Marathon Petroleum meets some but not all of Benjamin Graham's requirements for a defensive stock. The Oil & Gas Integrated company does not offer a large enough margin of safety for cautious investors, but it does have many qualities that may interest more enterprising investors.

Marathon Petroleum Trades at Fair Multiples

The “Graham number” is an equation that enables us to quickly determine how a stock is valued in terms of its earnings and assets:

√(22.5 * 6 year average earnings per share (6.53) * 6 year average book value per share (63.491) = $164.96

Despite its solid 39.0% performance over the 12 months, Marathon Petroleum still provides a margin of safety because its Graham number is -11.7% above its current price of $145.65 per share. Some people use the Graham number alone, but it is best to consider it together with the other requirements for defensive stocks that Graham listed in Chapter 14 of The Intelligent Investor.

Impressive Revenues, Consistent Profitability, and a Growing Dividend Imply Value

Marathon Petroleum’s average sales revenue over the last 6 years has been $162.21 Billion, so by Graham’s standards the stock has sufficient revenues to make it worthy of investment. When published in 1972, Graham’s threshold was $100 million in average sales, which would be the equivalent of around a half million dollars today.

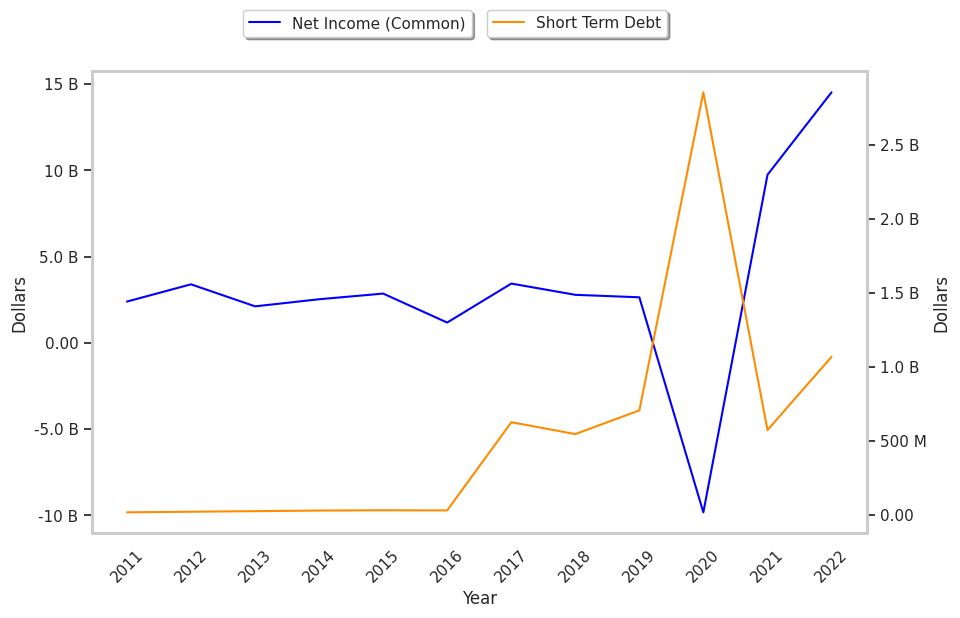

Ben Graham believed that a margin of safety could be obtained by investing only in companies with consistently positive retained earnings. Retained earnings represent the cumulative net earnings or (deficit) left to equity holders after dividends have been paid out. Marathon Petroleum had positive retained earnings from 2011 to 2022 with an average of $10.42 Billion over this period.

Ben Graham would also require a cumulative growth of Earnings Per Share of at least 30% over the last ten years.To determine Marathon Petroleum's EPS growth over time, we will average out its EPS for 2009, 2010, and 2011, which were $1.25, $0.64, and $6.67 respectively. This gives us an average of $2.85 for the period of 2009 to 2011. Next, we compare this value with the average EPS reported in 2020, 2021, and 2022, which were $-15.13, $15.24, and $28.12, for an average of $9.41. Now we see that Marathon Petroleum's EPS growth was 230.18% during this period, which satisfies Ben Graham's requirement.

Negative Current Asset to Liabilities Balance and a Decent Current Ratio

Graham sought companies with extremely low debt levels compared to their assets. For one, he expected their current ratio to be over 2 and their long term debt to net current asset ratio to be near, or ideally under, under 1. Marathon Petroleum fails on both counts with a current ratio of 1.8 and a debt to net current asset ratio of -1.3.

Conclusion

Marathon Petroleum offers a decent combination of value, growth, and profitability. These factors imply that the investment offers a decent margin of safety — especially if the shares are bought during a sell-off.

| 2018-02-28 | 2019-02-28 | 2020-02-28 | 2021-02-26 | 2022-02-24 | 2023-02-23 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $74,104 | $86,086 | $111,148 | $69,897 | $120,451 | $178,236 |

| Gross Margins | 10.0% | 10.0% | 11.0% | 6.0% | 9.0% | 15.0% |

| Operating Margins | 5% | 5% | 4% | -4% | 3% | 11% |

| Net Margins | 5.0% | 3.0% | 2.0% | -14.0% | 8.0% | 8.0% |

| Net Income (MM) | $3,432 | $2,780 | $2,637 | -$9,826 | $9,738 | $14,516 |

| Net Interest Expense (MM) | -$674 | -$993 | -$1,229 | -$1,365 | -$1,483 | -$1,000 |

| Depreciation & Amort. (MM) | -$2,114 | -$2,170 | -$3,225 | -$3,375 | -$3,364 | -$3,215 |

| Earnings Per Share | $6.7 | $5.29 | $3.97 | -$15.14 | $15.99 | $22.37 |

| EPS Growth | n/a | -21.04% | -24.95% | -481.36% | 205.61% | 39.9% |

| Diluted Shares (MM) | 512 | 526 | 664 | 649 | 609 | 649 |

| Free Cash Flow (MM) | $9,344 | $9,337 | $14,204 | $5,056 | $5,671 | $18,691 |

| Capital Expenditures (MM) | -$2,732 | -$3,179 | -$4,763 | -$2,637 | -$1,311 | -$2,330 |

| Net Current Assets (MM) | -$13,818 | -$29,864 | -$24,991 | -$26,651 | -$21,296 | -$19,575 |

| Long Term Debt (MM) | $12,322 | $26,980 | $28,020 | $28,730 | $24,968 | $25,634 |

| Net Debt / EBITDA | 1.71 | 3.94 | 3.35 | 39.66 | 2.05 | 0.65 |