We've been asking ourselves recently if the market has placed a fair valuation on Biogen. Let's dive into some of the fundamental values of this large-cap Health Care company to determine if there might be an opportunity here for value-minded investors.

A Lower P/B Ratio Than Its Sector Average but Trades Above Its Graham Number:

Biogen Inc. discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally. The company belongs to the Health Care sector, which has an average price to earnings (P/E) ratio of 24.45 and an average price to book (P/B) ratio of 4.16. In contrast, Biogen has a trailing 12 month P/E ratio of 13.5 and a P/B ratio of 2.47.

Biogen's PEG ratio is 33.68, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

The Company's Revenues Are Declining:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $13,453 | $14,378 | $13,445 | $10,982 | $10,173 | $9,972 |

| Gross Margins | 44% | 49% | 38% | 16% | 35% | 31% |

| Operating Margins | 44.0% | 50.0% | 38.0% | 26.0% | 35.0% | 31.0% |

| Net Margins | 33.0% | 41.0% | 30.0% | 16.0% | 30.0% | 27.0% |

| Net Income (MM) | $4,474 | $5,888 | $4,060 | $1,728 | $3,047 | $2,665 |

| Net Interest Expense (MM) | $11 | $83 | $497 | $254 | n/a | $372 |

| Depreciation & Amort. (MM) | $650 | $465 | $457 | $488 | $518 | $470 |

| Earnings Per Share | $21.58 | $31.42 | $24.8 | $10.4 | $20.87 | $18.31 |

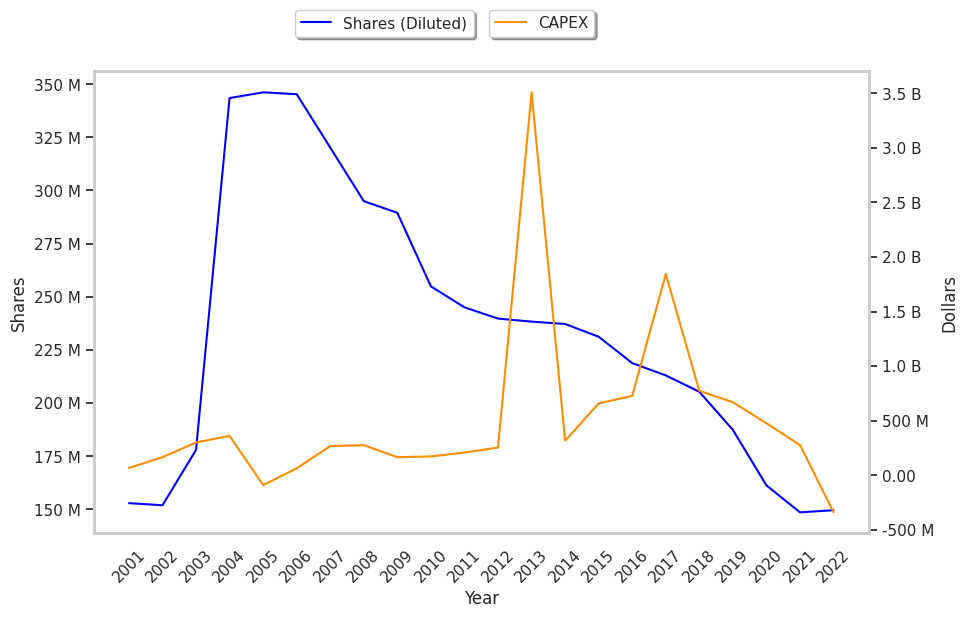

| Diluted Shares (MM) | 205 | 187 | 161 | 150 | 146 | 143 |

| Free Cash Flow (MM) | $4,688 | $6,564 | $3,805 | $3,382 | $1,144 | $1,145 |

| Capital Expenditures (MM) | $1,500 | $514 | $425 | $258 | $240 | $283 |

| Net Current Assets (MM) | -$4,616 | -$5,513 | -$7,046 | -$5,061 | -$1,374 | -$265 |

| Long Term Debt (MM) | $5,936 | $4,459 | $7,426 | $6,274 | $6,281 | $6,285 |

| Net Debt / EBITDA | 0.72 | 0.4 | 1.11 | 1.51 | 0.7 | 1.02 |

Biogen has declining revenues and decreasing reinvestment in the business, slimmer gross margins than its peers, and declining EPS growth. On the other hand, the company benefits from decent operating margins with a negative growth trend and healthy leverage. Furthermore, Biogen has irregular cash flows.