Kirby does not have the profile of a defensive investment based on the requirements of Ben Graham. The Marine Shipping firm may nonetheless be of interest to more risk-oriented investors who have a solid thesis on the company's future growth. At Market Inference, we remain agnostic as to such further developments, and prefer to use a company's past track record as the bellwether for future potential gains.

Kirby Is Probably Overvalued

Graham devised the below equation to give investors a quick way of determining whether a stock is trading at a fair multiple of its earnings and its assets:

√(22.5 * 6 year average earnings per share (0.46) * 6 year average book value per share (52.192) = $47.84

At today's price of $81.39 per share, Kirby is now trading 70.1% above the maximum price that Graham would have wanted to pay for the stock.

Even though the stock does not trade at an attractive multiple, it might still meet some of the other criteria for quality stocks that Graham listed in Chapter 14 of The Intelligent Investor.

Positive Retained Earnings From 2009 To 2022, No Dividend Record, and Decreasing Earnings Per Share

Ben Graham wrote that an investment in a company with a record of positive retained earnings could contribute significantly to the margin of safety. Kirby had positive retained earnings from 2009 to 2022 with an average of $2.04 Billion over this period.

Another one of Graham's requirements is for a 30% or more cumulative growth rate of the company's earnings per share over the last ten years.We are going to compare Kirby's earnings per share averages from the two 'bookends' of the 15 year period for which we have data. The first bookend comprises the years 2008, 2009, and 2010, whose EPS values of $2.91, $2.34, and $0.59 average out to $1.95. Next we look at the years 2020, 2021, and 2022, whose values of $-4.55, $-4.11, and $2.03 average out to $-2.21. The growth rate between the two averages does not meet Graham's standard since it is -213.33%.

We have no record of Kirby offering a regular dividend.

Kirby’s Balance Sheet Meets Graham’s Criteria

It was also essential to Graham that the company’s current assets outweigh its current liabilities, and that its long term debt be inferior to the sum of its net current assets (current assets minus total liabilities). This is the aspect of the analysis that most companies fail, yet Kirby passes comfortably, with an average current ratio of 2.3, and average debt to net current asset ratio of -0.8.

Conclusion

According to Graham's analysis, Kirby is likely a company of average quality, which does not offer a significant enough margin of safety for a risk averse investor.

| 2018-02-26 | 2019-02-26 | 2020-02-24 | 2021-02-23 | 2022-02-18 | 2023-02-21 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $2,214 | $2,971 | $2,838 | $2,171 | $2,247 | $2,785 |

| Gross Margins | 30.0% | 27.0% | 28.0% | 30.0% | 26.0% | 26.0% |

| Operating Margins | 9% | 8% | 9% | 6% | 3% | 7% |

| Net Margins | 14.0% | 3.0% | 5.0% | -13.0% | -11.0% | 4.0% |

| Net Income (MM) | $313 | $78 | $142 | -$273 | -$247 | $122 |

| Net Interest Expense (MM) | -$21 | -$47 | -$56 | -$49 | -$42 | -$45 |

| Depreciation & Amort. (MM) | -$203 | -$225 | -$220 | -$220 | -$214 | -$201 |

| Earnings Per Share | $5.66 | $1.31 | $2.38 | -$4.55 | -$4.09 | $2.02 |

| EPS Growth | n/a | -76.86% | 81.68% | -291.18% | 10.11% | 149.39% |

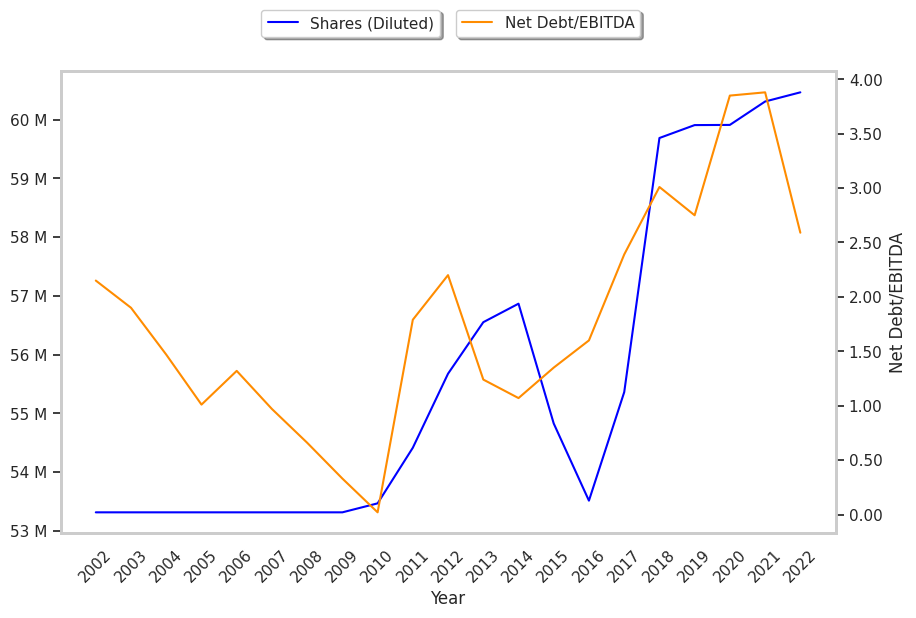

| Diluted Shares (MM) | 55 | 60 | 60 | 60 | 60 | 60 |

| Free Cash Flow (MM) | $476 | $596 | $702 | $576 | $368 | $430 |

| Capital Expenditures (MM) | -$123 | -$249 | -$191 | -$131 | -$47 | -$136 |

| Net Current Assets (MM) | -$1,056 | -$1,559 | -$1,790 | -$1,789 | -$1,506 | -$1,298 |

| Long Term Debt (MM) | $992 | $1,410 | $1,370 | $1,469 | $1,161 | $1,076 |

| Net Debt / EBITDA | 2.39 | 3.01 | 2.75 | 3.85 | 3.88 | 2.59 |