Large-cap Real Estate company Welltower has logged a -0.6% change today on a trading volume of 860,490. The average volume for the stock is 2,769,026.

Welltower Inc. (NYSE:WELL), a real estate investment trust ("REIT") and S&P 500 company headquartered in Toledo, Ohio, is driving the transformation of health care infrastructure. Based in Toledo, United States the company has 514 full time employees and a market cap of $46,012,936,192. Welltower currently offers its equity investors a dividend that yields 2.8% per year.

The company is now trading -3.87% away from its average analyst target price of $89.31 per share. The 16 analysts following the stock have set target prices ranging from $78.0 to $96.0, and on average give Welltower a rating of buy.

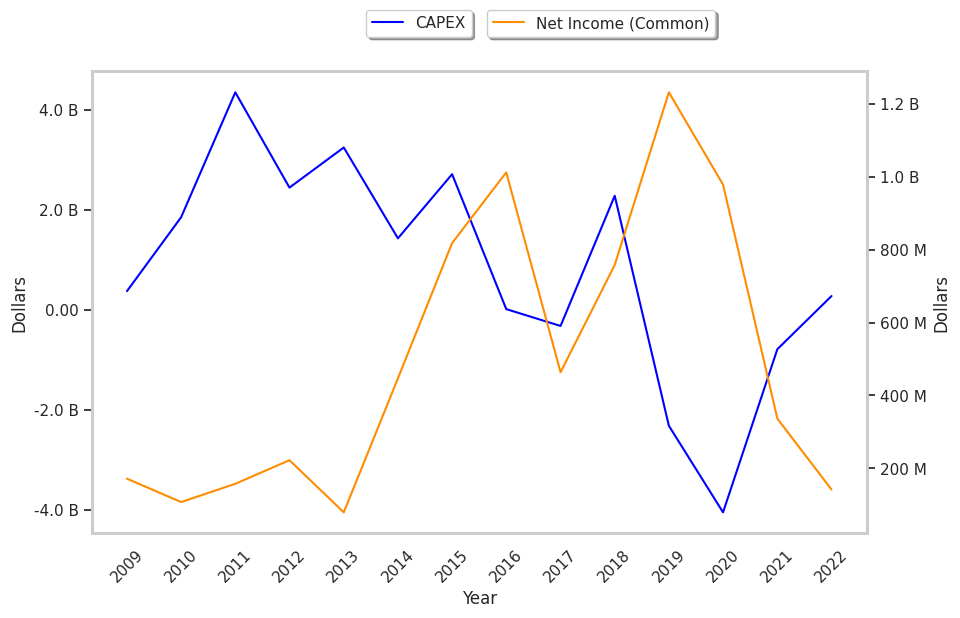

Over the last 52 weeks, WELL stock has risen 25.0%, which amounts to a 13.0% difference compared to the S&P 500. The stock's 52 week high is $89.69 whereas its 52 week low is $62.62 per share. With its net margins declining an average -29.8% over the last 6 years, Welltower may not have a strong enough profitability trend to support its stock price.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 6,218,582 | 134,122 | 2 | -33.33 |

| 2022 | 5,860,615 | 160,568 | 3 | -62.5 |

| 2021 | 4,742,115 | 374,479 | 8 | -65.22 |

| 2020 | 4,605,967 | 1,038,852 | 23 | -11.54 |

| 2019 | 5,121,306 | 1,330,410 | 26 | 44.44 |

| 2018 | 4,700,499 | 829,750 | 18 |