Shares of Iron Mountain have moved -1.8% today, and are now trading at a price of $59.17. In contrast, the S&P 500 index saw a 0.0% change. Today's trading volume is 1,075,903 compared to the stock's average volume of 1,530,715.

Iron Mountain Incorporated (NYSE: IRM) is a global leader in information management, innovative storage, data center infrastructure, and asset lifecycle management. Based in Portsmouth, United States the company has 26,000 full time employees and a market cap of $17,278,509,056. Iron Mountain currently offers its equity investors a dividend that yields 4.2% per year.

The company is now trading -14.06% away from its average analyst target price of $68.86 per share. The 7 analysts following the stock have set target prices ranging from $65.0 to $75.0, and on average give Iron Mountain a rating of buy.

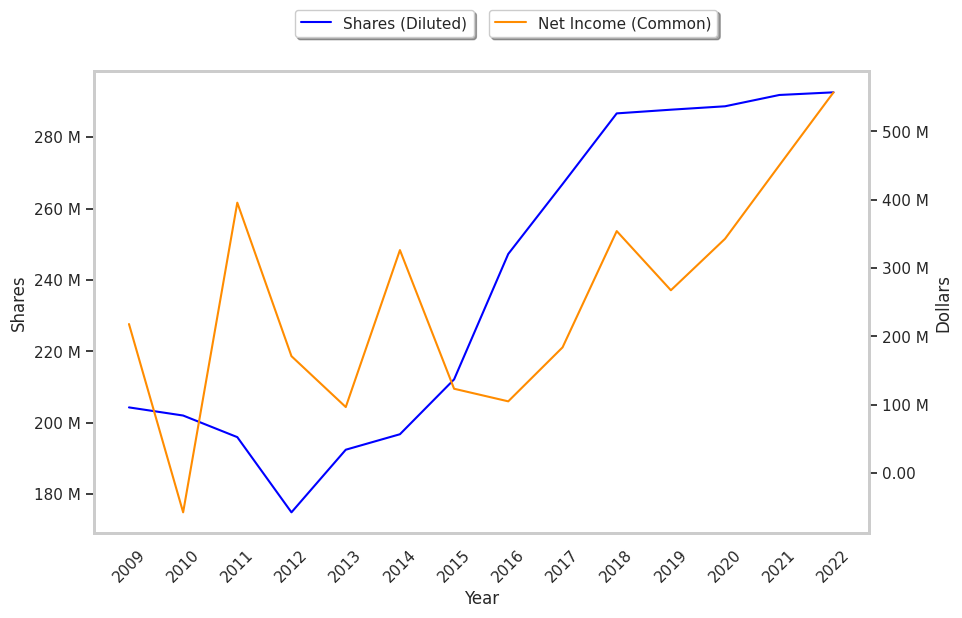

Over the last 52 weeks, IRM stock has risen 20.0%, which amounts to a 5.0% difference compared to the S&P 500. The stock's 52 week high is $64.48 whereas its 52 week low is $48.92 per share. With its net margins declining an average -17.3% over the last 6 years, Iron Mountain may not have a strong enough profitability trend to support its stock price.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 5,238,279 | 385,262 | 7 | -36.36 |

| 2022 | 5,103,574 | 562,149 | 11 | 10.0 |

| 2021 | 4,491,531 | 452,725 | 10 | 25.0 |

| 2020 | 4,147,270 | 343,096 | 8 | 33.33 |

| 2019 | 4,262,584 | 268,315 | 6 | -73.91 |

| 2018 | 1,603,306 | 367,558 | 23 |