We've been asking ourselves recently if the market has placed a fair valuation on Meta Platforms. Let's dive into some of the fundamental values of this large-cap Technology company to determine if there might be an opportunity here for value-minded investors.

Meta Platforms's Valuation Is in Line With Its Sector Averages:

Meta Platforms, Inc. engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables worldwide. The company belongs to the Technology sector, which has an average price to earnings (P/E) ratio of 27.16 and an average price to book (P/B) ratio of 6.23. In contrast, Meta Platforms has a trailing 12 month P/E ratio of 34.4 and a P/B ratio of 5.91.

When we divideMeta Platforms's P/E ratio by its expected five-year EPS growth rate, we obtain a PEG ratio of 0.74, which indicates that the market is undervaluing the company's projected growth (a PEG ratio of 1 indicates a fairly valued company). Your analysis of the stock shouldn't end here. Rather, a good PEG ratio should alert you that it may be worthwhile to take a closer look at the stock.

The Business Has Operating Margins Consistently Higher Than the 21.81% industry Average:

| 2018-02-01 | 2019-01-31 | 2020-01-30 | 2021-01-28 | 2022-02-03 | 2023-02-02 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $40,653 | $55,838 | $70,697 | $85,965 | $117,929 | $116,609 |

| Gross Margins | 87.0% | 83.0% | 82.0% | 81.0% | 81.0% | 78.0% |

| Operating Margins | 50% | 45% | 34% | 38% | 40% | 25% |

| Net Margins | 39.0% | 40.0% | 26.0% | 34.0% | 33.0% | 20.0% |

| Net Income (MM) | $15,934 | $22,112 | $18,485 | $29,146 | $39,370 | $23,200 |

| Earnings Per Share | $5.39 | $7.57 | $6.43 | $10.09 | $13.77 | $8.59 |

| EPS Growth | n/a | 40.45% | -15.06% | 56.92% | 36.47% | -37.62% |

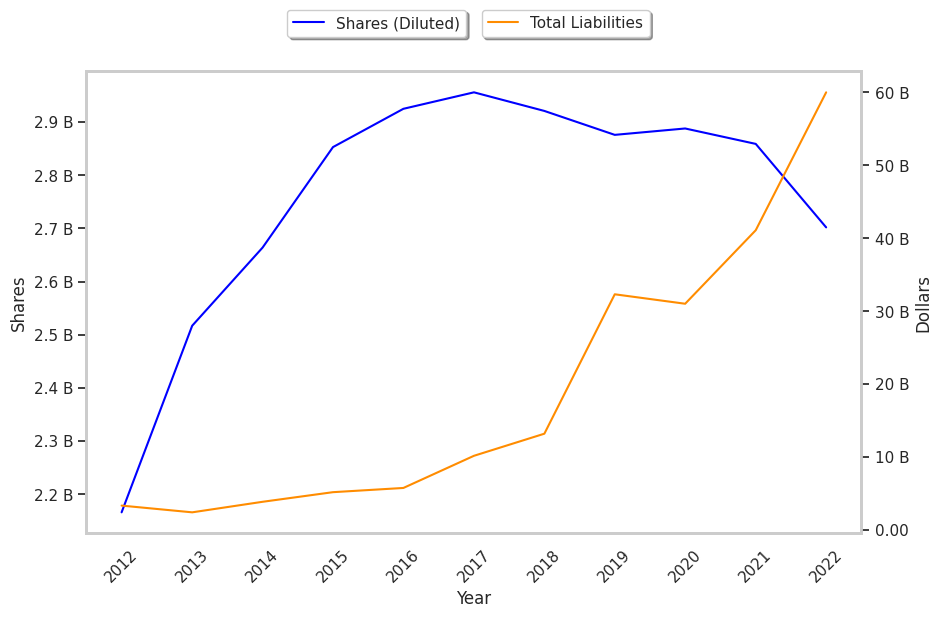

| Diluted Shares (MM) | 2,956 | 2,921 | 2,876 | 2,888 | 2,859 | 2,702 |

| Free Cash Flow (MM) | $30,949 | $43,189 | $51,416 | $53,862 | $76,250 | $81,661 |

| Capital Expenditures (MM) | -$6,733 | -$13,915 | -$15,102 | -$15,115 | -$18,567 | -$31,186 |

| Net Current Assets (MM) | n/a | n/a | n/a | n/a | n/a | -$465 |

| Long Term Debt (MM) | n/a | n/a | n/a | n/a | n/a | $9,923 |

Meta Platforms has strong margins with a negative growth trend, a pattern of improving cash flows, and an excellent current ratio. The company also benefits from healthy debt levels, wider gross margins than its peer group, and positive EPS growth. Furthermore, Meta Platforms has weak revenue growth and a flat capital expenditure trend.