Zillow logged a 2.3% change during today's afternoon session, and is now trading at a price of $89.95 per share.

Zillow returned gains of 62.5% last year, with its stock price reaching a high of $91.93 and a low of $53.03. Over the same period, the stock outperformed the S&P 500 index by 44.0%. More recently, the company's 50-day average price was $80.05. Zillow Group, Inc. operates real estate brands in mobile applications and Websites in the United States. Based in Seattle, WA, the Large-Cap Real Estate company has 6,944 full time employees. Zillow has not offered a dividend during the last year.

Wider Gross Margins Than the Industry Average of 29.19%:

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $2,743 | $1,624 | $2,132 | $1,958 | $1,945 | $2,236 |

| Gross Margins | 44% | 84% | 85% | 81% | 78% | 76% |

| Net Margins | -11% | -10% | -25% | -5% | -8% | -5% |

| Net Income (M) | -$305 | -$162 | -$528 | -$101 | -$158 | -$112 |

| Net Interest Expense (M) | $102 | $138 | $128 | $35 | $36 | $36 |

| Depreciation & Amort. (M) | $87 | $111 | $130 | $157 | $187 | $240 |

| Diluted Shares (M) | 206 | 231 | 262 | 242 | 234 | 234 |

| Earnings Per Share | -$1.48 | -$0.7 | -$2.02 | -$0.42 | -$0.68 | -$0.48 |

| EPS Growth | n/a | 52.7% | -188.57% | 79.21% | -61.9% | 29.41% |

| Avg. Price | $38.17 | $71.42 | $110.33 | $46.5 | $57.86 | $89.86 |

| P/E Ratio | -25.79 | -99.19 | -52.29 | -110.71 | -85.09 | -187.21 |

| Free Cash Flow (M) | -$679 | $338 | -$3,251 | $4,389 | $219 | $285 |

| CAPEX (M) | $67 | $85 | $74 | $115 | $135 | $143 |

| EV / EBITDA | -51.32 | 72.08 | 79.09 | 186.38 | -167.07 | 479.52 |

| Total Debt (M) | $1,543 | $2,614 | $4,946 | $1,738 | $1,800 | $722 |

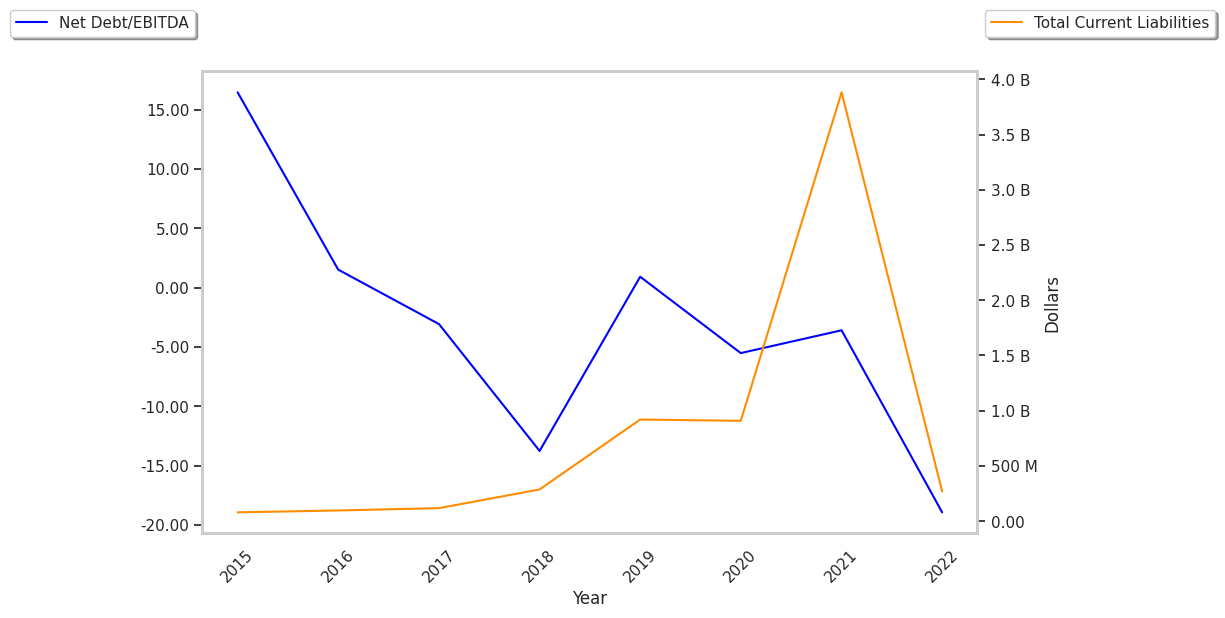

| Net Debt / EBITDA | -2.51 | 4.14 | 7.13 | 4.25 | -3.71 | -8.37 |

| Current Ratio | 3.81 | 5.46 | 1.98 | 13.34 | 3.24 | 2.81 |

Zillow benefits from generally positive cash flows, an excellent current ratio of 2.81, and wider gross margins than its peer group. The company's financial statements show a strong EPS growth trend and healthy leverage levels. Furthermore, Zillow has declining revenues and increasing reinvestment in the business.

Since its earnings per share are currently negative, Zillow does not have a meaningful trailing twelve month P/E ratio. The Real Estate sector has an average P/E ratio of 27.31. Furthermore, Zillow is likely overvalued compared to the book value of its equity, since its P/B ratio of 4.57 is higher than the sector average of 1.94. In conclusion, Zillow's impressive cash flow trend, decent P/B ratio, and reasonable use of leverage demonstrate that the company may still be fairly valued — despite its elevated earnings multiple.

Analysts Give Zillow No Average Rating:

The largest shareholder is Caledonia (Private) Investments Pty Ltd, whose 16% stake in the company is worth $2,610,281,859.