Tupperware Brands logged a 15.8% change during today's evening session, and is now trading at a price of $1.91 per share.

Tupperware Brands returned losses of -59.0% last year, with its stock price reaching a high of $5.91 and a low of $0.61. Over the same period, the stock underperformed the S&P 500 index by -71.0%. As of April 2023, the company's 50-day average price was $1.7. Tupperware Brands Corporation operates as a consumer products company in the Asia Pacific, Europe, Africa, the Middle East, North America, and South America. Based in Orlando, FL, the small-cap Industrials company has 6,600 full time employees. Tupperware Brands has not offered a dividend during the last year.

The Company's Revenues Are Declining:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $2,070 | $1,614 | $1,559 | $1,601 | $1,304 | $1,304 |

| Gross Margins | 67% | 66% | 68% | 67% | 64% | 64% |

| Operating Margins | 15% | 10% | 13% | 15% | 2% | 2% |

| Net Margins | 8% | 1% | 8% | 9% | -18% | -18% |

| Net Income (MM) | $156 | $12 | $124 | $151 | -$232 | -$232 |

| Net Interest Expense (MM) | $46 | $42 | $39 | $36 | $41 | $41 |

| Depreciation & Amort. (MM) | $58 | $47 | $41 | $40 | $37 | $37 |

| Earnings Per Share | $3.11 | $0.25 | $2.36 | $0.29 | -$5.1 | -$5.24 |

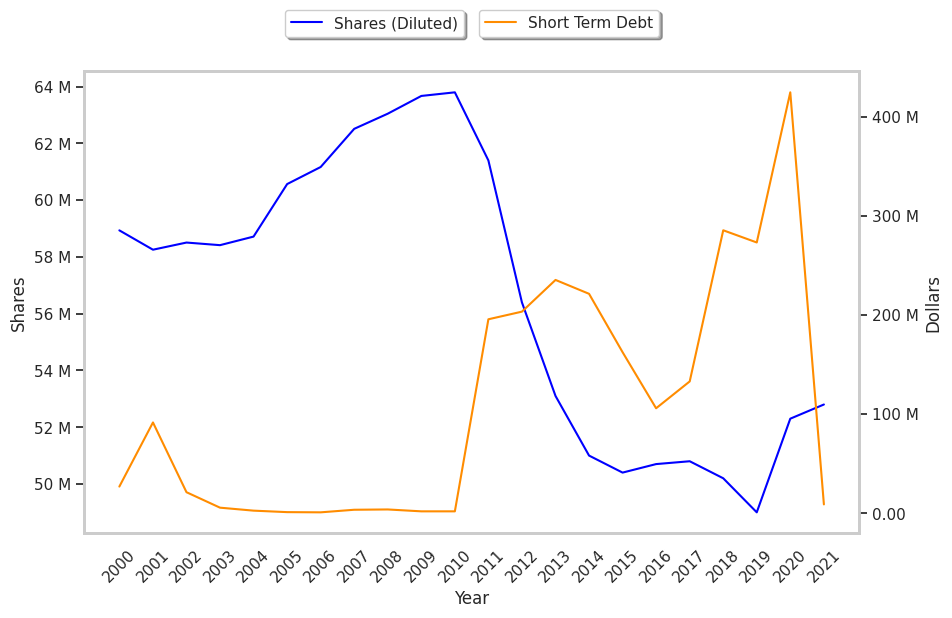

| Diluted Shares (MM) | 50 | 49 | 52 | 53 | 46 | 46 |

| Free Cash Flow (MM) | $57 | $28 | $138 | $71 | -$66 | -$66 |

| Capital Expenditures (MM) | $75 | $60 | $28 | $38 | $32 | $32 |

| Net Current Assets (MM) | -$685 | -$520 | -$878 | -$807 | -$742 | n/a |

Tupperware Brands has declining revenues and decreasing reinvestment in the business, weak operating margins with a negative growth trend, and declining EPS growth. On the other hand, the company has wider gross margins than its peer group working in its favor. Furthermore, Tupperware Brands has irregular cash flows.

Tupperware Brands does not have a meaningful trailing P/E ratio since its earnings per share are currently in the red. Based on its EPS guidance of $0.83, the company has a forward P/E ratio of 2.0. In comparison, the average P/E ratio for the Industrials sector is 20.49.

Overview of Tupperware Brands's Market Factors:

Tupperware Brands has an unusually large proportion of its shares sold short because 22.5% of the company's shares are sold short. Institutions own 60.8% of the company's shares, and the insider ownership rate stands at 11.29%, suggesting a decent amount of insider shareholders. The largest shareholder is Charles Schwab Investment Management, Inc., whose 8% stake in the company is worth $7,345,548.