Ventas logged a -2.7% change during today's afternoon session, and is now trading at a price of $39.65 per share.

Ventas returned gains of 6.0% last year, with its stock price reaching a high of $53.15 and a low of $35.33. Over the same period, the stock underperformed the S&P 500 index by -13.0%. As of April 2023, the company's 50-day average price was $43.34. Ventas Inc., an S&P 500 company, operates at the intersection of two large and dynamic industries healthcare and real estate. Based in Chicago, IL, the large-cap Real Estate company has 451 full time employees. Ventas has offered a 4.4% dividend yield over the last 12 months.

Shareholders Are Confronted With a Declining EPS Growth Trend:

| 2018-02-09 | 2019-02-08 | 2020-02-24 | 2021-02-23 | 2022-02-18 | 2023-02-10 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $3,574 | $3,746 | $3,873 | $3,795 | $3,828 | $4,129 |

| Operating Margins | 30% | 26% | 22% | 16% | 10% | 11% |

| Net Margins | 38.0% | 11.0% | 11.0% | 12.0% | 1.0% | -1.0% |

| Net Income (MM) | $1,356 | $409 | $433 | $439 | $49 | -$47 |

| Net Interest Expense (MM) | -$448 | -$442 | -$452 | -$470 | -$440 | -$468 |

| Depreciation & Amort. (MM) | -$888 | -$920 | -$1,046 | -$1,110 | -$1,197 | -$1,198 |

| Earnings Per Share | $3.78 | $1.14 | $1.17 | $1.17 | $0.13 | -$0.13 |

| EPS Growth | n/a | -69.84% | 2.63% | 0.0% | -88.89% | -200.0% |

| Diluted Shares (MM) | 359 | 359 | 370 | 377 | 386 | 377 |

| Free Cash Flow (MM) | $1,665 | $1,756 | $2,809 | $1,013 | $1,988 | $1,908 |

| Capital Expenditures (MM) | -$236 | -$375 | -$1,371 | $437 | -$962 | -$788 |

| Net Current Assets (MM) | -$12,610 | -$11,988 | -$13,727 | -$12,964 | -$12,977 | -$13,190 |

| Long Term Debt (MM) | $11,276 | $10,734 | $12,159 | $11,895 | $12,028 | $12,297 |

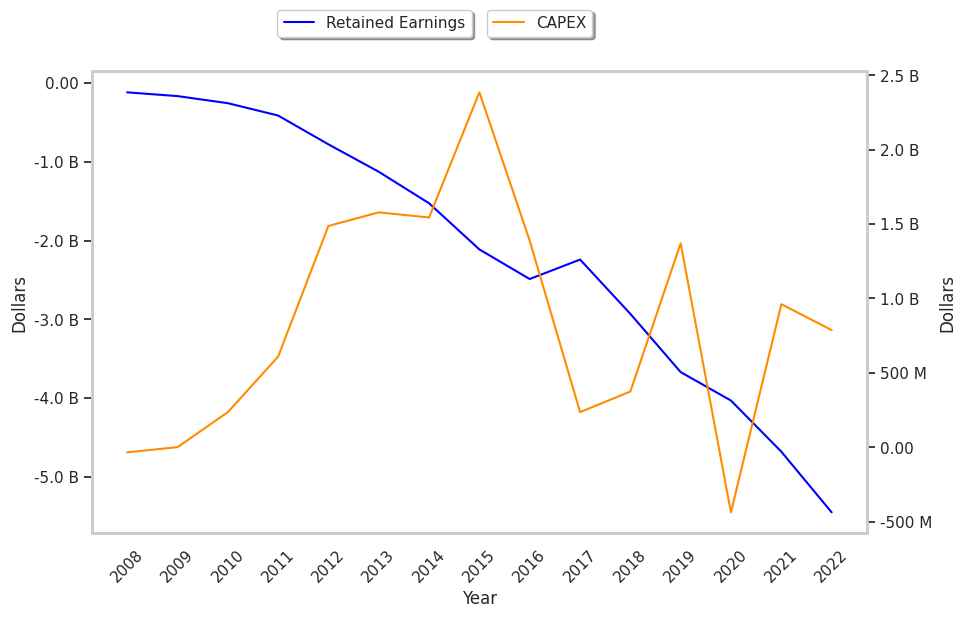

Ventas has weak revenue growth and a flat capital expenditure trend, irregular cash flows, and an average amount of debt. Furthermore, the firm suffers from weak operating margins with a negative growth trend and declining EPS growth.

Ventas Has an Attractive P/B Ratio but a Worrisome P/E Ratio:

Ventas has a trailing twelve month P/E ratio of 197.0, compared to an average of 24.81 for the Real Estate sector. Based on its EPS guidance of $0.16, the company has a forward P/E ratio of 270.9. The company doesn't issue forward earnings guidance, and the compound average growth rate of its last 6 years of reported EPS is -37.7%. On this basis, the company's PEG ratio is -5.22, which indicates that its shares are overpriced. In contrast, the market is likely undervaluing Ventas in terms of its equity because its P/B ratio is 1.59 while the sector average is 2.24.

Analysts Give Ventas an Average Rating of Buy:

The 18 analysts following Ventas have set target prices ranging from $44.0 to $58.0 per share, for an average of $50.83 with a buy rating. As of April 2023, the company is trading -14.7% away from its average target price, indicating that there is an analyst consensus of strong upside potential.

Ventas has an average amount of shares sold short because 2.9% of the company's shares are sold short. Institutions own 97.3% of the company's shares, and the insider ownership rate stands at 0.55%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 16% stake in the company is worth $2,563,556,891.