Now trading at a price of $124.86, Prologis has moved 0.7% so far today.

Over the last year, Prologis logged a 1.0% change, with its stock price reaching a high of $136.67 and a low of $98.03. Over the same period, the stock underperformed the S&P 500 index by -13.0%. As of April 2023, the company's 50-day average price was $123.1. Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. Based in San Francisco, CA, the large-cap Real Estate company has 2,466 full time employees. Prologis has offered a 2.7% dividend yield over the last 12 months.

The Business Has Operating Margins Consistently Higher Than the 25.46% industry Average:

| 2018-02-15 | 2019-02-13 | 2020-02-11 | 2021-02-11 | 2022-02-09 | 2023-02-14 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $2,618 | $2,804 | $3,331 | $4,439 | $4,759 | $5,974 |

| Operating Margins | 28% | 30% | 30% | 32% | 34% | 38% |

| Net Margins | 63.0% | 59.0% | 47.0% | 33.0% | 62.0% | 56.0% |

| Net Income (MM) | $1,652 | $1,649 | $1,573 | $1,482 | $2,940 | $3,365 |

| Net Interest Expense (MM) | -$274 | -$229 | -$240 | -$315 | -$266 | -$309 |

| Depreciation & Amort. (MM) | -$879 | -$947 | -$1,140 | -$1,562 | -$1,578 | -$1,813 |

| Earnings Per Share | $2.97 | $2.78 | $2.39 | $1.95 | $3.84 | $4.14 |

| EPS Growth | n/a | -6.4% | -14.03% | -18.41% | 96.92% | 7.81% |

| Diluted Shares (MM) | 552 | 590 | 655 | 754 | 765 | 812 |

| Free Cash Flow (MM) | $3,847 | $4,849 | $5,208 | $4,326 | $5,486 | $6,830 |

| Capital Expenditures (MM) | -$2,159 | -$3,045 | -$2,944 | -$1,389 | -$2,490 | -$2,703 |

| Net Current Assets (MM) | -$9,952 | -$11,651 | -$12,151 | -$18,072 | -$19,518 | -$29,225 |

| Long Term Debt (MM) | $9,413 | $11,090 | $11,906 | $16,849 | $17,715 | $23,876 |

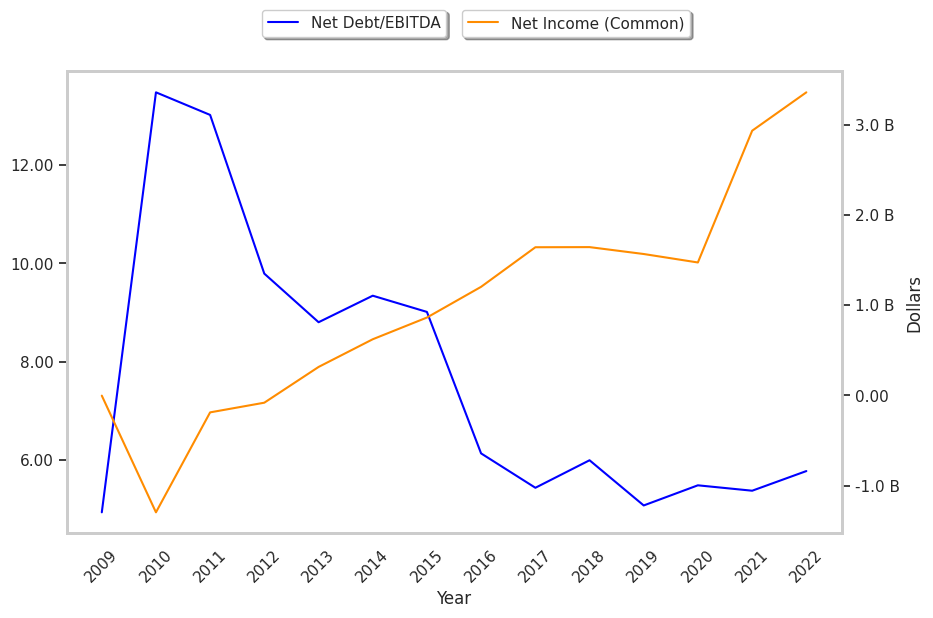

Prologis has strong margins with a positive growth rate, healthy debt levels, and positive EPS growth. Furthermore, Prologis has weak revenue growth and a flat capital expenditure trend and irregular cash flows.

Prologis's Valuation Is in Line With Its Sector Averages:

Prologis has a trailing twelve month P/E ratio of 33.3, compared to an average of 24.81 for the Real Estate sector. Based on its EPS guidance of $2.8, the company has a forward P/E ratio of 44.0. The company doesn't issue forward earnings guidance, and the compound average growth rate of its last 6 years of reported EPS is 3.7%. On this basis, the company's PEG ratio is 8.92, which suggests that it is overpriced. In contrast, the market is likely undervaluing Prologis in terms of its equity because its P/B ratio is 2.16 while the sector average is 2.24. The company's shares are currently trading 53.2% above their Graham number.

There's an Analyst Consensus of Some Upside Potential for Prologis:

The 21 analysts following Prologis have set target prices ranging from $128.0 to $162.0 per share, for an average of $142.81 with a buy rating. As of April 2023, the company is trading -13.8% away from its average target price, indicating that there is an analyst consensus of some upside potential.

Prologis has a very low short interest because 1.4% of the company's shares are sold short. Institutions own 95.5% of the company's shares, and the insider ownership rate stands at 0.32%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 13% stake in the company is worth $14,989,148,710.