Today we're going to take a closer look at large-cap Consumer Staples company General Mills, whose shares are currently trading at $64.13. We've been asking ourselves whether the company is under or over valued at today's prices... let's perform a brief value analysis to find out!

A Very Low P/E Ratio but Trades Above Its Graham Number:

General Mills, Inc. manufactures and markets branded consumer foods worldwide. The company belongs to the Consumer Staples sector, which has an average price to earnings (P/E) ratio of 21.21 and an average price to book (P/B) ratio of 4.12. In contrast, General Mills has a trailing 12 month P/E ratio of 15.6 and a P/B ratio of 3.63.

General Mills's PEG ratio is 1.85, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

The Company May Be Profitable, but Its Balance Sheet Is Highly Leveraged:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $15,740 | $16,865 | $17,627 | $18,127 | $18,993 | $20,094 |

| Gross Margins | 34% | 34% | 35% | 36% | 34% | 33% |

| Operating Margins | 15% | 15% | 17% | 17% | 18% | 17% |

| Net Margins | 14% | 11% | 13% | 13% | 14% | 13% |

| Net Income (MM) | $2,163 | $1,786 | $2,211 | $2,346 | $2,735 | $2,610 |

| Net Interest Expense (MM) | $374 | $522 | $466 | $420 | $380 | $382 |

| Depreciation & Amort. (MM) | $619 | $620 | $595 | $601 | $570 | $547 |

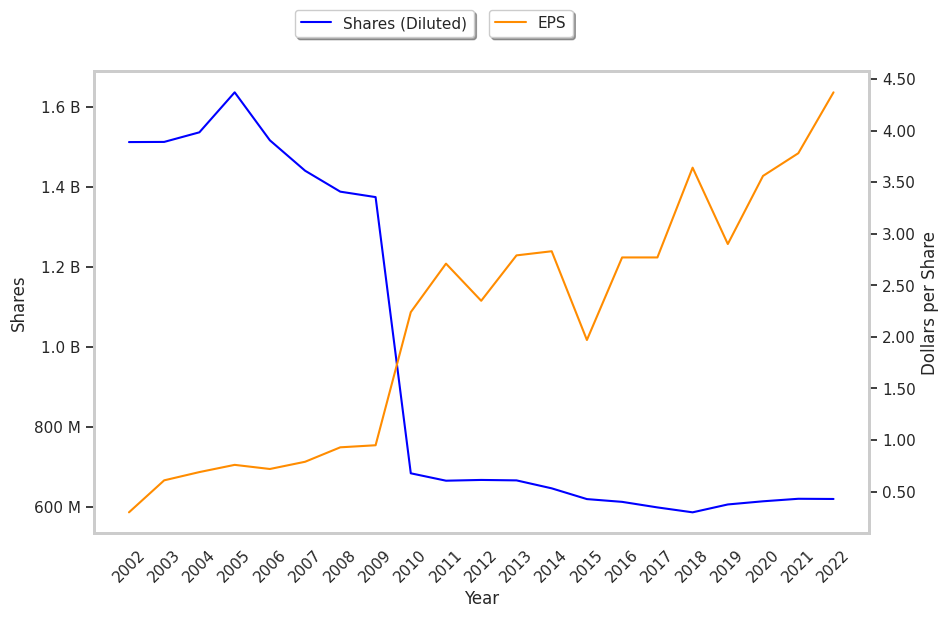

| Earnings Per Share | $3.64 | $2.9 | $3.56 | $3.78 | $4.42 | $4.3100000000000005 |

| Diluted Shares (MM) | 586 | 605 | 613 | 619 | 613 | 601 |

| Free Cash Flow (MM) | $2,218 | $2,269 | $3,215 | $2,452 | $2,747 | $2,089 |

| Capital Expenditures (MM) | $623 | $538 | $461 | $531 | $569 | $690 |

| Net Current Assets (MM) | -$18,623 | -$17,408 | -$16,459 | -$15,503 | -$15,617 | -$15,697 |

| Long Term Debt (MM) | $12,669 | $11,625 | $10,929 | $9,787 | $9,135 | $10,524 |

| Net Debt / EBITDA | 4.87 | 4.4 | 3.04 | 3.29 | 2.8 | 2.96 |

General Mills has growing revenues and a flat capital expenditure trend and wider gross margins than its peer group. Additionally, the company's financial statements display decent operating margins with a stable trend and positive EPS growth. However, the firm has a highly leveraged balance sheet. Finally, we note that General Mills has irregular cash flows.