Today we're going to take a closer look at large-cap Technology company Zoom Video Communications, whose shares are currently trading at $68.72. We've been asking ourselves whether the company is under or over valued at today's prices... let's perform a brief value analysis to find out!

A Lower P/B Ratio Than Its Sector Average but Trades Above Its Graham Number:

Zoom Video Communications, Inc. provides unified communications platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. The company belongs to the Technology sector, which has an average price to earnings (P/E) ratio of 35.0 and an average price to book (P/B) ratio of 7.92. In contrast, Zoom Video Communications has a trailing 12 month P/E ratio of 90.4 and a P/B ratio of 2.82.

Zoom Video Communications's PEG ratio is 9.2, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

Growing Revenues With Increasing Reinvestment in the Business:

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Revenue (MM) | $331 | $623 | $2,651 | $4,100 | $4,393 |

| Revenue Growth | n/a | 88.39% | 325.81% | 54.63% | 7.15% |

| Gross Margins | 20% | 21% | 56% | 52% | 31% |

| Operating Margins | 3% | 4% | 26% | 27% | 6% |

| Net Margins | 2% | 4% | 25% | 34% | 2% |

| Net Income (MM) | $8 | $25 | $672 | $1,376 | $104 |

| Net Interest Expense (MM) | $2 | $14 | $16 | -$6 | $41 |

| Depreciation & Amort. (MM) | $7 | $16 | $29 | $48 | $82 |

| Diluted Shares (MM) | 116 | 254 | 298 | 306 | 304 |

| Free Cash Flow (MM) | $23 | $114 | $1,391 | $1,473 | $1,186 |

| Capital Expenditures (MM) | $28 | $38 | $80 | $133 | $104 |

| Current Ratio | 3.21 | 1.86 | 3.61 | 3.24 | 4.27 |

| Long Term Debt (MM) | $45 | $54 | $62 | $51 | $19 |

| Net Debt / EBITDA | -11.25 | -13.27 | -1.59 | -0.65 | -3.8 |

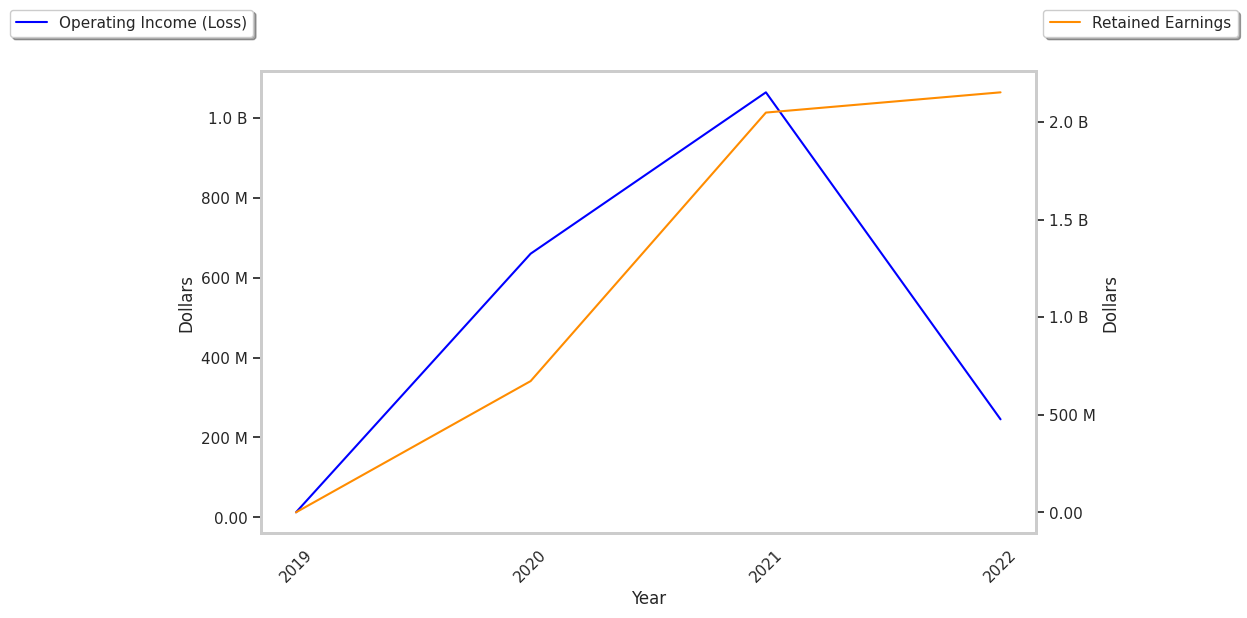

Zoom Video Communications has growing revenues and increasing reinvestment in the business, low leverage, and generally positive cash flows. However, the firm suffers from slimmer gross margins than its peers and weak operating margins with a positive growth rate. Finally, we note that Zoom Video Communications has positive expected EPS Growth.