We've been asking ourselves recently if the market has placed a fair valuation on Zimmer Biomet. Let's dive into some of the fundamental values of this Large-Cap Health Care company to determine if there might be an opportunity here for value-minded investors.

a Lower P/B Ratio Than Its Sector Average but Its Shares Are Expensive:

Zimmer Biomet Holdings, Inc., together with its subsidiaries, operates as a medical technology company worldwide. The company belongs to the Health Care sector, which has an average price to earnings (P/E) ratio of 22.94 and an average price to book (P/B) ratio of 3.19. In contrast, Zimmer Biomet has a trailing 12 month P/E ratio of 24.4 and a P/B ratio of 1.58.

Zimmer Biomet has moved -6.7% over the last year compared to 17.6% for the S&P 500 — a difference of -24.3%. Zimmer Biomet has a 52 week high of $114.72 and a 52 week low of $89.22.

The Firm Has a Declining EPS Growth Trend:

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $6,961 | $6,128 | $6,827 | $6,940 | $7,394 | $7,679 |

| Gross Margins | 16% | -1% | 11% | 10% | 17% | 17% |

| Net Margins | 16% | -2% | 6% | 3% | 14% | 12% |

| Net Income (M) | $1,132 | -$139 | $402 | $231 | $1,024 | $904 |

| Net Interest Expense (M) | -$227 | -$212 | -$208 | -$165 | -$201 | -$218 |

| Depreciation & Amort. (M) | $871 | $898 | $938 | $926 | $952 | $404 |

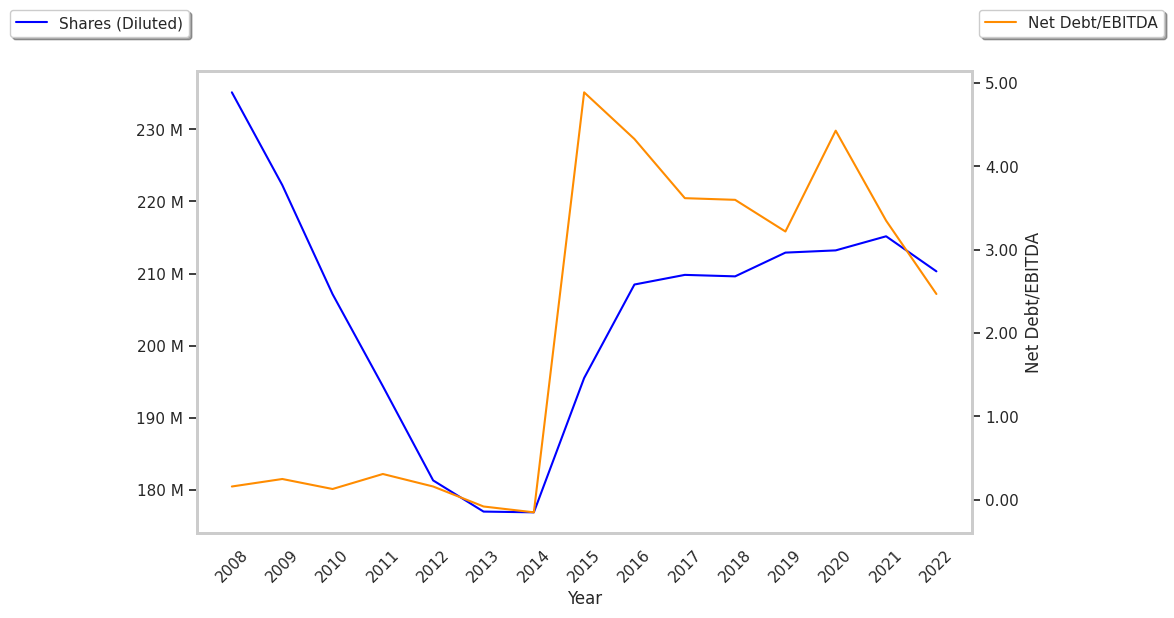

| Diluted Shares (M) | 207 | 207 | 210 | 210 | 210 | 204 |

| Earnings Per Share | $5.47 | -$0.67 | $1.91 | $1.1 | $4.88 | $4.43 |

| EPS Growth | n/a | -112.25% | 385.07% | -42.41% | 343.64% | -9.22% |

| Avg. Price | $120.94 | $126.7 | $146.24 | $117.82 | $121.7 | $99.12 |

| P/E Ratio | 21.91 | -189.1 | 75.77 | 107.11 | 24.79 | 22.27 |

| Free Cash Flow (M) | $1,387 | $1,093 | $1,356 | $1,168 | $1,290 | $1,296 |

| CAPEX (M) | $198 | $112 | $144 | $188 | $291 | $204 |

| EV / EBITDA | 16.3 | 34.13 | 18.14 | 18.47 | 13.81 | 15.39 |

| Total Debt (M) | $8,221 | $8,126 | $2,605 | $5,696 | $5,768 | $6,205 |

| Net Debt / EBITDA | 3.83 | 7.49 | 1.24 | 3.28 | 2.4 | 3.36 |

| Current Ratio | 1.37 | 1.99 | 1.41 | 1.88 | 1.61 | 1.91 |

Zimmer Biomet has growing revenues and a flat capital expenditure trend, generally positive cash flows, and a decent current ratio of 1.91. However, the firm suffers from slimmer gross margins than its peers and declining EPS growth. Finally, we note that Zimmer Biomet has significant leverage levels.