Today Barrons is reported that Carrier Global was among the many large U.S. companies that declared dividend increases this week." For full coverage click here.

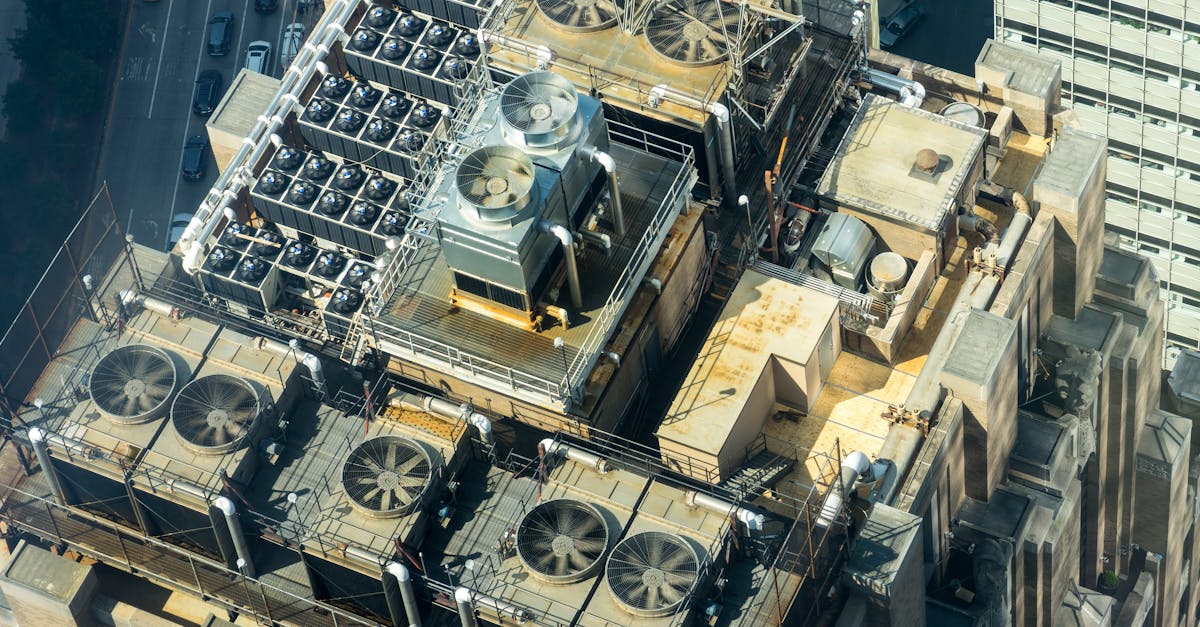

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies worldwide. The company belongs to the Industrials sector, which has an average price to earnings (P/E) ratio of 21.46 and an average price to book (P/B) ratio of 3.7. In contrast, Carrier Global has a trailing 12 month P/E ratio of 10.4 and a P/B ratio of 5.0.

Carrier Global has moved -21.7% over the last year compared to -15.7% for the S&P 500 -- a difference of -5.9%. Carrier Global has a 52 week high of $56.04 and a 52 week low of $33.1. At today's price of $43.02 per share, Carrier Global is -4.04% away from its target price of $44.83, and on average, analysts give the stock a rating of buy. 1.2% of the company's shares are linked to short positions, and 87.9% of the shares are owned by institutional investors.