Integrated Freight & Logistics company Expedia is standing out today, surging to $176.48 and marking a 3.2% change. In comparison the S&P 500 moved only 1.0%. EXPE is -6.25% below its average analyst target price of $188.25, which implies there is more upside for the stock.

As such, the average analyst rates it at buy. Over the last year, Expedia shares have outperformed the S&P 500 by 30.0%, with a price change of 42.8%.

Expedia Group, Inc. operates as an online travel company in the United States and internationally. The company is a consumer cyclical company, whose sales and revenues correlate with periods of economic expansion and contraction. The reason behind this is that when the economy is growing, the average consumer has more money to spend on the discretionary (non necessary) products that cyclical consumer companies tend to offer. Consumer cyclical stocks may offer more growth potential than non-cyclical or defensive stocks, but at the expense of higher volatility.

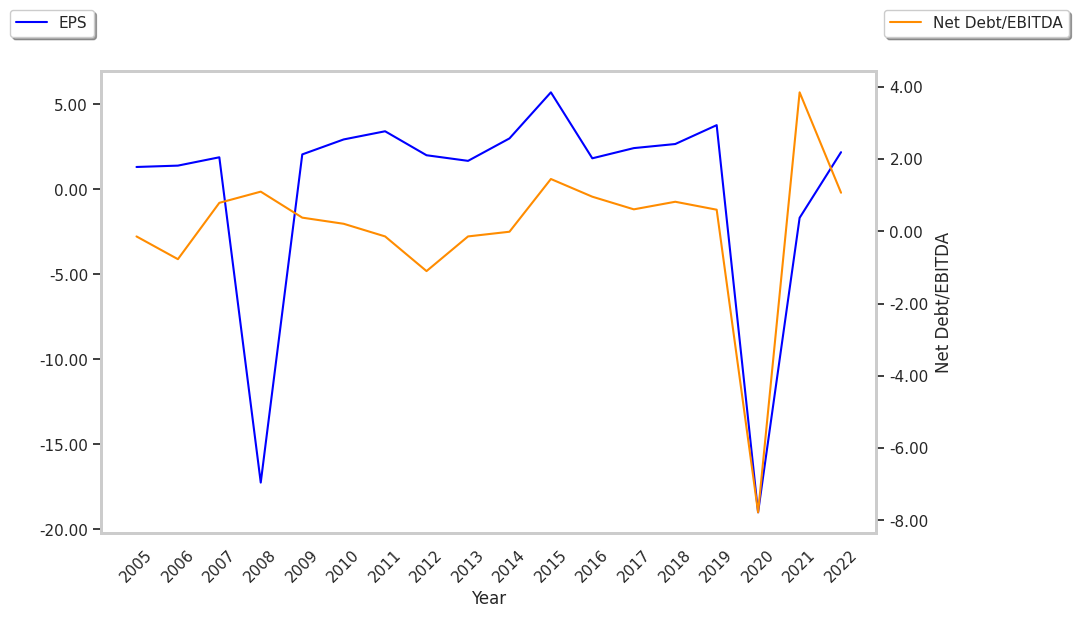

Expedia's trailing 12 month P/E ratio is 21.1, based on its trailing EPS of $8.38. The company has a forward P/E ratio of 10.6 according to its forward EPS of $14.36 -- which is an estimate of what its earnings will look like in the next quarter.

As of the third quarter of 2024, the average Price to Earnings (P/E) ratio for US consumer discretionary companies is 20.93, and the S&P 500 has an average of 29.3. The P/E ratio consists in the stock's share price divided by its earnings per share (EPS), representing how much investors are willing to spend for each dollar of the company's earnings. Earnings are the company's revenues minus the cost of goods sold, overhead, and taxes.

Another key to assessing a company's health is to look at its free cash flow, which is calculated on the basis of its total cash flow from operating activities minus its capital expenditures. Capital expenditures are the costs of maintaining fixed assets such as land, buildings, and equipment. From Expedia's last four annual reports, we are able to obtain the following rundown of its free cash flow:

| Date Reported | Cash Flow from Operations ($ k) | Capital expenditures ($ k) | Free Cash Flow ($ k) | YoY Growth (%) |

|---|---|---|---|---|

| 2024 | 3,085,000 | 756,000 | 2,329,000 | 26.3 |

| 2023 | 2,690,000 | 846,000 | 1,844,000 | -33.62 |

| 2022 | 3,440,000 | 662,000 | 2,778,000 | -9.66 |

| 2021 | 3,748,000 | 673,000 | 3,075,000 | 166.4 |

| 2020 | -3,834,000 | 797,000 | -4,631,000 | -388.18 |

| 2019 | 2,767,000 | 1,160,000 | 1,607,000 |

- Average free cash flow: $1.17 Billion

- Average free cash flown growth rate: 7.7 %

- Coefficient of variability (the lower the better): 0.0 %

With its positive cash flow, the company can not only re-invest in its business, it can offer regular returns to its equity investors in the form of dividends. Over the last 12 months, investors in EXPE have received an annualized dividend yield of 0.2% on their capital.

Value investors often analyze stocks through the lens of its Price to Book (P/B) Ratio (market value divided by book value). The book value refers to the present value of the company if the company were to sell off all of its assets and pay all of its debts today - a number whose value may differ significantly depending on the accounting method.

Expedia's P/B ratio indicates that the market value of the company exceeds its book value by a factor of 21, so the company's assets may be overvalued compared to the average P/B ratio of the Consumer Discretionary sector, which stands at 2.93 as of the third quarter of 2024.

Expedia is by most measures fairly valued because it has an average P/E ratio, a higher than Average P/B Ratio, and generally positive cash flows with an upwards trend. The stock has poor growth indicators because it has a an average PEG ratio and decent operating margins with a positive growth rate. We hope you enjoyed this overview of EXPE's fundamentals.