Pulte meets some but not all of Benjamin Graham's requirements for a defensive stock. The Residential Construction company does not offer a large enough margin of safety for cautious investors, but it does have many qualities that may interest more enterprising investors.

Pulte Trades at Fair Multiples

The “Graham number” is an equation that enables us to quickly determine how a stock is valued in terms of its earnings and assets:

√(22.5 * 6 year average earnings per share (5.26) * 6 year average book value per share (44.135) = $88.15

Despite its solid 88.0% performance over the 12 months, Pulte still provides a margin of safety because its Graham number is -13.5% above its current price of $76.28 per share. Some people use the Graham number alone, but it is best to consider it together with the other requirements for defensive stocks that Graham listed in Chapter 14 of The Intelligent Investor.

Negative Retained Earnings In 2010 And 2011, A Solid Record Of Dividends, and Eps Growth In Excess Of Graham'S Requirements

Ben Graham wrote that an investment in a company with a record of positive retained earnings could contribute significantly to the margin of safety. However, Pulte had negative retained earnings in 2010 and 2011 with an average of $1.57 Billion over this period.

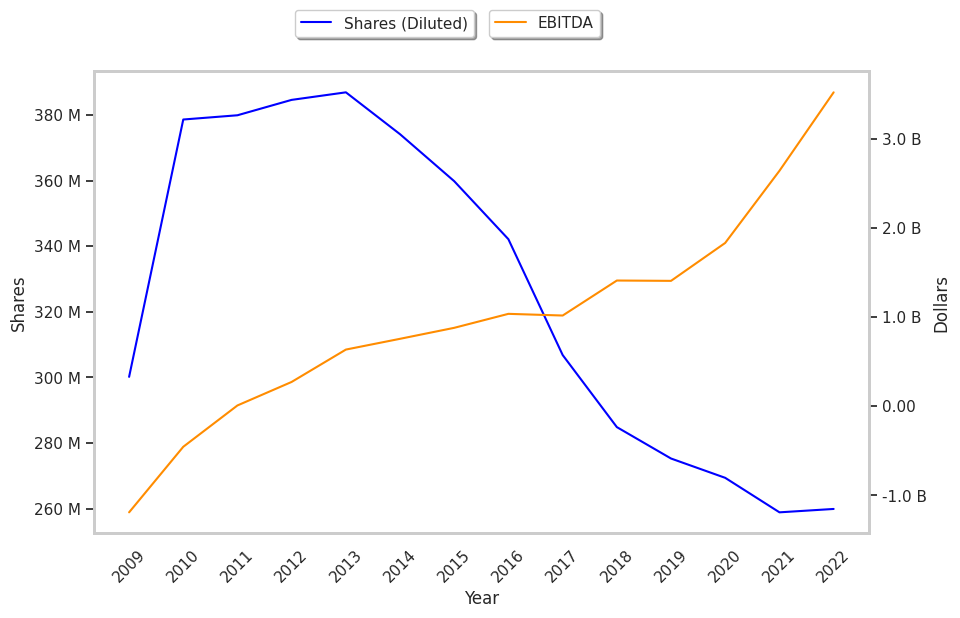

Another one of Graham's requirements is for a 30% or more cumulative growth rate of the company's earnings per share over the last ten years.To determine Pulte's EPS growth over time, we will average out its EPS for 2008, 2009, and 2010, which were $-5.81, $-3.94, and $-0.44 respectively. This gives us an average of $-3.40 for the period of 2008 to 2010. Next, we compare this value with the average EPS reported in 2020, 2021, and 2022, which were $1.62, $7.43, and $11.01, for an average of $6.69. Now we see that Pulte's EPS growth was 296.76% during this period, which satisfies Ben Graham's requirement.

Shareholders of Pulte have received regular dividends since 2008. The company has returned an average dividend yield of 1.2% over the last five years.

Pulte’s Balance Sheet Meets Graham’s Criteria

It was also essential to Graham that the company’s current assets outweigh its current liabilities, and that its long term debt be inferior to the sum of its net current assets (current assets minus total liabilities). This is the aspect of the analysis that most companies fail, yet Pulte passes comfortably, with an average current ratio of 4.3, and average debt to net current asset ratio of 0.4.

Conclusion

Pulte offers a decent combination of value, growth, and profitability. These factors imply that the investment offers a decent margin of safety — especially if the shares are bought during a sell-off.

| 2018-02-07 | 2019-01-31 | 2020-01-30 | 2021-02-02 | 2022-02-07 | 2023-02-06 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $8,573 | $10,188 | $10,213 | $11,036 | $13,927 | $16,229 |

| Gross Margins | 23.0% | 25.0% | 25.0% | 27.0% | 28.0% | 31.0% |

| Operating Margins | 11% | 13% | 13% | 16% | 18% | 21% |

| Net Margins | 5.0% | 10.0% | 10.0% | 13.0% | 14.0% | 16.0% |

| Net Income (MM) | $447 | $1,022 | $1,017 | $1,407 | $1,946 | $2,617 |

| Earnings Per Share | $1.46 | $3.59 | $3.69 | $5.22 | $7.52 | $10.07 |

| EPS Growth | n/a | 145.89% | 2.79% | 41.46% | 44.06% | 33.91% |

| Diluted Shares (MM) | 307 | 285 | 275 | 269 | 259 | 260 |

| Free Cash Flow (MM) | $695 | $1,507 | $1,134 | $1,843 | $1,077 | $781 |

| Capital Expenditures (MM) | -$32 | -$59 | -$58 | -$58 | -$73 | -$113 |

| Net Current Assets (MM) | n/a | n/a | n/a | n/a | $5,994 | $7,258 |

| Long Term Debt (MM) | n/a | n/a | n/a | n/a | $2,655 | $2,632 |