Sunrun logged a -0.9% change during today's afternoon session, and is now trading at a price of $10.57 per share. On average, analysts give it a target price of $32.86.

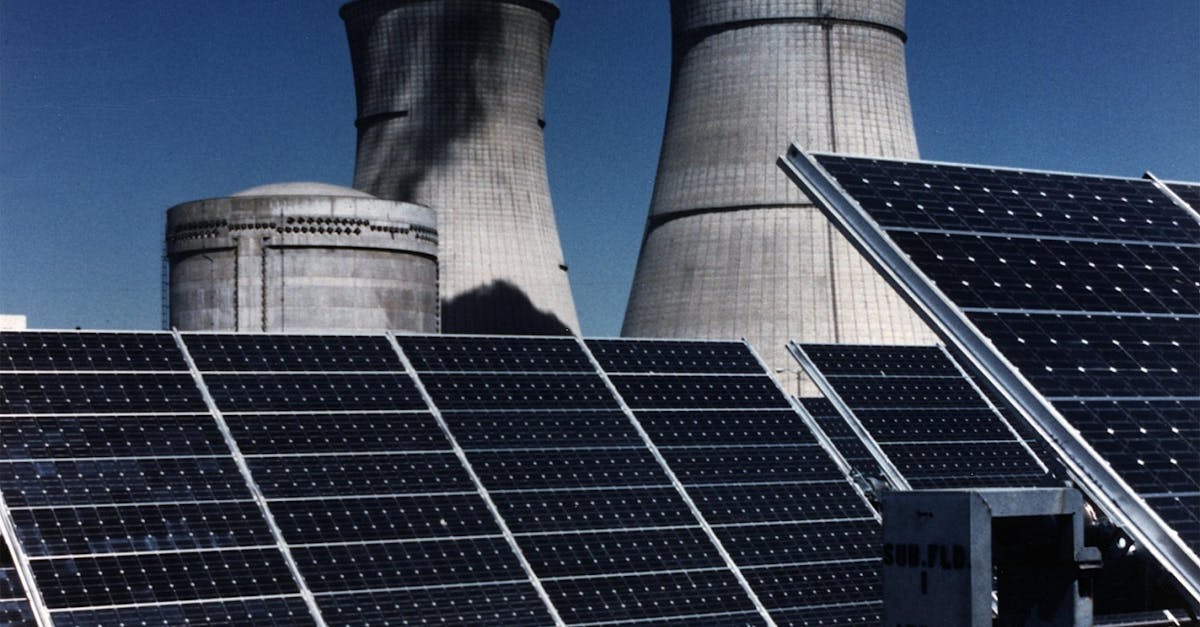

Sunrun Inc. engages in the design, development, installation, sale, ownership, and maintenance of residential solar energy systems in the United States. The mid-cap company is based in the United States.

What to Consider if You Are Thinking of Buying Sunrun:

-

Sunrun has moved -62.0% over the last year.

-

RUN has a forward P/E ratio of -11.5 based on its EPS guidance of -0.92.

-

Over the last 6 years, earnings per share (EPS) have been growing at a compounded average rate of -17.6%.

-

The company has a price to earnings growth (PEG) ratio of 1.28.

-

Its Price to Book (P/B) ratio is 0.35

Sunrun Has an Unconvincing Cash Flow History

| Date Reported | Cash Flow from Operations ($ k) | Capital expenditures ($ k) | Free Cash Flow ($ k) | YoY Growth (%) |

|---|---|---|---|---|

| 2023-02-22 | -848,793 | -18,203 | -830,590 | -2.72 |

| 2022-02-17 | -817,186 | -8,576 | -808,610 | -156.8 |

| 2021-02-25 | -317,972 | -3,095 | -314,877 | -75.77 |

| 2020-02-27 | -204,487 | -25,345 | -179,142 | -211.5 |

| 2019-03-05 | -62,461 | -4,951 | -57,510 | -8.4 |

| 2018-03-06 | -61,011 | -7,956 | -53,055 |

Sunrun's recent cash flow history is disappointing. They've averaged $-373.96 Million over the last 6 years while displaying a coefficient of variability of 472324043.3%. During this time, they grew at a -0.0% compounded yearly rate