Now trading at a price of $36.22, Bath & Body Works has moved -0.2% so far today.

Bath & Body Works returned losses of -6.0% last year, with its stock price reaching a high of $49.55 and a low of $30.52. Over the same period, the stock underperformed the S&P 500 index by -21.0%. As of April 2023, the company's 50-day average price was $36.74. Bath & Body Works, Inc. operates a specialty retailer of home fragrance, body care, and soaps and sanitizer products. Based in Columbus, OH, the mid-cap Consumer Cyclical company has 8,800 full time employees. Bath & Body Works has offered a 2.2% dividend yield over the last 12 months.

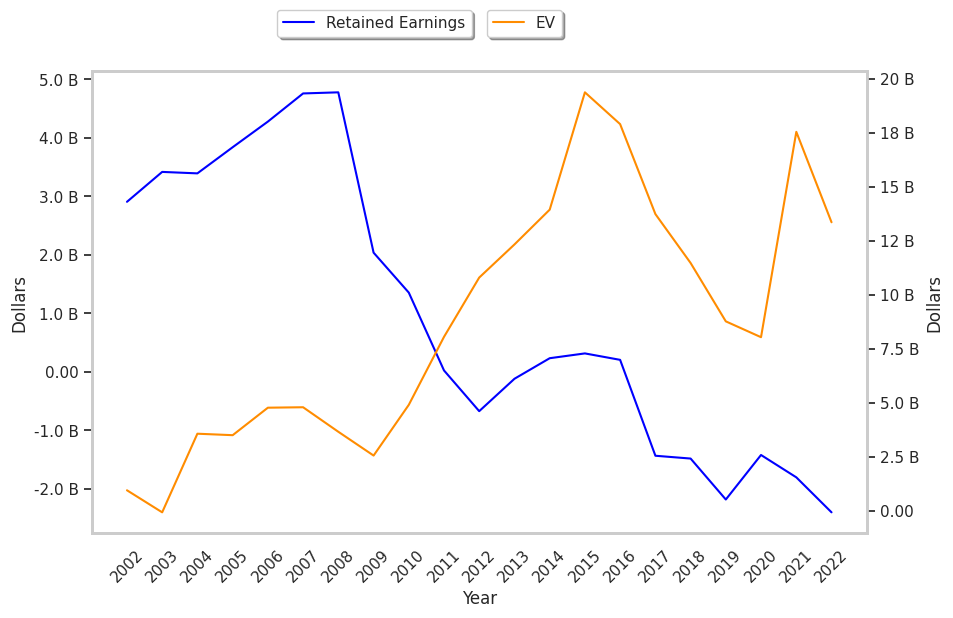

The Company Has a Negative Equity Levels:

| 2018-03-23 | 2019-03-22 | 2020-03-30 | 2021-03-19 | 2022-03-18 | 2023-03-17 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $12,632 | $13,237 | $5,405 | $6,434 | $7,882 | $7,560 |

| Gross Margins | 39.0% | 37.0% | 44.0% | 48.0% | 49.0% | 43.0% |

| Operating Margins | 14% | 10% | 19% | 25% | 25% | 18% |

| Net Margins | 8.0% | 5.0% | -7.0% | 13.0% | 17.0% | 11.0% |

| Net Income (MM) | $983 | $644 | -$366 | $844 | $1,333 | $800 |

| Net Interest Expense (MM) | -$406 | -$385 | -$370 | -$432 | -$388 | -$348 |

| Depreciation & Amort. (MM) | -$524 | -$590 | -$588 | -$521 | -$363 | -$221 |

| Earnings Per Share | $3.43 | $2.31 | -$1.33 | $3.0 | $5.11 | $3.43 |

| EPS Growth | n/a | -32.65% | -157.58% | 325.56% | 70.33% | -32.88% |

| Diluted Shares (MM) | 287 | 279 | 276 | 281 | 261 | 233 |

| Free Cash Flow (MM) | $2,113 | $2,006 | $1,694 | $2,267 | $1,762 | $1,472 |

| Capital Expenditures (MM) | -$707 | -$629 | -$458 | -$228 | -$270 | -$328 |

| Net Current Assets (MM) | -$5,607 | -$5,695 | -$8,375 | -$6,653 | -$4,534 | -$5,433 |

| Long Term Debt (MM) | $5,707 | $5,739 | $5,487 | $6,366 | $4,854 | $4,862 |

Bath & Body Works has weak revenue growth and a flat capital expenditure trend, irregular cash flows, and a decent current ratio. We also note that the company benefits from wider gross margins than its peer group and decent operating margins with a stable trend. However, the firm has declining EPS growth.

Bath & Body Works Is Overpriced:

Bath & Body Works has a trailing twelve month P/E ratio of 12.2, compared to an average of 22.33 for the Consumer Cyclical sector. Based on its EPS guidance of $3.58, the company has a forward P/E ratio of 10.3. The company doesn't issue forward earnings guidance, and the compound average growth rate of its last 6 years of reported EPS is -2.1%. On this basis, the company's PEG ratio is -5.79, which indicates that its shares are overpriced.

There's an Analyst Consensus of Strong Upside Potential for Bath & Body Works:

The 18 analysts following Bath & Body Works have set target prices ranging from $37.0 to $68.0 per share, for an average of $47.78 with a buy rating. As of April 2023, the company is trading -23.1% away from its average target price, indicating that there is an analyst consensus of strong upside potential.

Bath & Body Works has an average amount of shares sold short because 3.9% of the company's shares are sold short. Institutions own 93.8% of the company's shares, and the insider ownership rate stands at 0.46%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 11% stake in the company is worth $928,015,216.