Today we're going to take a closer look at large-cap Real Estate company Welltower, whose shares are currently trading at $87.51. We've been asking ourselves whether the company is under or over valued at today's prices... let's perform a brief value analysis to find out!

Welltower's Valuation Is in Line With Its Sector Averages:

Welltower Inc. (NYSE:WELL), a real estate investment trust ("REIT") and S&P 500 company headquartered in Toledo, Ohio, is driving the transformation of health care infrastructure. The company belongs to the Real Estate sector, which has an average price to earnings (P/E) ratio of 25.55 and an average price to book (P/B) ratio of 2.1. In contrast, Welltower has a trailing 12 month P/E ratio of 165.1 and a P/B ratio of 2.03.

Welltower's PEG ratio is 1.8, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

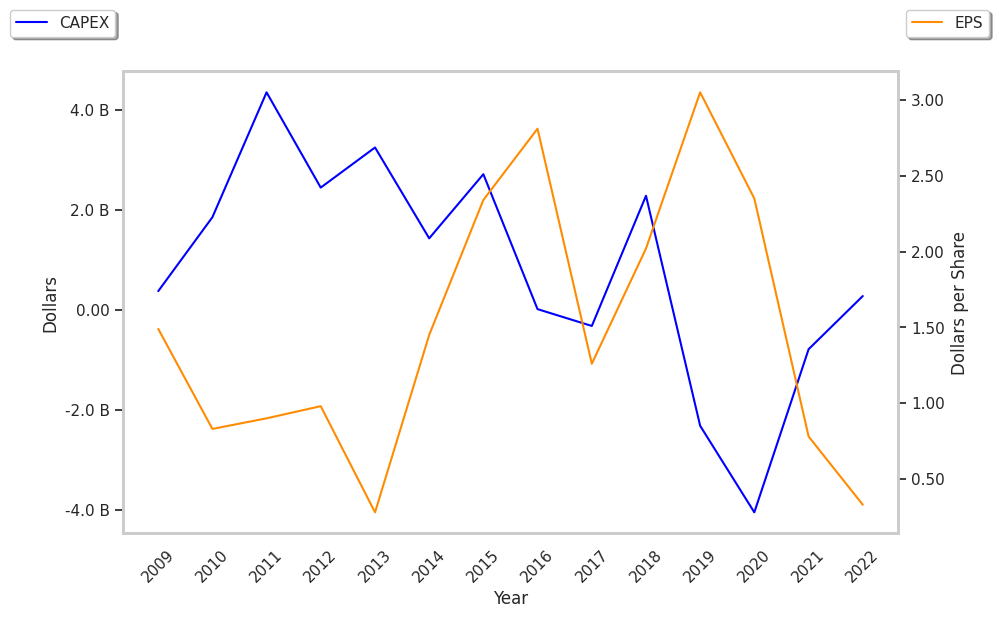

The Company Has a Highly Leveraged Balance Sheet and a Declining EPS Growth Trend:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $4,700 | $5,121 | $4,606 | $4,742 | $5,861 | $6,407 |

| Revenue Growth | n/a | 8.95% | -10.06% | 2.96% | 23.59% | 9.32% |

| Operating Margins | 9% | 11% | -1% | 4% | 3% | 4% |

| Net Margins | 18% | 26% | 23% | 8% | 3% | 4% |

| Net Income (MM) | $830 | $1,330 | $1,039 | $374 | $161 | $271 |

| Net Interest Expense (MM) | $527 | $556 | $514 | $490 | $530 | $594 |

| Depreciation & Amort. (MM) | $950 | $1,027 | $1,038 | $1,038 | $1,310 | $1,363 |

| Earnings Per Share | $2.02 | $3.05 | $2.33 | $0.78 | $0.3 | $0.46 |

| EPS Growth | n/a | 50.99% | -23.61% | -66.52% | -61.54% | 53.33% |

| Diluted Shares (MM) | 375 | 404 | 417 | 427 | 465 | 617 |

| Free Cash Flow (MM) | -$1,976 | $1,207 | $1,120 | $857 | $697 | $586 |

| Capital Expenditures (MM) | $3,560 | $329 | $245 | $418 | $632 | $899 |

| Current Ratio | 97.33 | 76.51 | 12.8 | 16.56 | 22.4 | 33.41 |

| Long Term Debt (MM) | $14,329 | $16,385 | $14,193 | $14,644 | $14,869 | $16,185 |

| Net Debt / EBITDA | 10.27 | 10.26 | 12.56 | 11.9 | 9.6 | 8.34 |

Welltower's financial statements include several red flags such as weak operating margins with a negative growth trend, declining EPS growth, and a deteriorating pattern of cash flows. Additionally, the firm has a highly leveraged balance sheet. On the other hand, the company has growing revenues and decreasing reinvestment in the business working in its favor.