Welltower logged a 2.6% change during today's afternoon session, and is now trading at a price of $84.23 per share.

Welltower returned gains of 47.0% last year, with its stock price reaching a high of $86.72 and a low of $56.5. Over the same period, the stock outperformed the S&P 500 index by 24.0%. More recently, the company's 50-day average price was $82.67. Welltower Inc. (NYSE:WELL), a real estate investment trust ("REIT") and S&P 500 company headquartered in Toledo, Ohio, is driving the transformation of health care infrastructure. Based in Toledo, OH, the large-cap Real Estate company has 514 full time employees. Welltower has offered a 3.0% dividend yield over the last 12 months.

Healthy Debt Levels but a Declining EPS Growth Trend:

| 2018-02-28 | 2019-02-25 | 2020-02-14 | 2021-02-10 | 2022-02-16 | 2023-02-21 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $4,317 | $4,700 | $5,121 | $4,606 | $4,742 | $5,861 |

| Operating Margins | 28% | 25% | 25% | 18% | 17% | 14% |

| Net Margins | 12.0% | 17.0% | 24.0% | 21.0% | 7.0% | 2.0% |

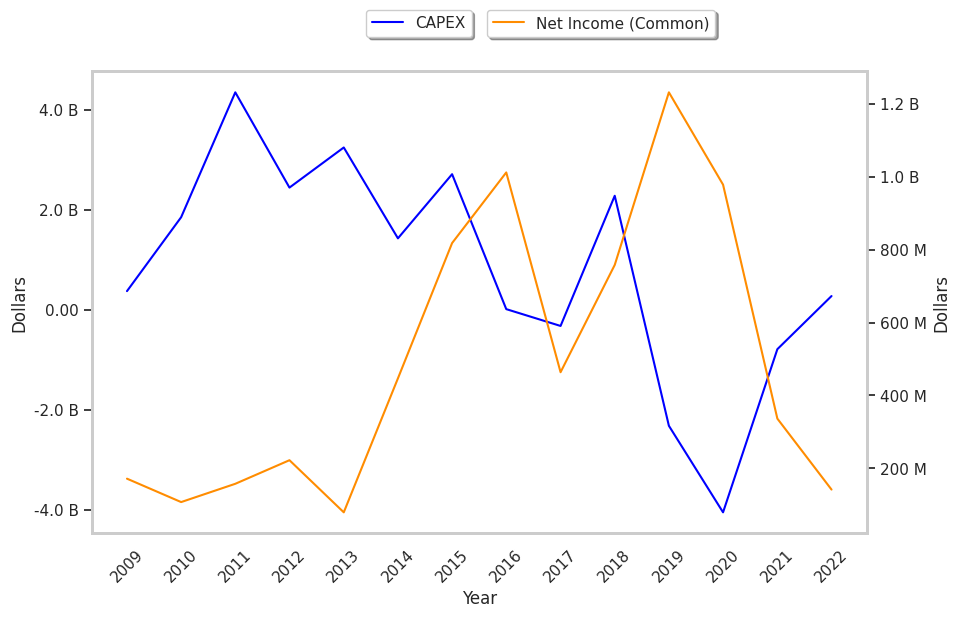

| Net Income (MM) | $523 | $805 | $1,232 | $979 | $336 | $141 |

| Net Interest Expense (MM) | -$485 | -$527 | -$556 | -$514 | -$490 | -$530 |

| Depreciation & Amort. (MM) | -$922 | -$950 | -$1,027 | -$1,038 | -$1,038 | -$1,310 |

| Earnings Per Share | $1.26 | $2.02 | $3.05 | $2.35 | $0.78 | $0.33 |

| EPS Growth | n/a | 60.32% | 50.99% | -22.95% | -66.81% | -57.69% |

| Diluted Shares (MM) | 369 | 375 | 404 | 417 | 430 | 427 |

| Free Cash Flow (MM) | $1,112 | $3,869 | -$786 | -$2,690 | $488 | $1,605 |

| Capital Expenditures (MM) | $322 | -$2,285 | $2,322 | $4,055 | $788 | -$277 |

| Net Current Assets (MM) | -$8,720 | -$10,460 | -$11,648 | -$12,555 | -$13,918 | -$14,520 |

| Long Term Debt (MM) | $11,732 | $13,297 | $14,915 | $13,799 | $14,131 | $14,548 |

Welltower's Valuation Is in Line With Its Sector Averages:

Welltower has a trailing twelve month P/E ratio of 318.0, compared to an average of 24.81 for the Real Estate sector. Based on its EPS guidance of $1.08, the company has a forward P/E ratio of 76.5. The company doesn't issue forward earnings guidance, and the compound average growth rate of its last 6 years of reported EPS is -23.1%. On this basis, the company's PEG ratio is -13.75, which indicates that its shares are overpriced. In contrast, the market is likely undervaluing Welltower in terms of its equity because its P/B ratio is 2.02 while the sector average is 2.24. The company's shares are currently trading 336.7% above their Graham number.

Welltower Has an Average Rating of Buy:

The 16 analysts following Welltower have set target prices ranging from $78.0 to $96.0 per share, for an average of $88.75 with a buy rating. As of April 2023, the company is trading -6.9% away from its average target price, indicating that there is an analyst consensus of some upside potential.

Welltower has an average amount of shares sold short because 3.4% of the company's shares are sold short. Institutions own 98.8% of the company's shares, and the insider ownership rate stands at 0.06%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 15% stake in the company is worth $6,620,555,671.