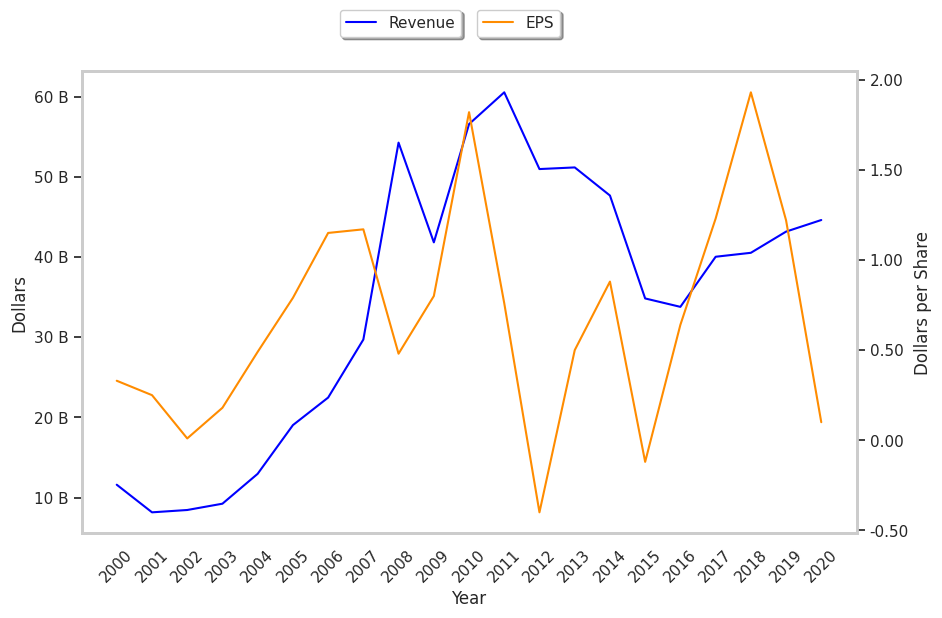

Shares of Basic Materials sector company Rio Tinto Plc moved 4.3% today, and are now trading at a price of $65.83. The large-cap stock's daily volume was 3,087,150 compared to its average volume of 2,793,701. The S&P 500 index returned a 1.0% performance.

Rio Tinto Group engages in exploring, mining, and processing mineral resources worldwide. The company is based in London and has 54,000 full time employees. Its market capitalization is $106,787,897,344. Rio Tinto Plc currently offers its equity investors a dividend that yields 6.3% per year.

3 analysts are following Rio Tinto Plc and have set target prices ranging from $73.5 to $92.0 per share. On average, they have given the company a rating of buy. At today's prices, RIO is trading -19.89% away from its average analyst target price of $82.17 per share.

Over the last year, RIO's share price has increased by 23.0%, which represents a difference of 6.0% when compared to the S&P 500. The stock's 52 week high is $80.52 per share whereas its 52 week low is $50.92.

| Date Reported | Cash Flow from Operations ($ k) | Capital expenditures ($ k) | Free Cash Flow ($ k) | YoY Growth (%) |

|---|---|---|---|---|

| 2021-01-01 | 21,822,000 | -6,144,000 | 27,966,000 | 37.42 |

| 2020-01-01 | 14,912,000 | -5,439,000 | 20,351,000 | 17.97 |

| 2019-01-01 | 11,821,000 | -5,430,000 | 17,251,000 | -6.07 |

| 2018-01-01 | 13,884,000 | -4,482,000 | 18,366,000 | 60.02 |

| 2017-01-01 | 8,465,000 | -3,012,000 | 11,477,000 | -18.42 |

| 2016-01-01 | 9,383,000 | -4,685,000 | 14,068,000 |