A strong performer from today's morning trading session is Cisco Systems, whose shares rose 1.3% to $54.25 per share. For those of you thinking about investing in the stock, here is a brief value analysis of the stock using the company's basic fundamental ratios.

an Increase in Expected Earnings Improves Value but Trading Above Its Fair Price:

Cisco Systems, Inc. designs, manufactures, and sells Internet Protocol based networking and other products related to the communications and information technology industry in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China. The company belongs to the Telecommunications sector, which has an average price to earnings (P/E) ratio of 20.57 and an average price to book (P/B) ratio of 2.36. In contrast, Cisco Systems has a trailing 12 month P/E ratio of 21.4 and a P/B ratio of 4.78.

Cisco Systems's PEG ratio is 3.71, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

The Company's Revenues Are Declining:

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $51,904 | $49,301 | $49,818 | $51,557 | $56,998 | $53,803 |

| Gross Margins | 63% | 64% | 64% | 63% | 63% | 65% |

| Net Margins | 22% | 23% | 21% | 23% | 22% | 19% |

| Net Income (M) | $11,621 | $11,214 | $10,591 | $11,812 | $12,613 | $10,320 |

| Net Interest Expense (M) | $859 | $585 | $434 | $360 | $427 | $53 |

| Depreciation & Amort. (M) | $150 | $141 | $215 | $313 | $282 | $698 |

| Diluted Shares (M) | 4,273 | 4,244 | 4,243 | 4,116 | 4,087 | 4,062 |

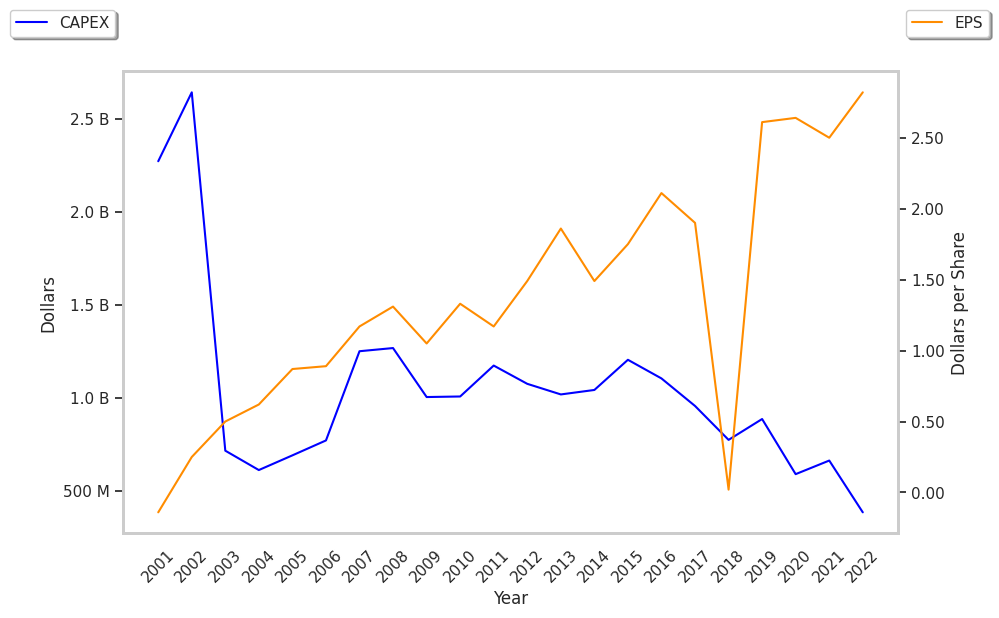

| Earnings Per Share | $2.61 | $2.64 | $2.5 | $2.82 | $3.07 | $2.54 |

| EPS Growth | n/a | 1.15% | -5.3% | 12.8% | 8.87% | -17.26% |

| Avg. Price | $44.56 | $39.15 | $49.99 | $49.6 | $54.25 | $54.25 |

| P/E Ratio | 16.94 | 14.77 | 19.92 | 17.53 | 17.61 | 21.27 |

| Free Cash Flow (M) | $14,922 | $14,656 | $14,762 | $12,749 | $19,037 | $10,210 |

| CAPEX (M) | $909 | $770 | $692 | $477 | $849 | $670 |

| EV / EBITDA | 14.13 | 12.53 | 16.5 | 14.47 | 14.3 | 18.67 |

| Total Debt (M) | $22,497 | $17,571 | $12,010 | $10,127 | $8,640 | $31,450 |

| Net Debt / EBITDA | 0.97 | 0.49 | 0.34 | 0.2 | -0.06 | 1.86 |

| Current Ratio | 1.7 | 1.59 | 1.62 | 1.45 | 1.47 | 0.91 |

Cisco Systems has slight revenue growth and decreasing reinvestment in the business, positive cash flows, and not enough current assets to cover current liabilities because its current ratio is 0.91. On the other hand, the company benefits from wider gross margins than its peer group and healthy leverage levels. Furthermore, Cisco Systems has flat EPS growth.