Large-cap Technology company Veeva Systems has logged a 0.9% change today on a trading volume of 79,276. The average volume for the stock is 870,948.

Veeva Systems Inc. provides cloud-based software for the life sciences industry. Based in Pleasanton, United States the company has 6,744 full time employees and a market cap of $34,545,860,608.

The company is now trading -3.98% away from its average analyst target price of $223.95 per share. The 21 analysts following the stock have set target prices ranging from $181.0 to $250.0, and on average give Veeva Systems a rating of buy.

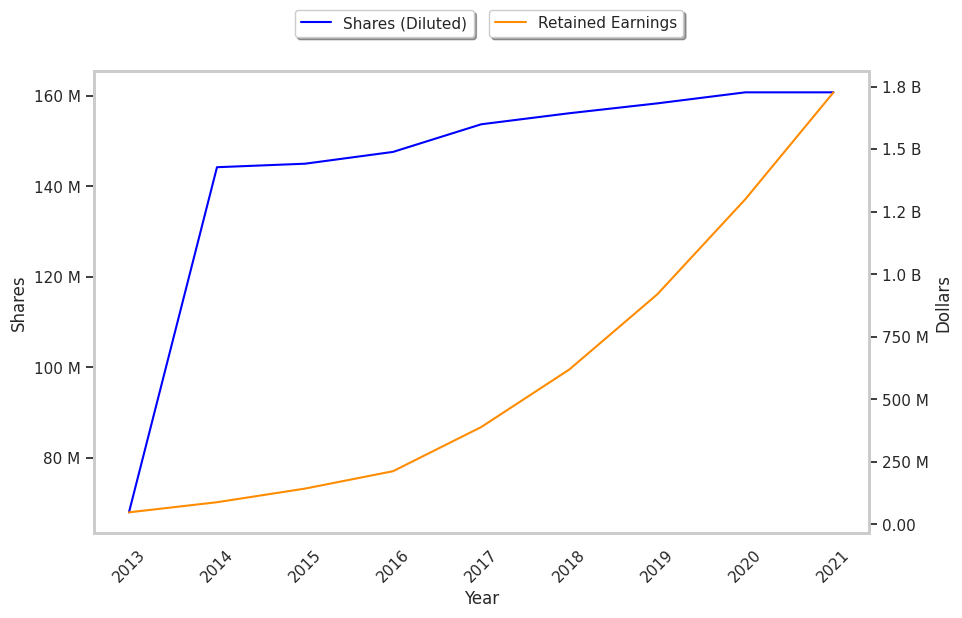

Over the last 52 weeks, VEEV stock has risen 33.0%, which amounts to a 10.0% difference compared to the S&P 500. The stock's 52 week high is $225.49 whereas its 52 week low is $151.02 per share. Based on Veeva Systems's average net margin growth of 10.0% over the last 6 years, its core business is on track for profitability and its strong stock performance may continue in the long term.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) | YoY Growth (%) |

|---|---|---|---|---|

| 2022-03-30 | 1,850,777 | 427,390 | 23 | -11.54 |

| 2021-03-30 | 1,465,069 | 379,998 | 26 | -3.7 |

| 2020-03-30 | 1,104,081 | 301,118 | 27 | 0.0 |

| 2019-03-28 | 862,210 | 229,832 | 27 | 28.57 |

| 2018-03-30 | 685,571 | 141,966 | 21 | 61.54 |

| 2017-03-30 | 544,043 | 68,804 | 13 |