Moderna logged a 1.8% change during today's afternoon session, and is now trading at a price of $79.61 per share.

Moderna returned losses of -55.0% last year, with its stock price reaching a high of $217.25 and a low of $62.55. Over the same period, the stock underperformed the S&P 500 index by -68.0%. As of April 2023, the company's 50-day average price was $86.39. Moderna, Inc., a biotechnology company, discovers, develops, and commercializes messenger RNA therapeutics and vaccines for the treatment of infectious diseases, immuno-oncology, rare diseases, autoimmune, and cardiovascular diseases in the United States, Europe, and internationally. Based in Cambridge, MA, the large-cap Health Care company has 3,900 full time employees. Moderna has not offered a dividend during the last year.

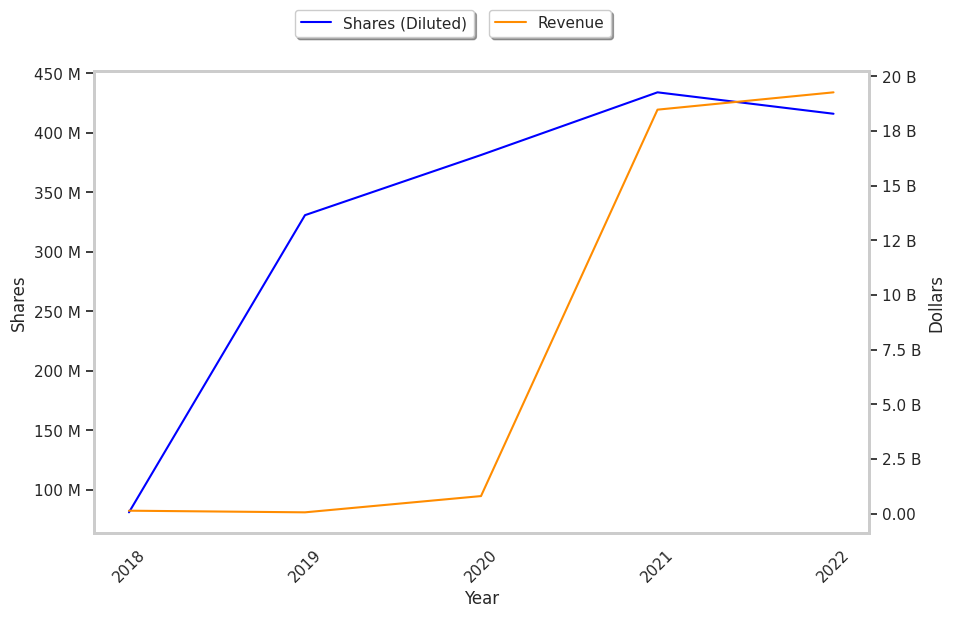

Growing Revenues With Increasing Reinvestment in the Business:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $135 | $60 | $803 | $18,471 | $19,263 | $10,654 |

| Gross Margins | -306% | -910% | -95% | 72% | 49% | -11% |

| Operating Margins | -285% | -858% | -93% | 72% | 50% | -22% |

| Net Margins | -285% | -857% | -93% | 66% | 43% | -33% |

| Net Income (MM) | -$385 | -$514 | -$747 | $12,202 | $8,362 | -$3,466 |

| Net Interest Expense (MM) | $2 | -$8 | -$6 | -$29 | -$45 | -$97 |

| Depreciation & Amort. (MM) | $25 | $31 | $31 | $232 | $348 | $494 |

| Free Cash Flow (MM) | -$437 | -$491 | $1,959 | $13,336 | $4,581 | -$2,657 |

| Capital Expenditures (MM) | $106 | $32 | $68 | $284 | $400 | $579 |

| Net Current Assets (MM) | $1,131 | $714 | $1,522 | $5,547 | $6,696 | $4,804 |

| Long Term Debt (MM) | $28 | $123 | $189 | $656 | $919 | $1,187 |

Moderna does not have a meaningful trailing P/E ratio since its earnings per share are negative. Its forward EPS guidance is negative too, at $-6.63. The average P/E ratio for the Health Care sector is 24.45. On the other hand, the market is undervaluing Moderna in terms of its equity because its P/B ratio is 2.25. In comparison, the sector average is 4.16.

There's an Analyst Consensus of Strong Upside Potential for Moderna:

The 18 analysts following Moderna have set target prices ranging from $52.0 to $300.0 per share, for an average of $137.22 with a hold rating. As of April 2023, the company is trading -37.0% away from its average target price, indicating that there is an analyst consensus of strong upside potential.

Moderna has an average amount of shares sold short because 7.8% of the company's shares are sold short. Institutions own 69.5% of the company's shares, and the insider ownership rate stands at 9.69%, suggesting a large amount of insider shareholders. The largest shareholder is Baillie Gifford and Company, whose 12% stake in the company is worth $3,633,980,683.