We've been asking ourselves recently if the market has placed a fair valuation on Coca-Cola. Let's dive into some of the fundamental values of this large-cap Consumer Staples company to determine if there might be an opportunity here for value-minded investors.

Coca-Cola's Valuation Is in Line With Its Sector Averages:

The Coca-Cola Company, a beverage company, manufactures, markets, and sells various nonalcoholic beverages worldwide. The company belongs to the Consumer Staples sector, which has an average price to earnings (P/E) ratio of 24.36 and an average price to book (P/B) ratio of 4.29. In contrast, Coca-Cola has a trailing 12 month P/E ratio of 23.6 and a P/B ratio of 9.56.

Coca-Cola's PEG ratio is 4.35, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

The Company May Be Profitable, but Its Balance Sheet Is Highly Leveraged:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $34,300 | $37,266 | $33,014 | $38,655 | $43,004 | $45,030 |

| Gross Margins | 62% | 61% | 59% | 60% | 57% | 59% |

| Operating Margins | 27% | 28% | 30% | 32% | 27% | 28% |

| Net Margins | 19% | 24% | 24% | 25% | 22% | 24% |

| Net Income (MM) | $6,476 | $8,985 | $7,768 | $9,804 | $9,571 | $10,773 |

| Net Interest Expense (MM) | $950 | $946 | $1,437 | $2,000 | $882 | $1,418 |

| Depreciation & Amort. (MM) | $1,086 | $1,365 | $1,536 | $1,452 | $1,260 | $1,164 |

| Earnings Per Share | $1.5 | $2.07 | $1.79 | $2.25 | $2.19 | $2.48 |

| Diluted Shares (MM) | 4,299 | 4,314 | 4,323 | 4,340 | 4,350 | 4,319 |

| Free Cash Flow (MM) | $389 | $8,417 | $8,667 | $11,258 | $9,534 | $10,170 |

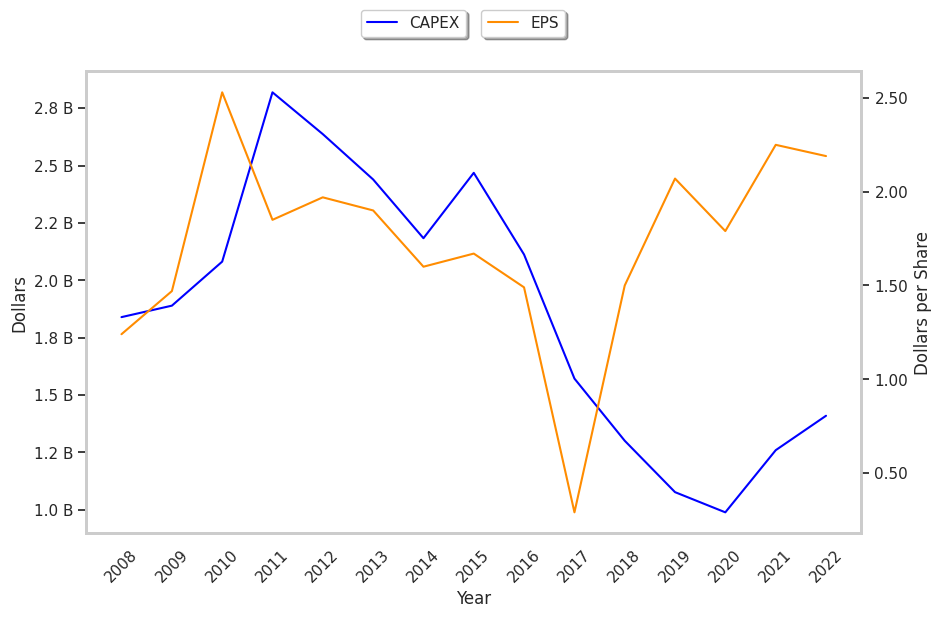

| Capital Expenditures (MM) | $1,548 | $2,054 | $1,177 | $1,367 | $1,484 | $1,709 |

| Net Current Assets (MM) | -$14,165 | -$17,484 | -$5,651 | -$6,733 | -$6,084 | -$5,840 |

| Long Term Debt (MM) | $25,376 | $27,516 | $40,125 | $38,116 | $36,377 | $34,176 |

| Net Debt / EBITDA | 4.36 | 3.92 | 4.18 | 3.44 | 3.45 | 3.14 |

Coca-Cola has growing revenues and a flat capital expenditure trend and wider gross margins than its peer group. Additionally, the company's financial statements display decent operating margins with a stable trend and positive EPS growth. However, the firm has a highly leveraged balance sheet. Finally, we note that Coca-Cola has irregular cash flows.