T-Mobile US logged a 5.2% change during today's afternoon session, and is now trading at a price of $232.55 per share.

T-Mobile US returned gains of 54.7% last year, with its stock price reaching a high of $233.5 and a low of $138.42. Over the same period, the stock outperformed the S&P 500 index by 14.5%. More recently, the company's 50-day average price was $204.7. T-Mobile US, Inc., together with its subsidiaries, provides mobile communications services in the United States, Puerto Rico, and the United States Virgin Islands. Based in Bellevue, WA, the Large-Cap Telecommunications company has 67,000 full time employees. T-Mobile US has offered a 0.3% dividend yield over the last 12 months.

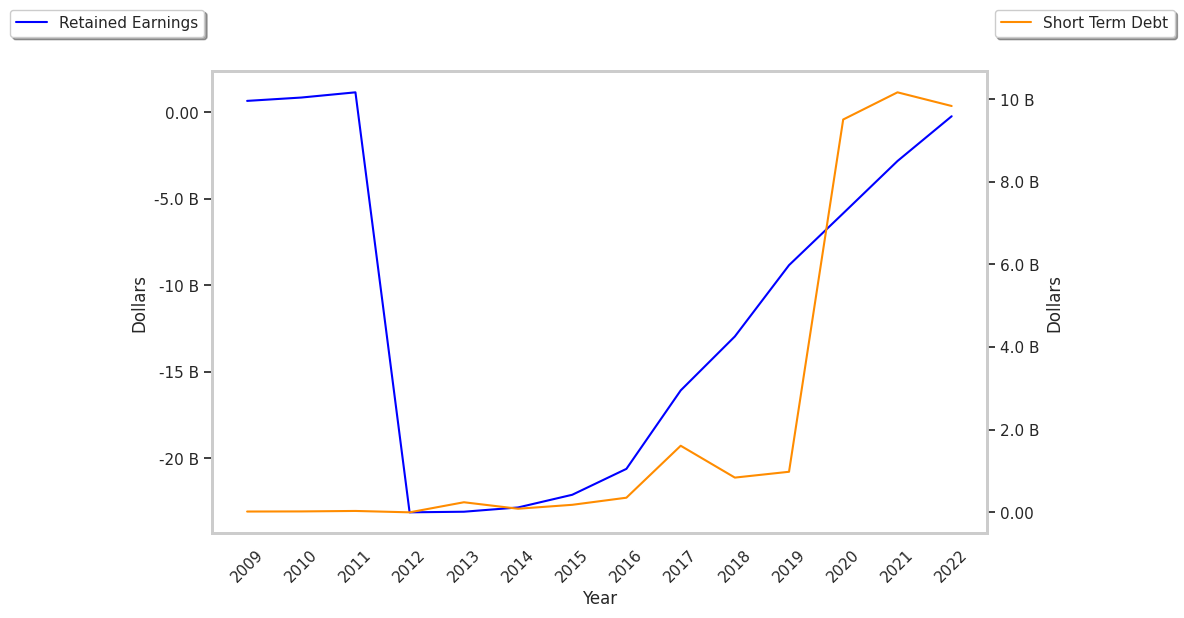

Strong Revenue Growth but Not Enough Current Assets to Cover Current Liabilities:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $43,310 | $44,998 | $68,397 | $80,118 | $79,571 | $78,558 |

| Operating Margins | 12% | 13% | 10% | 9% | 8% | 18% |

| Net Margins | 7% | 8% | 4% | 4% | 3% | 11% |

| Net Income (M) | $2,888 | $3,468 | $3,064 | $3,024 | $2,590 | $8,317 |

| Net Interest Expense (M) | $835 | $727 | $2,483 | $3,189 | -$3,364 | -$3,335 |

| Depreciation & Amort. (M) | $6,486 | $6,616 | $14,151 | $16,383 | $13,651 | $12,818 |

| Diluted Shares (M) | 856 | 864 | 125 | 1,255 | 1,255 | 1,200 |

| Earnings Per Share | $3.36 | $4.02 | $2.65 | $2.41 | $2.06 | $6.93 |

| EPS Growth | n/a | 19.64% | -34.08% | -9.06% | -14.52% | 236.41% |

| Avg. Price | $63.27 | $75.39 | $103.89 | $130.23 | $125.25 | $233.08 |

| P/E Ratio | 18.61 | 18.57 | 38.76 | 53.81 | 60.51 | 33.2 |

| Free Cash Flow (M) | -$1,642 | $433 | -$2,394 | $1,591 | $2,811 | $8,758 |

| CAPEX (M) | $5,541 | $6,391 | $11,034 | $12,326 | $13,970 | $9,801 |

| EV / EBITDA | 6.87 | 7.13 | 7.43 | 9.95 | 11.09 | 13.21 |

| Total Debt (M) | $28,198 | $25,444 | $75,704 | $76,438 | $71,960 | $78,637 |

| Net Debt / EBITDA | 2.29 | 1.94 | 3.14 | 3.0 | 3.34 | 2.71 |

| Current Ratio | 0.81 | 0.74 | 1.1 | 0.89 | 0.77 | 0.91 |

T-Mobile US has rapidly growing revenues and increasing reinvestment in the business and strong operating margins with a positive growth rate. Additionally, the company's financial statements display generally positive cash flows and a strong EPS growth trend. However, the firm has not enough current assets to cover current liabilities because its current ratio is 0.91. Finally, we note that T-Mobile US has significant leverage levels.

T-Mobile US's Valuation Is in Line With Its Sector Averages:

T-Mobile US has a trailing twelve month P/E ratio of 23.3, compared to an average of 20.57 for the Telecommunications sector. Based on its EPS guidance of $10.82, the company has a forward P/E ratio of 18.9. According to the 18.2% compound average growth rate of T-Mobile US's historical and projected earnings per share, the company's PEG ratio is 1.28. Taking the weighted average of the company's EPS CAGR and the broader market's 5-year projected EPS growth rate, we obtain a normalized growth rate of 13.0%. On this basis, the company's PEG ratio is 1.8. This suggests that these shares are overvalued. Furthermore, T-Mobile US is likely overvalued compared to the book value of its equity, since its P/B ratio of 4.22 is higher than the sector average of 2.36. The company's shares are currently trading 153.6% below their Graham number. In conclusion, T-Mobile US's impressive cash flow trend, decent P/B ratio, and reasonable use of leverage demonstrate that the company may still be fairly valued — despite its elevated earnings multiple.

Analysts Give T-Mobile US an Average Rating of Buy:

The 27 analysts following T-Mobile US have set target prices ranging from $143.48 to $260.0 per share, for an average of $220.13 with a buy rating. The company is trading 5.6% away from its average target price, indicating that there is an analyst consensus of little upside potential.

T-Mobile US has an average amount of shares sold short because 2.7% of the company's shares are sold short. Institutions own 40.0% of the company's shares, and the insider ownership rate stands at 58.84%, suggesting a large amount of insider shareholders. The largest shareholder is Softbank Group Corporation, whose 7% stake in the company is worth $19,850,629,960.