Today we're going to take a closer look at Large-Cap Real Estate company Kimco Realty, whose shares are currently trading at $23.37. We've been asking ourselves whether the company is under or over valued at today's prices... let's perform a brief value analysis to find out!

a Lower P/B Ratio Than Its Sector Average but Priced Beyond Its Margin of Safety:

Kimco Realty (NYSE: KIM) is a real estate investment trust (REIT) and leading owner and operator of high-quality, open-air, grocery-anchored shopping centers and mixed-use properties in the United States. The company belongs to the Real Estate sector, which has an average price to earnings (P/E) ratio of 31.12 and an average price to book (P/B) ratio of 2.15. In contrast, Kimco Realty has a trailing 12 month P/E ratio of 43.3 and a P/B ratio of 1.5.

Kimco Realty has moved 9.8% over the last year compared to 25.9% for the S&P 500 — a difference of -16.1%. Kimco Realty has a 52 week high of $25.83 and a 52 week low of $17.57.

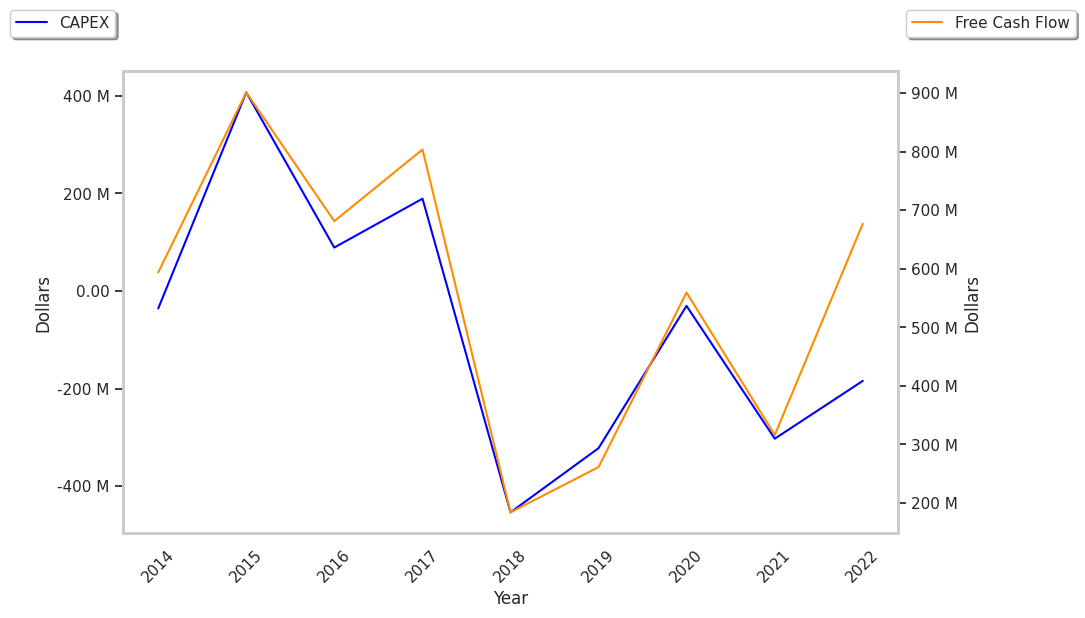

Generally Positive Cash Flows but a Highly Leveraged Balance Sheet:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $1,165 | $1,159 | $1,058 | $1,365 | $1,728 | $1,783 |

| Operating Margins | 50% | 41% | 31% | 31% | 33% | 36% |

| Net Margins | 43% | 35% | 95% | 62% | 7% | 37% |

| Net Income (M) | $498 | $411 | $1,001 | $844 | $126 | $654 |

| Net Interest Expense (M) | $183 | $177 | $187 | $204 | $227 | $250 |

| Depreciation & Amort. (M) | $310 | $278 | $289 | $395 | $505 | $507 |

| Diluted Shares (M) | 421 | 422 | 432 | 511 | 618 | 618 |

| Earnings Per Share | $1.02 | $0.8 | $2.25 | $1.6 | $0.16 | $1.02 |

| EPS Growth | n/a | -21.57% | 181.25% | -28.89% | -90.0% | 537.5% |

| Avg. Price | $12.31 | $15.77 | $11.83 | $19.23 | $22.18 | $23.37 |

| P/E Ratio | 12.07 | 19.71 | 5.26 | 12.02 | 138.62 | 22.91 |

| Free Cash Flow (M) | $347 | $465 | $568 | $619 | $861 | $1,072 |

| EV / EBITDA | 10.61 | 15.03 | 15.86 | 18.32 | 18.98 | 18.27 |

| Total Debt (M) | $4,382 | $4,832 | $5,044 | $7,027 | $6,781 | $7,263 |

| Net Debt / EBITDA | 4.75 | 6.23 | 7.64 | 8.18 | 6.2 | 5.66 |