Medical Care Facility company HCA Healthcare is taking Wall Street by surprise today, falling to $313.07 and marking a -3.8% change compared to the S&P 500, which moved -0.0%. HCA is -18.92% below its average analyst target price of $386.14, which implies there is more upside for the stock.

As such, the average analyst rates it at buy. Over the last year, HCA Healthcare has underperfomed the S&P 500 by -14.6%, moving 9.2%.

HCA Healthcare, Inc., through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States. The company is categorized within the healthcare sector. The catalysts that drive valuations in this sector are complex. From demographics, regulations, scientific breakthroughs, to the emergence of new diseases, healthcare companies see their prices swing on the basis of a variety of factors.

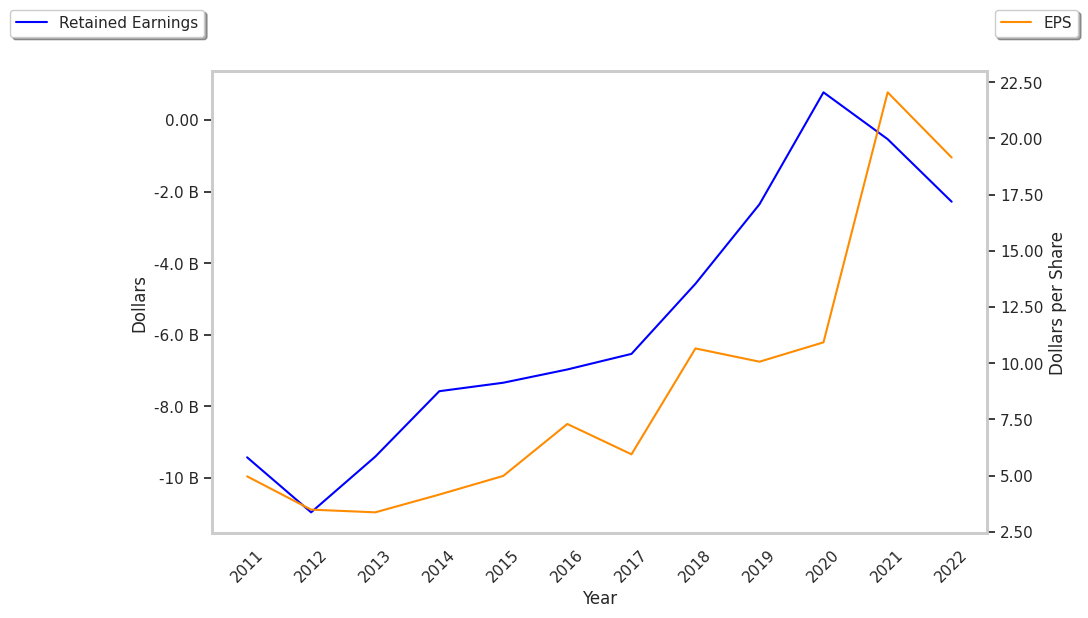

HCA Healthcare's trailing 12 month P/E ratio is 14.2, based on its trailing EPS of $22.01. The company has a forward P/E ratio of 11.6 according to its forward EPS of $24.55 -- which is an estimate of what its earnings will look like in the next quarter. As of the third quarter of 2024, the average Price to Earnings (P/E) ratio for US health care companies is 26.07, and the S&P 500 has an average of 29.3. The P/E ratio consists in the stock's share price divided by its earnings per share (EPS), representing how much investors are willing to spend for each dollar of the company's earnings. Earnings are the company's revenues minus the cost of goods sold, overhead, and taxes.

When we subtract capital expenditures from operating cash flows, we are left with the company's free cash flow, which for HCA Healthcare was $4.69 Billion as of its last annual report. This represents the amount of money that is available for reinvesting in the business, or for paying out to investors in the form of a dividend. With its strong cash flows, HCA is in a position to do either -- which can encourage more investors to place their capital in the company. Over the last four years, the company's free cash flow has been growing at a rate of 7.2% and has on average been $4.54 Billion.

Since it has a Very low P/E ratio, no published P/B ratio, and generally positive cash flows with an upwards trend, HCA Healthcare is likely undervalued at today's prices. The company has strong growth indicators because of an average PEG ratio and strong operating margins with a stable trend. We hope you enjoyed this overview of HCA's fundamentals. Be sure to check the numbers for yourself, especially focusing on their trends over the last few years.