Shares of Moderna have moved 5.6% today, and are now trading at a price of $78.26. In contrast, the S&P 500 index saw a 1.0% change. Today's trading volume is 1,380,319 compared to the stock's average volume of 4,324,639.

Moderna, Inc., a biotechnology company, discovers, develops, and commercializes messenger RNA therapeutics and vaccines for the treatment of infectious diseases, immuno-oncology, rare diseases, autoimmune, and cardiovascular diseases in the United States, Europe, and internationally. Based in Cambridge, United States the company has 3,900 full time employees and a market cap of $29,839,286,272.

The company is now trading -42.97% away from its average analyst target price of $137.22 per share. The 18 analysts following the stock have set target prices ranging from $52.0 to $300.0, and on average give Moderna a rating of hold.

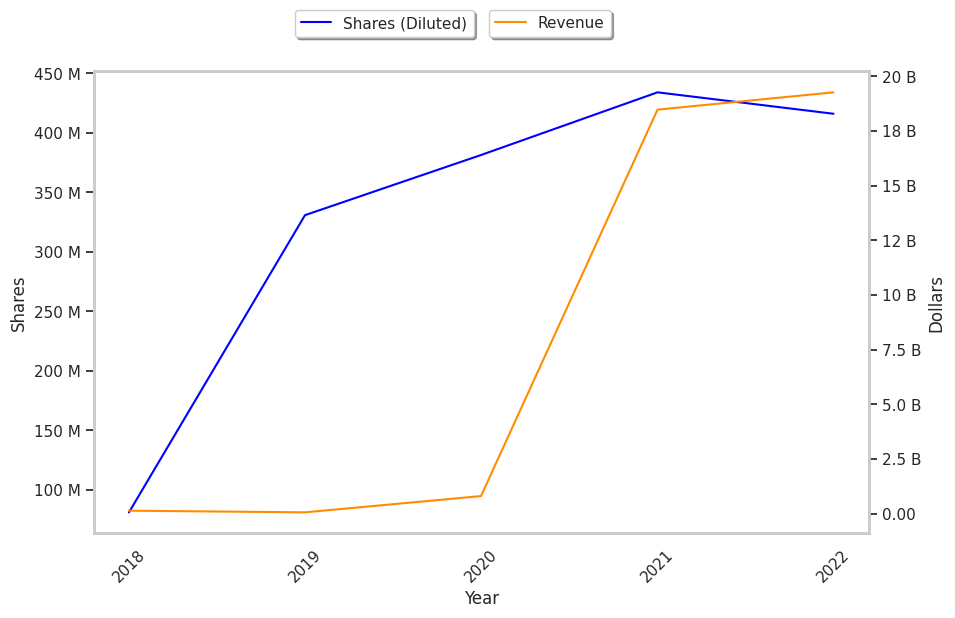

Over the last 12 months MRNA shares have declined by -58.0%, which represents a difference of -73.0% when compared to the S&P 500. The stock's 52 week high is $217.25 per share and its 52 week low is $62.55. Based on Moderna's average net margin growth of 0.7% over the last 6 years, its core business remains strong and the stock price may recover in the long term.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 10,654,000 | 1,207,000 | 11 | -74.42 |

| 2022 | 19,263,000 | 8,362,000 | 43 | -34.85 |

| 2021 | 18,471,000 | 12,202,000 | 66 | 170.97 |

| 2020 | 803,000 | -747,000 | -93 | 89.15 |

| 2019 | 60,000 | -514,000 | -857 | -200.7 |

| 2018 | 135,068 | -384,734 | -285 |