We've been asking ourselves recently if the market has placed a fair valuation on Prologis. Let's dive into some of the fundamental values of this large-cap Real Estate company to determine if there might be an opportunity here for value-minded investors.

Prologis's Valuation Is in Line With Its Sector Averages:

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. The company belongs to the Real Estate sector, which has an average price to earnings (P/E) ratio of 24.81 and an average price to book (P/B) ratio of 2.24. In contrast, Prologis has a trailing 12 month P/E ratio of 33.0 and a P/B ratio of 2.11.

When we divide Prologis's P/E ratio by its expected EPS growth rate of the next five years, we obtain its PEG ratio of -6.89. Since it's negative, the company has negative growth expectations, and most investors will probably avoid the stock unless it has an exceptionally low P/E and P/B ratio.

The Business Has Operating Margins Consistently Higher Than the 25.46% industry Average:

| 2018-02-15 | 2019-02-13 | 2020-02-11 | 2021-02-11 | 2022-02-09 | 2023-02-14 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $2,618 | $2,804 | $3,331 | $4,439 | $4,759 | $5,974 |

| Operating Margins | 28% | 30% | 30% | 32% | 34% | 38% |

| Net Margins | 63.0% | 59.0% | 47.0% | 33.0% | 62.0% | 56.0% |

| Net Income (MM) | $1,652 | $1,649 | $1,573 | $1,482 | $2,940 | $3,365 |

| Net Interest Expense (MM) | -$274 | -$229 | -$240 | -$315 | -$266 | -$309 |

| Depreciation & Amort. (MM) | -$879 | -$947 | -$1,140 | -$1,562 | -$1,578 | -$1,813 |

| Earnings Per Share | $2.97 | $2.78 | $2.39 | $1.95 | $3.84 | $4.14 |

| EPS Growth | n/a | -6.4% | -14.03% | -18.41% | 96.92% | 7.81% |

| Diluted Shares (MM) | 552 | 590 | 655 | 754 | 765 | 812 |

| Free Cash Flow (MM) | $3,847 | $4,849 | $5,208 | $4,326 | $5,486 | $6,830 |

| Capital Expenditures (MM) | -$2,159 | -$3,045 | -$2,944 | -$1,389 | -$2,490 | -$2,703 |

| Net Current Assets (MM) | -$9,952 | -$11,651 | -$12,151 | -$18,072 | -$19,518 | -$29,225 |

| Long Term Debt (MM) | $9,413 | $11,090 | $11,906 | $16,849 | $17,715 | $23,876 |

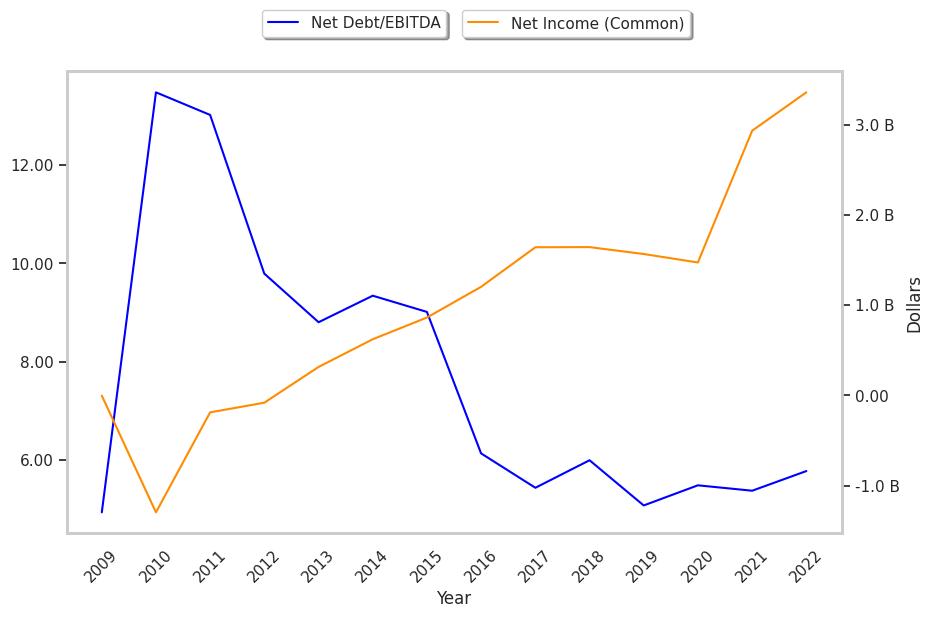

Prologis has strong margins with a positive growth rate, healthy debt levels, and positive EPS growth. Furthermore, Prologis has weak revenue growth and a flat capital expenditure trend and irregular cash flows.