Shares of Telecommunications sector company AT&T moved -1.6% today, and are now trading at a price of $16.94. The large-cap stock's daily volume was 44,810,526 compared to its average volume of 36,819,511. The S&P 500 index returned a -0.0% performance.

AT&T Inc. provides telecommunications and technology services worldwide. The company is based in Dallas and has 152,740 full time employees. Its market capitalization is $121,121,341,440. AT&T currently offers its equity investors a dividend that yields 6.4% per year.

20 analysts are following AT&T and have set target prices ranging from $8.0 to $28.0 per share. On average, they have given the company a rating of hold. At today's prices, T is trading -7.53% away from its average analyst target price of $18.32 per share.

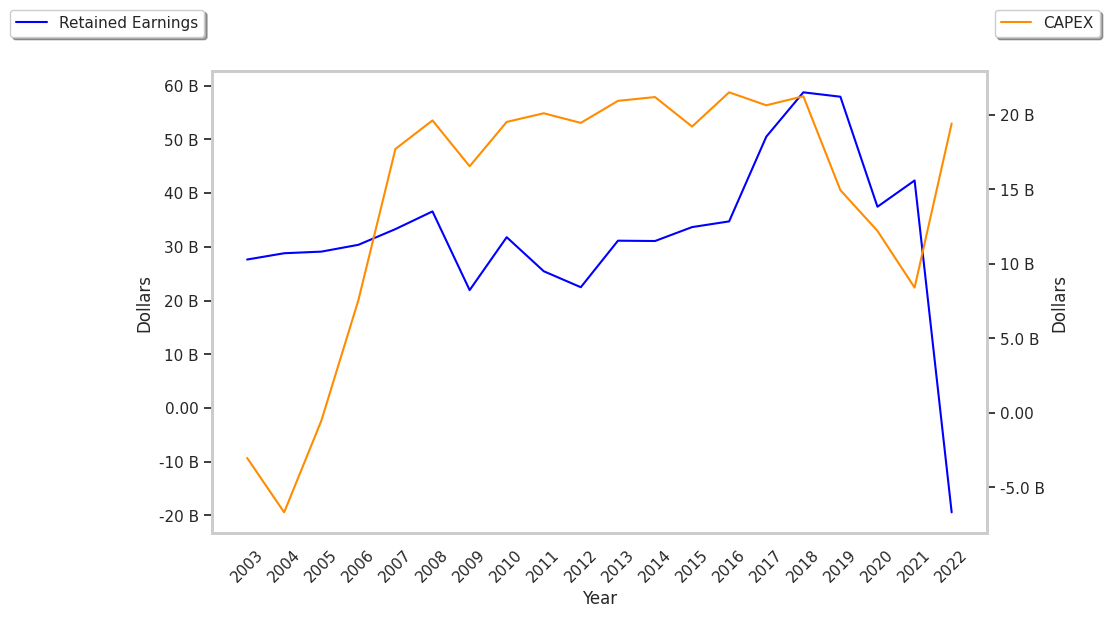

Over the last year, T shares have gone down by -11.0%, which represents a difference of -28.0% when compared to the S&P 500. The stock's 52 week high is $21.53 per share and its 52 week low is $13.43. Although AT&T's average free cash flow over the last 6 years has been $23.7 Billion, they have been decreasing at an average rate of -2.0%. For this reason, investors may continue to shun the stock.

| Date Reported | Cash Flow from Operations ($ k) | Capital expenditures ($ k) | Free Cash Flow ($ k) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 37,284,000 | 17,481,000 | 19,803,000 | 22.35 |

| 2022 | 35,812,000 | 19,626,000 | 16,186,000 | -38.72 |

| 2021 | 41,957,000 | 15,545,000 | 26,412,000 | -7.13 |

| 2020 | 43,130,000 | 14,690,000 | 28,440,000 | -2.04 |

| 2019 | 48,668,000 | 19,635,000 | 29,033,000 | 29.9 |

| 2018 | 43,602,000 | 21,251,000 | 22,351,000 |