Now trading at a price of $141.9, Alphabet has moved 0.6% so far today.

Alphabet returned gains of 41.0% last year, with its stock price reaching a high of $142.38 and a low of $83.45. Over the same period, the stock outperformed the S&P 500 index by 22.0%. More recently, the company's 50-day average price was $134.62. Alphabet Inc. offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. Based in Mountain View, CA, the large-cap Technology company has 181,798 full time employees. Alphabet has not offered a dividend during the last year.

The Company Has a Positive Net Current Asset Value:

| 2018-02-06 | 2019-02-06 | 2020-02-04 | 2021-02-03 | 2022-02-02 | 2023-02-03 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $110,855 | $136,819 | $161,857 | $182,527 | $257,637 | $282,836 |

| Gross Margins | 59.0% | 56.0% | 56.0% | 54.0% | 56.0% | 55.0% |

| Operating Margins | 26% | 24% | 22% | 23% | 31% | 26% |

| Net Margins | 11.0% | 22.0% | 21.0% | 22.0% | 30.0% | 21.0% |

| Net Income (MM) | $12,662 | $30,736 | $34,343 | $40,269 | $76,033 | $59,972 |

| Earnings Per Share | $0.84 | $2.05 | $2.3 | $2.75 | $5.62 | $4.42 |

| EPS Growth | n/a | 144.05% | 12.2% | 19.57% | 104.36% | -21.35% |

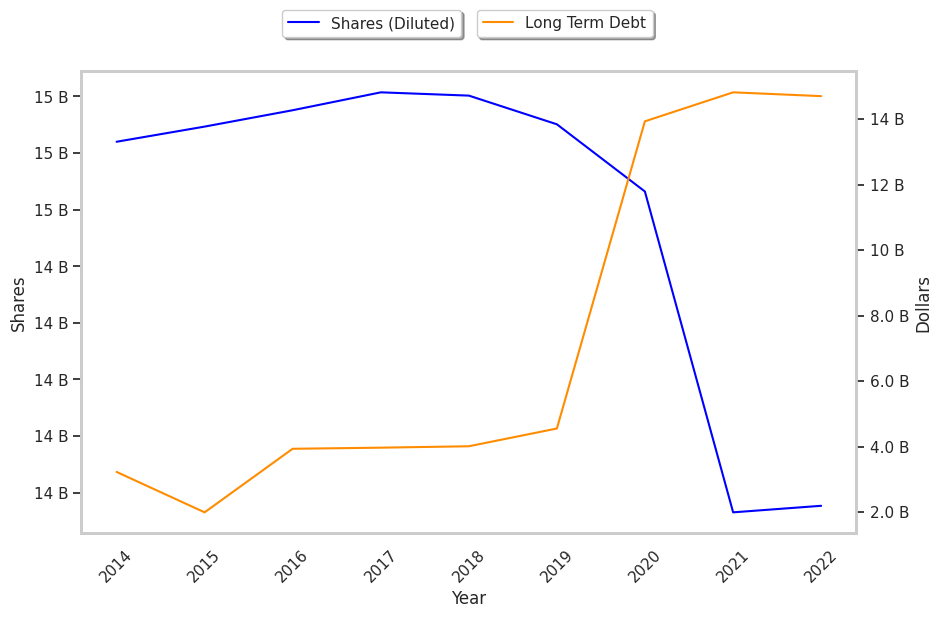

| Diluted Shares (MM) | 15,015 | 15,003 | 14,902 | 14,664 | 13,530 | 13,553 |

| Free Cash Flow (MM) | $50,176 | $73,110 | $78,068 | $87,405 | $116,292 | $122,980 |

| Capital Expenditures (MM) | -$13,085 | -$25,139 | -$23,548 | -$22,281 | -$24,640 | -$31,485 |

| Net Current Assets (MM) | $79,515 | $80,512 | $78,111 | $77,224 | $80,510 | $55,675 |

| Long Term Debt (MM) | $3,969 | $4,012 | $4,554 | $13,932 | $14,817 | $14,701 |

Alphabet benefits from exceptional EPS growth, a pattern of improving cash flows, and an excellent current ratio. The company's financial statements show healthy debt levels and average operating margins with a stable trend. However, the firm has slimmer gross margins than its peers. Finally, we note that Alphabet has weak revenue growth and a flat capital expenditure trend.

Alphabet's Valuation Is in Line With Its Sector Averages:

Alphabet has a trailing twelve month P/E ratio of 28.5, compared to an average of 27.16 for the Technology sector. Based on its EPS guidance of $6.66, the company has a forward P/E ratio of 20.2. The company doesn't provide forward earnings guidance, and the compound average growth rate of its last 6 years of reported EPS is 31.9%. On this basis, Alphabet's PEG ratio is 0.89. Using instead the 10.9% weighted average of Alphabet's earnings CAGR and the broader market's anticipated 5-year EPS growth rate, the company's PEG ratio is 2.62, which suggests that its shares may be overpriced. The market is placing a fair value on Alphabet's equity, since its P/B ratio of 6.71 is comparable to its sector average of 6.23. The company's shares are currently trading 227.3% above their Graham number.

Analysts Give Alphabet No Average Rating Visible In Our Data:

The 10 analysts following Alphabet have set target prices ranging from $120.0 to $160.0 per share, for an average of $143.5 with a buy rating. As of April 2023, the company is trading -6.2% away from its average target price, indicating that there is an analyst consensus of some upside potential.

The largest shareholder is Vanguard Group Inc, whose 7% stake in the company is worth $58,665,557,960.