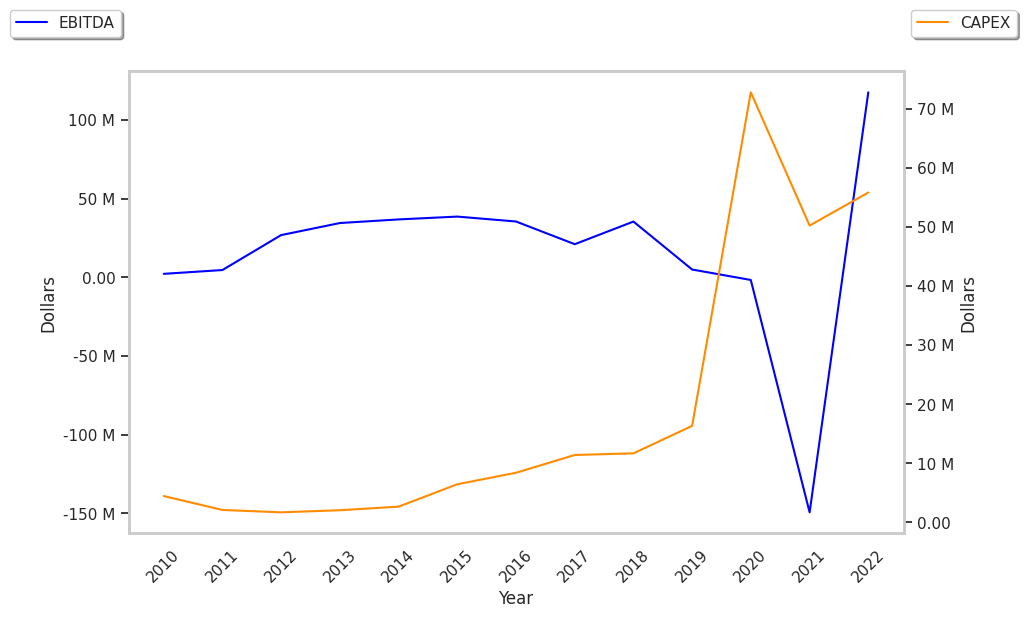

| CAPEX (M) | $11 | $16 | $73 | $50 | $56 | $60 |

| Current Ratio | 3.36 | 3.12 | 3.83 | 2.65 | 3.0 | 3.0 |

Axon Enterprise has strong operating margins with a positive growth rate and exceptional EPS growth. Additionally, the company's financial statements display an excellent current ratio of 3.0 and positive cash flows. Furthermore, Axon Enterprise has declining revenues and increasing reinvestment in the business.