It's been a great afternoon session for T-Mobile US investors, who saw their shares rise 1.7% to a price of $235.31 per share. At these higher prices, is the company still fairly valued? If you are thinking about investing, make sure to check the company's fundamentals before making a decision.

T-Mobile US's Valuation Is in Line With Its Sector Averages:

T-Mobile US, Inc., together with its subsidiaries, provides mobile communications services in the United States, Puerto Rico, and the United States Virgin Islands. The company belongs to the Telecommunications sector, which has an average price to earnings (P/E) ratio of 20.57 and an average price to book (P/B) ratio of 2.36. In contrast, T-Mobile US has a trailing 12 month P/E ratio of 26.8 and a P/B ratio of 4.27.

T-Mobile US's PEG ratio is 1.2, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

Strong Revenue Growth but Not Enough Current Assets to Cover Current Liabilities:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $43,310 | $44,998 | $68,397 | $80,118 | $79,571 | $78,558 |

| Operating Margins | 12% | 13% | 10% | 9% | 8% | 18% |

| Net Margins | 7% | 8% | 4% | 4% | 3% | 11% |

| Net Income (M) | $2,888 | $3,468 | $3,064 | $3,024 | $2,590 | $8,317 |

| Net Interest Expense (M) | $835 | $727 | $2,483 | $3,189 | -$3,364 | -$3,335 |

| Depreciation & Amort. (M) | $6,486 | $6,616 | $14,151 | $16,383 | $13,651 | $12,818 |

| Diluted Shares (M) | 856 | 864 | 125 | 1,255 | 1,255 | 1,200 |

| Earnings Per Share | $3.36 | $4.02 | $2.65 | $2.41 | $2.06 | $6.93 |

| EPS Growth | n/a | 19.64% | -34.08% | -9.06% | -14.52% | 236.41% |

| Avg. Price | $63.27 | $75.39 | $103.89 | $130.23 | $125.25 | $235.31 |

| P/E Ratio | 18.61 | 18.57 | 38.76 | 53.81 | 60.51 | 33.52 |

| Free Cash Flow (M) | -$1,642 | $433 | -$2,394 | $1,591 | $2,811 | $8,758 |

| CAPEX (M) | $5,541 | $6,391 | $11,034 | $12,326 | $13,970 | $9,801 |

| EV / EBITDA | 6.87 | 7.13 | 7.43 | 9.95 | 11.09 | 13.31 |

| Total Debt (M) | $28,198 | $25,444 | $75,704 | $76,438 | $71,960 | $78,637 |

| Net Debt / EBITDA | 2.29 | 1.94 | 3.14 | 3.0 | 3.34 | 2.71 |

| Current Ratio | 0.81 | 0.74 | 1.1 | 0.89 | 0.77 | 0.91 |

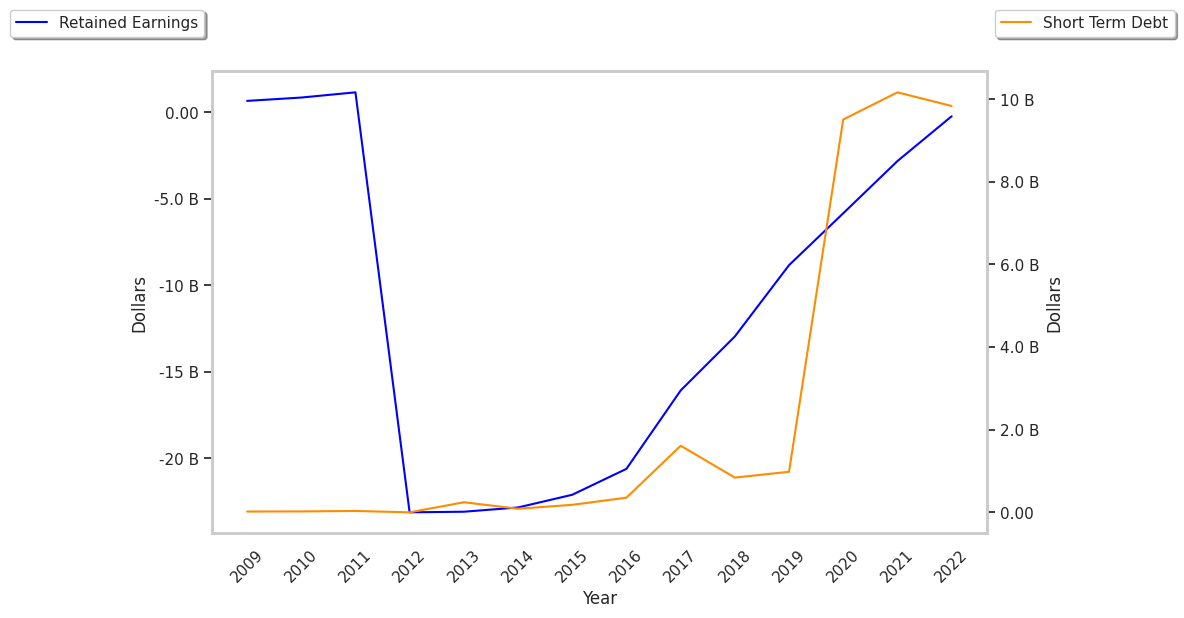

T-Mobile US has rapidly growing revenues and increasing reinvestment in the business and strong operating margins with a positive growth rate. Additionally, the company's financial statements display generally positive cash flows and a strong EPS growth trend. However, the firm has not enough current assets to cover current liabilities because its current ratio is 0.91. Finally, we note that T-Mobile US has significant leverage levels.