The Southern Company has moved 2.0% so far today on a volume of 860,859, compared to its average of 3,982,173. In contrast, the S&P 500 index moved 4.2%

The large-cap utilities company -5.91% away from its average analyst target price of $68.81 per share. The 16 analysts following the stock have set target prices ranging from $55 to $82, and on average have given Southern Company (The) a rating of hold.

Below are some factors that could be affecting the stocks's performance and analyst recommendation:

-

the Southern Company has moved 0.6% over the last year, and the S&P 500 logged a change of -19.4%

-

Based on its trailing earning per share of 3.16, Southern Company (The) has a trailing 12 month Price to Earnings (P/E) ratio of 20.5 while the S&P 500 average is 15.97

-

SO has a forward P/E ratio of 17.0 based on its forward 12 month price to earnings (Eps) is $3.81 per share

-

The company has a price to earnings growth (PEG) ratio of 2.75 -- a number near or below 1 signifying that the Southern Company is fairly valued compared to its estimated growth potential

-

Its Price to Book (P/B) ratio is 2.3 compared to its sector average of 1.47

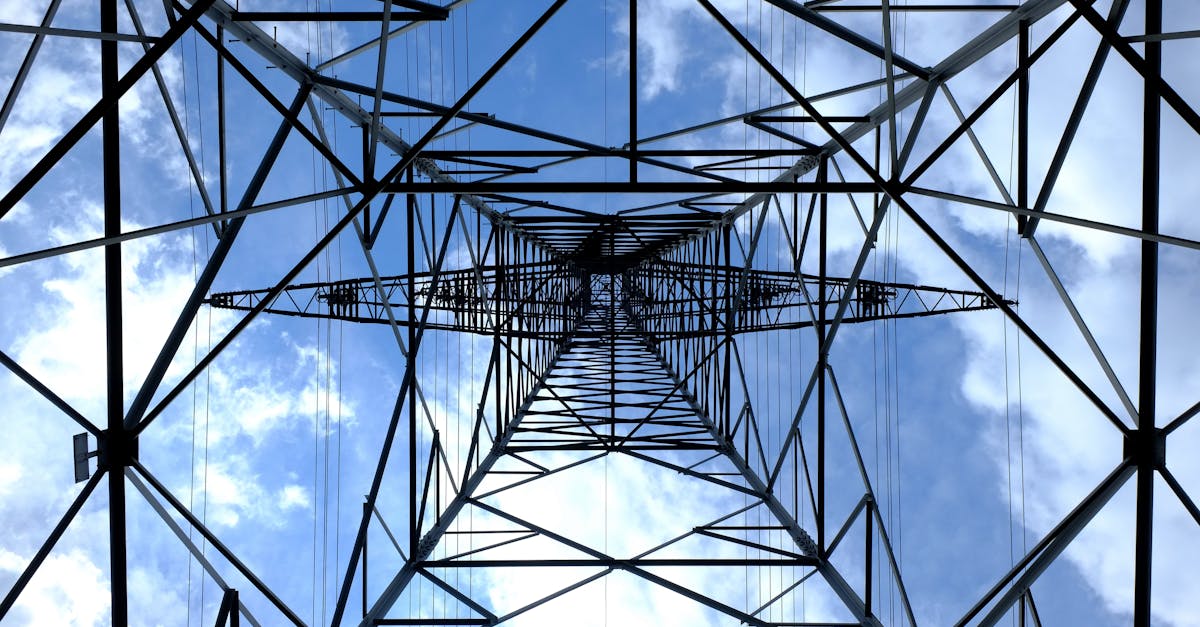

The Southern Company, through its subsidiaries, engages in the generation, transmission, and distribution of electricity. Based in Atlanta, the company has 27,027 full time employees and a market cap of $70,480,486,400. the Southern Company currently returns an annual dividend yield of 4.2%.

If you would like more in-depth discussions of stocks such as Southern Company (The), subscribe to our free newsletter!