Now trading at a price of $75.13, GoDaddy has moved 1.9% so far today.

Over the last year, GoDaddy logged a 0.0% change, with its stock price reaching a high of $85.32 and a low of $64.65. Over the same period, the stock underperformed the S&P 500 index by -15.0%. As of April 2023, the company's 50-day average price was $73.71. GoDaddy Inc. engages in the design and development of cloud-based products in the United States and internationally. Based in Tempe, AZ, the large-cap Technology company has 6,910 full time employees. GoDaddy has not offered a dividend during the last year.

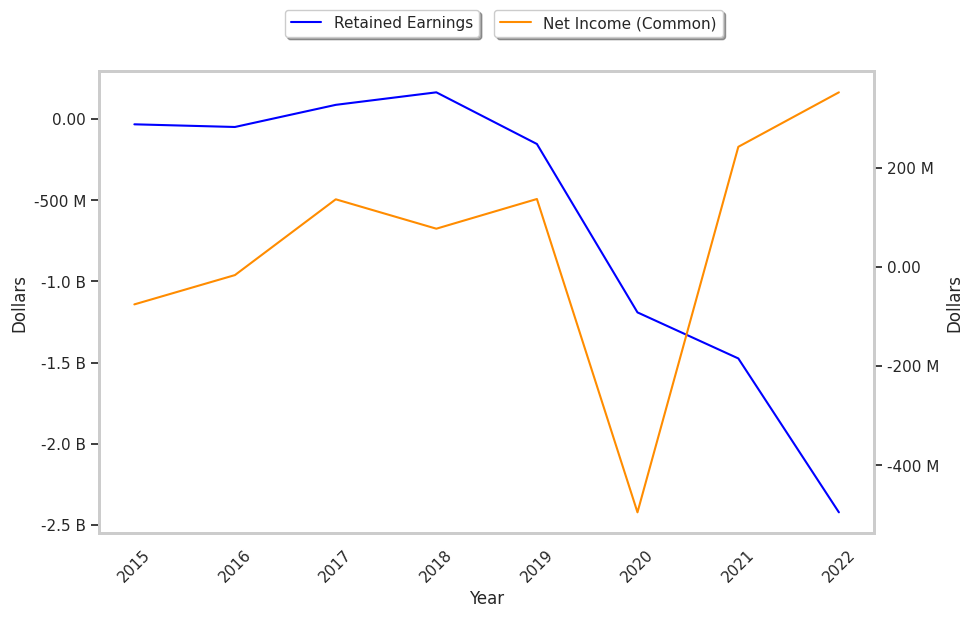

The Company Has a Negative Equity Levels:

| 2018-02-27 | 2019-02-22 | 2020-02-21 | 2021-02-19 | 2022-02-17 | 2023-02-16 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $2,232 | $2,660 | $2,988 | $3,317 | $3,816 | $4,091 |

| Gross Margins | 49.0% | 50.0% | 66.0% | 65.0% | 64.0% | 64.0% |

| Operating Margins | 3% | 6% | 7% | 10% | 10% | 13% |

| Net Margins | 6.0% | 3.0% | 5.0% | -15.0% | 6.0% | 9.0% |

| Net Income (MM) | $136 | $77 | $137 | -$495 | $242 | $352 |

| Net Interest Expense (MM) | -$83 | -$98 | -$92 | -$91 | -$126 | -$146 |

| Depreciation & Amort. (MM) | -$206 | -$234 | -$210 | -$203 | -$200 | -$195 |

| Earnings Per Share | $0.77 | $0.43 | $0.75 | -$2.94 | $1.43 | $2.18 |

| EPS Growth | n/a | -44.16% | 74.42% | -492.0% | 148.64% | 52.45% |

| Diluted Shares (MM) | 177 | 181 | 182 | 169 | 170 | 161 |

| Free Cash Flow (MM) | $611 | $657 | $816 | $846 | $1,082 | $1,040 |

| Capital Expenditures (MM) | -$135 | -$97 | -$92 | -$82 | -$253 | -$60 |

| Net Current Assets (MM) | -$4,132 | -$3,832 | -$3,944 | -$5,153 | -$5,444 | -$5,720 |

| Long Term Debt (MM) | $2,411 | $2,394 | $2,377 | $3,090 | $3,882 | $3,831 |

GoDaddy's P/B and P/E Ratios Are Higher Than Average:

GoDaddy has a trailing twelve month P/E ratio of 36.3, compared to an average of 27.16 for the Technology sector. Based on its EPS guidance of $3.5, the company has a forward P/E ratio of 21.1. GoDaddy's PEG ratio is 3.65 on the basis of the 9.9% weighted average of the company and the broader market's EPS compound average growth rates. This suggests that the company's shares are overvalued.

GoDaddy Has an Average Rating of Buy:

The 14 analysts following GoDaddy have set target prices ranging from $80.0 to $110.0 per share, for an average of $92.93 with a buy rating. As of April 2023, the company is trading -20.7% away from its average target price, indicating that there is an analyst consensus of some upside potential.

GoDaddy has a very low short interest because 1.8% of the company's shares are sold short. Institutions own 95.8% of the company's shares, and the insider ownership rate stands at 0.28%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 10% stake in the company is worth $1,135,628,375.