Now trading at a price of $8.5, NIO has moved 0.7% so far today.

NIO returned losses of -28.0% last year, with its stock price reaching a high of $16.18 and a low of $7.0. Over the same period, the stock underperformed the S&P 500 index by -51.0%. As of April 2023, the company's 50-day average price was $10.48. NIO Inc. designs, develops, manufactures, and sells smart electric vehicles in China. Based in Shanghai, China, the large-cap Consumer Discretionary company has 26,763 full time employees. NIO has not offered a regular dividend during the last year.

The Company Trades Below Its Net Current Asset Value:

| 2019-04-02 | 2020-05-14 | 2021-04-06 | 2022-04-29 | |

|---|---|---|---|---|

| Revenue (MM) | $4,951 | $7,825 | $16,258 | $36,136 |

| Gross Margins | -5.0% | -15.0% | 12.0% | 19.0% |

| Operating Margins | -194% | -142% | -28% | -12% |

| Net Margins | -195.0% | -144.0% | -33.0% | -11.0% |

| Net Income (MM) | -$9,661 | -$11,287 | -$5,299 | -$3,986 |

| Net Interest Expense (MM) | $10 | -$210 | -$259 | $274 |

| Depreciation & Amort. (MM) | -$474 | -$999 | -$1,046 | -$1,708 |

| Earnings Per Share | -$70.23 | -$11.08 | -$4.74 | -$8.94 |

| EPS Growth | n/a | 84.22% | 57.22% | -88.61% |

| Diluted Shares (MM) | 332 | 1,030 | 1,183 | 1,183 |

| Free Cash Flow (MM) | -$5,268 | -$7,015 | $2,916 | $6,044 |

| Capital Expenditures (MM) | -$2,644 | -$1,707 | -$965 | -$4,078 |

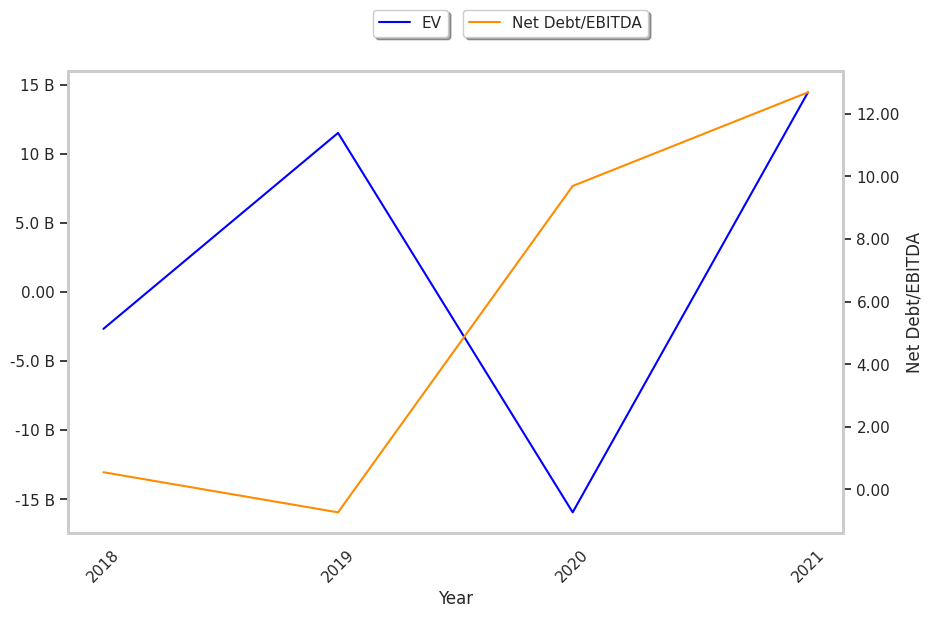

| Net Current Assets (MM) | $1,477 | -$14,476 | $23,427 | $18,821 |

| Long Term Debt (MM) | $1,168 | $7,155 | $5,938 | $9,739 |

| LT Debt to Equity | 0.14 | -1.48 | 0.19 | 0.26 |

NIO has slimmer gross margins than its peers, consistently negative margins with a positive growth rate, and an unconvincing cash flow history. On the other hand, the company benefits from an excellent current ratio and a strong EPS growth trend. Furthermore, NIO has weak revenue growth and a flat capital expenditure trend.

NIO does not have a meaningful trailing P/E ratio since its earnings per share are negative. Its forward EPS guidance is negative too, at $-0.71. The average P/E ratio for the Consumer Discretionary sector is 22.33. On the other hand, the market is undervaluing NIO in terms of its equity because its P/B ratio is 0.98. In comparison, the sector average is 3.12.

Overview of NIO's Market Factors:

The largest shareholder is Baillie Gifford and Company, whose 8% stake in the company is worth $1,015,233,663.