It's been a great afternoon session for Quanta Services investors, who saw their shares rise 2.2% to a price of $185.31 per share. At these higher prices, is the company still fairly valued? If you are thinking about investing, make sure to check the company's fundamentals before making a decision.

None:

Quanta Services, Inc. provides infrastructure solutions for the electric and gas utility, renewable energy, communications, and pipeline and energy industries worldwide. The company belongs to the Industrials sector, which has an average price to earnings (P/E) ratio of None and an average price to book (P/B) ratio of None. In contrast, Quanta Services has a trailing 12 month P/E ratio of 39.4 and a P/B ratio of 4.5.

Quanta Services's PEG ratio is 1.52, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

None:

Year 2018 2019 2020 \

Revenue (MM) $11,171 $12,112 $11,203

Gross Margins 13% 13% 15%

Operating Margins 5% 5% 5%

Net Margins 3% 3% 4%

Net Income (MM) $296 $407 $452

Net Interest Expense (MM) $37 $83 $45

Depreciation & Amort. (MM) $203 $218 $225

Earnings Per Share $1.9 $2.73 $3.07

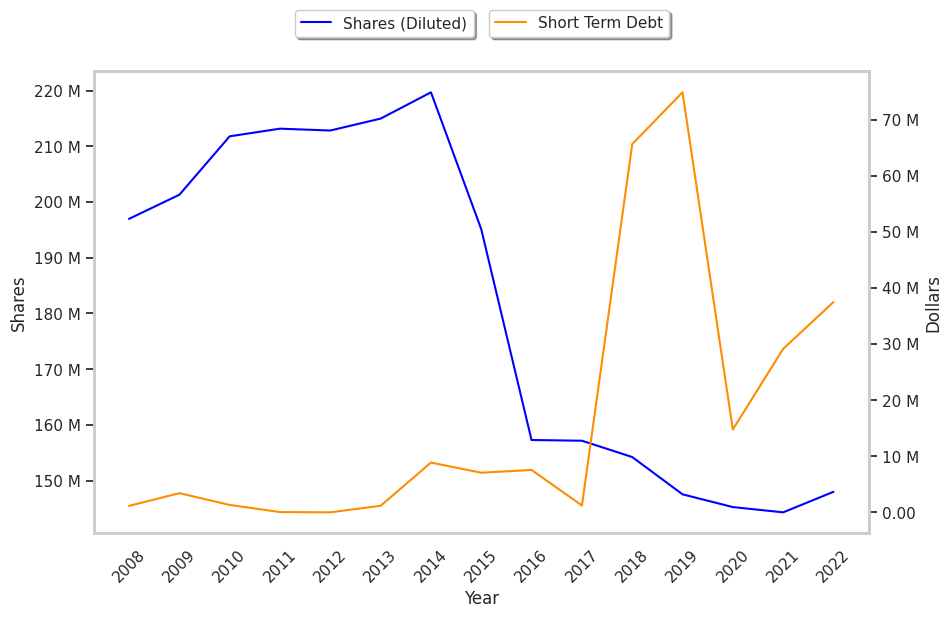

Diluted Shares (MM) 154 148 145

Year 2021 2022 2023

Revenue (MM) $12,980 $17,074 $19,515

Gross Margins 15% 15% 14%

Operating Margins 5% 5% 5%

Net Margins 4% 3% 4%

Net Income (MM) $492 $512 $711

Net Interest Expense (MM) $69 $124 $175

Depreciation & Amort. (MM) $256 $354 $312

Earnings Per Share $3.34 $3.32 $4.69

Diluted Shares (MM) 145 148 150